Panera Bread 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.locations and generally require the Company to pay a proportionate share of real estate taxes, insurance,

common area, and other operating costs. Many bakery-cafe leases provide for contingent rental (i.e.

percentage rent) payments based on sales in excess of speciÑed amounts. In addition, the Company is a prime

tenant or guarantor for certain operating leases of four franchisee locations and 74 locations of the former

Au Bon Pain Division, or its franchisees. The leases have terms expiring on various dates from January 31,

2004 to February 1, 2014, and the guarantees have a potential amount of future rental payments of

approximately $38.6 million. The obligation from leases or guarantees will continue to decrease over time as

these operating leases expire or are not renewed. As these guarantees were initiated prior to December 31,

2002, the Company has not recorded a liability for these leases or guarantees. Also, the Company has not had

to make any payments related to the leases or guarantees. Au Bon Pain and the respective franchisees

continue to have primary liability for these operating leases.

In 2001, the Company, pursuant to an agreement with its former president as a minority interest owner, is

developing and managing up to 50 bakery-cafes in the Northern Virginia and Central Pennsylvania markets.

After October 2006, the Company and the minority interest owner each have rights which could, if exercised,

permit/require the Company to purchase the bakery-cafes at contractually determined values based on

multiples of cash Öows. The Company has not recorded a liability for these purchase rights. Had the Company

been required to repurchase the 27 bakery-cafes in operation under this agreement at December 27, 2003 at

the contractually determined value based on the minority interest owner's right to sell, a payment of

$6.1 million would have been required.

The Company reached agreement with Dawn Food Products, Inc. in the Ñrst quarter of 2003 to provide

sweet goods for the period 2003-2007. The agreement with Dawn is structured as a cost plus agreement.

In Ñscal 2003, the Company executed ConÑdential and Proprietary Information and Non-Competition

Agreements (Agreements) with certain employees. These Agreements contain a provision whereby employ-

ees would be due a certain number of weeks of their salary if their employment was terminated by the

Company as speciÑed in the Agreement. In accordance with SFAS 5, the Company has not recorded a

liability for these amounts due employees. Rather, the Company will record a liability for these amounts when

an amount becomes due to an employee. As of December 27, 2003, the total amount potentially owed

employees under these Agreements was approximately $4.5 million.

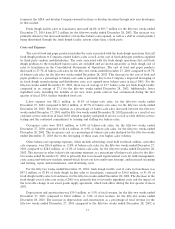

Liquidity and Capital Resources

Cash and cash equivalents were $42.4 million at December 27, 2003 compared with $29.9 million at

December 28, 2002. The Company's principal requirements for cash are capital expenditures for the

development of new bakery-cafes, for maintaining or remodeling existing bakery-cafes, for developing,

remodeling, and maintaining fresh dough facilities, and for enhancements of information systems. For the

Ñfty-two weeks ended December 27, 2003, the Company met its requirements for capital with cash from

operations and proceeds from the exercise of stock options. Proceeds from the exercise of stock options totaled

$4.2 million for the Ñfty-two weeks ended December 27, 2003 and $3.0 million for the Ñfty-two weeks ended

December 28, 2002.

Funds provided by operating activities for the Ñfty-two weeks ended December 27, 2003 were

$68.5 million compared to $46.3 million for the Ñfty-two weeks ended December 28, 2002. For 2003, funds

provided consisted primarily of $30.4 million from net income, $19.5 from depreciation, $6.8 million from the

tax beneÑt from stock option exercises, and $8.8 million from decreased deferred taxes due principally to

utilization of net operating loss carryforwards. For 2002, funds provided consisted primarily of $21.8 million

from net income, $14.0 million from depreciation, $8.1 million from the tax beneÑt from stock option

exercises, and $4.2 million from decreased deferred taxes due principally to utilization of net operating loss

carryforwards.

As of December 27, 2003 the Company had fully utilized all of its net operating loss carryforwards. At

December 28, 2002, the Company had net operating loss carryforwards of $17.2 million. At December 27,

2003 and December 28, 2002, the Company had federal jobs tax credit carryforwards of $0.1 million and

$1.2 million, respectively, which expire in the years 2014-2015, and charitable contribution carryforwards of

23