Panera Bread 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

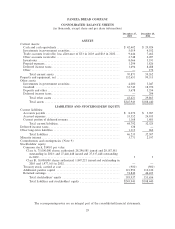

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

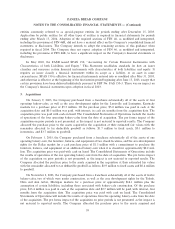

Preparation of Financial Statements

The preparation of Ñnancial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that aÅect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Ñnancial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could diÅer from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity at the time of purchase of three

months or less to be cash equivalents.

Investments in Government Securities

Investments consist of United States Treasury notes and mortgage-backed government notes and are

classiÑed as short-term or long-term investments in the accompanying consolidated balance sheet based upon

their stated maturity dates which range from July 2004 to December 2006. One mortgage-backed government

note with a net carrying amount of $4.0 million matured in Ñscal 2003, the proceeds of which were used to

purchase similar investments.

Management designates the appropriate classiÑcation of its investments at the time of purchase based

upon its intended holding period and reevaluates such designation at each balance sheet date. At Decem-

ber 27, 2003, all investments are classiÑed as held-to-maturity as the Company has the intent and ability to

hold the securities to maturity. Held-to-maturity securities are stated at amortized cost, adjusted for

amortization of premiums to maturity using the eÅective interest method, which approximates fair value at

December 27, 2003.

Trade and Other Accounts Receivable

Trade accounts receivable at Ñscal year-end consist primarily of amounts due to the Company from its

32 franchise groups for purchases of fresh dough from the Company's fresh dough facilities and royalties due

to the Company from franchisee sales. The Company does not require collateral and maintains reserves for

potential uncollectible accounts, which in the aggregate have not exceeded management's expectation. Other

accounts receivable consist primarily of tenant allowances due from landlords for leasehold improvements

made by the Company.

Inventories

Inventories, which consist of food products, paper goods and supplies, smallwares, and promotional items,

are valued at the lower of cost or market, determined under the Ñrst-in, Ñrst-out method.

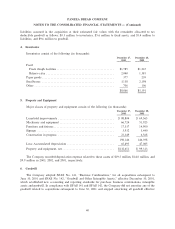

Property and Equipment

Property, equipment, and leaseholds are stated at cost. Depreciation is provided using the straight-line

method over the estimated useful lives of the assets. Leasehold improvements are amortized using the

straight-line method over the shorter of their estimated useful lives or the remaining terms of the leases. The

estimated useful lives used for Ñnancial statement purposes are:

Leasehold improvements ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10-15 years

Machinery and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5-10 years

Furniture and ÑxturesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3-7 years

Signage ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6 years

34