Panera Bread 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

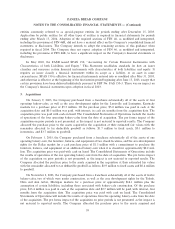

from an ownership structure to a multi-year bonus structure, which will allow operators to participate in the

success of a bakery-cafe. The Company expects to continue implementation of this bonus structure where

appropriate as an alternative to its traditional Company-owned or franchised bakery-cafes to facilitate the

development and operation of bakery-cafes.

In March 1998, the Company entered into a multi-year supply agreement with Bunge Food Corporation

(""Bunge'') for the supply of substantially all of its sweet goods. The Company's pricing was structured as a

cost plus arrangement. In November 2002, the Company signed an agreement with Dawn Food Products, Inc.

(""Dawn'') to provide sweet goods for the period 2003-2007. The agreement with Dawn is also structured as a

cost plus agreement. The transition from Bunge to Dawn was completed in the Ñrst quarter of Ñscal 2003.

In Ñscal 2003, the Company executed ConÑdential and Proprietary Information and Non-Competition

Agreements (Agreements) with certain employees. These Agreements contain a provision whereby employ-

ees would be due a certain number of weeks of their salary if their employment was terminated by the

Company as speciÑed in the Agreement. In accordance with SFAS 5, the Company has not recorded a

liability for these amounts due employees. Rather, the Company will record a liability for these amounts when

an amount becomes due to an employee. As of December 27, 2003, the total amount potentially owed

employees under these Agreements was approximately $4.5 million.

The Company is subject to legal proceedings and claims which arise in the normal course of business. In

the opinion of management, the ultimate liabilities with respect to these actions will not have a material

adverse eÅect on the Company's Ñnancial position, results of operations, or cash Öow.

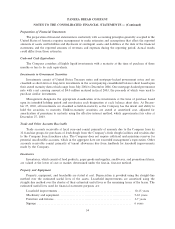

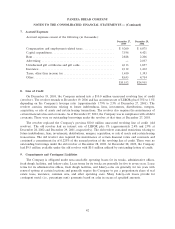

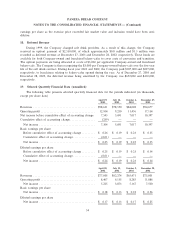

10. Income Taxes

The provision for income taxes attributable to income before income taxes and cumulative eÅect of

accounting change in the consolidated statements of operations is comprised of the following (in thousands):

December 27, December 28, December 29,

2003 2002 2001

Current:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,421 $ Ì $ Ì

State ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 550 253 (3)

1,971 253 (3)

Deferred:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,370 11,660 6,956

State ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 412 597 1,319

15,782 12,257 8,275

Tax Provision ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,753 12,510 8,272

Tax beneÑt on cumulative eÅect ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (137) Ì Ì

$17,616 $12,510 $8,272

44