Panera Bread 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

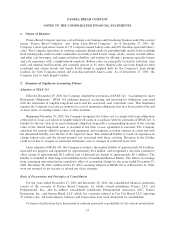

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

entities commonly referred to as special-purpose entities for periods ending after December 15, 2003.

Application by public entities for all other types of entities is required in Ñnancial statements for periods

ending after March 15, 2004. Adoption of the required sections of FIN 46, as modiÑed and interpreted,

including the provisions of FIN 46R, did not have a material eÅect on the Company's consolidated Ñnancial

statements or disclosures. The Company intends to adopt the remaining sections of this guidance when

required in Ñscal 2004. The Company does not expect adoption of FIN 46, as modiÑed and interpreted,

including the provisions of FIN 46R, to have a signiÑcant impact on the Company's Ñnancial statements or

disclosures.

In May 2003, the FASB issued SFAS 150, ""Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity.'' This Statement establishes standards for how an issuer

classiÑes and measures certain Ñnancial instruments with characteristics of both liabilities and equity. It

requires an issuer classify a Ñnancial instrument within its scope as a liability, or an asset in some

circumstances. SFAS 150 is eÅective for Ñnancial instruments entered into or modiÑed after May 31, 2003,

and otherwise is eÅective at the beginning of the Ñrst interim period beginning after June 15, 2003, except that

certain provisions have been deferred indeÑnitely pursuant to FSP No. FAS 150-3. There was no impact on

the Company's Ñnancial statements upon adoption in Ñscal 2003.

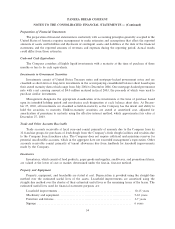

3. Acquisitions

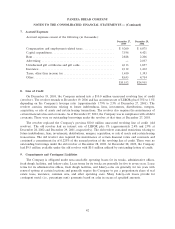

On January 9, 2003, the Company purchased from a franchisee substantially all of the assets of four

operating bakery-cafes, as well as the area development rights for the Louisville and Lexington, Kentucky

markets for a purchase price of $5.5 million. Of the purchase price, $5.0 million was paid in cash at the

acquisition date and $0.5 million was paid, with interest, in cash six months from the acquisition date. The

acquisition price was paid with cash on hand. The Consolidated Statements of Operations include the results

of operations of the four operating bakery-cafes from the date of acquisition. The pro forma impact of the

acquisition on prior periods is not presented, as the impact is not material to reported results. The Company

allocated the purchase price to the assets acquired in the acquisition at their estimated fair values with the

remainder allocated to tax deductible goodwill as follows: $1.7 million to Ñxed assets, $0.1 million to

inventories, and $3.7 million to goodwill.

On February 1, 2003, the Company purchased from a franchisee substantially all of the assets of one

operating bakery-cafe, the furniture, Ñxtures, and equipment of two closed locations, and the area development

rights for the Dallas market for a cash purchase price of $1.3 million with a commitment to purchase the

furniture, Ñxtures, and equipment of an additional bakery-cafe when it is closed for approximately $0.2 mil-

lion. The acquisition price was paid with cash on hand. The Consolidated Statements of Operations include

the results of operations of the one operating bakery-cafe from the date of acquisition. The pro forma impact

of the acquisition on prior periods is not presented, as the impact is not material to reported results. The

Company allocated the purchase price to the assets acquired in the acquisition at their estimated fair values

with the remainder allocated to tax deductible goodwill as follows: $0.9 million to Ñxed assets and $0.4 million

to goodwill.

On November 2, 2003, the Company purchased from a franchisee substantially all of the assets of twelve

bakery-cafes, two of which were under construction, as well as the area development rights for the Toledo,

Ohio and Ann Arbor, Michigan markets for a purchase price of approximately $14.1 million plus the

assumption of certain liabilities, including those associated with bakery-cafe construction. Of the purchase

price, $13.4 million was paid in cash at the acquisition date and $0.7 million will be paid, with interest, four

months from the acquisition date. The acquisition price was paid with cash on hand. The Consolidated

Statements of Operations will include the results of operations from the operating bakery-cafes from the date

of the acquisition. The pro forma impact of the acquisition on prior periods is not presented, as the impact is

not material to reported results. The Company allocated the purchase price to the assets acquired and

39