Panera Bread 2003 Annual Report Download - page 28

Download and view the complete annual report

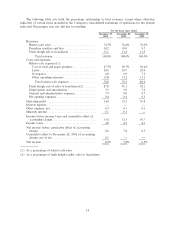

Please find page 28 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$8.6 million and $6.5 million, respectively, which expire in the years 2005-2008. In addition, the Company has

federal alternative minimum tax credit carryforwards of $3.5 million at December 27, 2003 and December 28,

2002 which are available to reduce future regular Federal income taxes over an indeÑnite period. The

Company reevaluates the positive and negative evidence impacting the realizability of its deferred income tax

assets on an annual basis. A valuation allowance of $3.6 million and $3.8 million at December 27, 2003 and

December 28, 2002, respectively, is provided to reduce the deferred tax assets to a level which, more likely

than not, will be realized. As the Company utilized its $17.2 million of federal income tax net operating loss

carryforwards in 2003, it will become a cash federal income tax payer in Ñscal 2004.

As of December 27, 2003 and December 28, 2002, the Company had investments of $9.0 million and

$9.1 million, respectively, in United States Treasury Notes and Mortgage Backed Government Notes.

Investments are classiÑed as short or long-term in the accompanying consolidated balance sheet based upon

their stated maturity dates. As of December 27, 2003, all investments are classiÑed as held-to-maturity as the

Company has the intent and ability to hold the securities to maturity. Held-to-maturity securities are stated at

amortized cost, adjusted for amortization of premiums to maturity, which approximates fair value at

December 27, 2003.

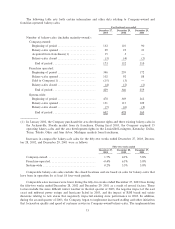

Total capital expenditures for the Ñfty-two weeks ended December 27, 2003 were $41.2 million and were

primarily related to the opening of 29 Company-owned bakery-cafes, the opening of 3 fresh dough facilities,

and the maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally, the

Company acquired 15 operating bakery-cafes, 2 closed bakery-cafes, and 2 bakery-cafes under construction

from franchisees for $21.0 million. The Company recorded goodwill of $13.8 million related to these

acquisitions. Total capital expenditures were $27.1 million for the Ñfty-two weeks ended December 28, 2002

and were primarily related to the opening of 23 Company-owned bakery-cafes, the opening of two fresh dough

facilities, and the maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally,

the Company acquired 4 operating bakery-cafes from a franchisee for $3.3 million. These expenditures were

funded by cash from operating activities and the proceeds from the exercise of stock options.

On December 19, 2003, the Company entered into a $10.0 million unsecured revolving line of credit

(revolver). The revolver extends to December 19, 2006 and has an interest rate of LIBOR plus 0.75% to 1.5%

depending on the Company's leverage ratio (approximately 1.79% to 2.5% at December 27, 2003). The

revolver contains restrictions relating to future indebtedness, liens, investments, distributions, mergers,

acquisition, or sale of assets and certain leasing transactions. The revolver also requires the maintenance of

certain Ñnancial ratios and covenants. As of December 27, 2003, the Company was in compliance with all debt

covenants. There were no outstanding borrowings under the revolver at December 27, 2003.

Financing activities provided $6.2 million for the Ñfty-two weeks ended December 27, 2003 and

$5.7 million for the Ñfty-two weeks ended December 28, 2002. The Ñnancing activities in the Ñfty-two weeks

ended December 27, 2003 included $4.2 million from the exercise of stock options, $0.8 million from the

issuance of common stock under employee beneÑt plans, and $1.2 million from capital investments by our

minority interest owner. The Ñnancing activities for the Ñfty-two weeks ended December 28, 2002 included

$3.0 million from the exercise of stock options, $0.9 million from the issuance of common stock under

employee beneÑt plans, $1.5 million from capital investments by our minority interest owner, and $0.2 million

in proceeds on payment of a note receivable from our minority interest owner.

The Company had working capital of $26.1 million at December 27, 2003 and $26.9 million at

December 28, 2002. The $0.8 million decrease and $13.3 million increase in working capital for the Ñfty-two

weeks ended December 27, 2003 and December 28, 2002, respectively, is net of the $4.0 million and

$5.0 million, respectively, of the long-term portion of cash invested in government securities previously

described. The Company has experienced no liquidity diÇculties and has historically been able to Ñnance its

operations through internally generated cash Öow, cash from the exercise of employee stock options, and,

when necessary, borrowings under its revolving line of credit.

The Company currently anticipates total capital expenditures for Ñscal year 2004 of approximately $75 to

$80 million, principally for the opening of 45 to 55 new Company-owned bakery-cafes and the maintaining

and remodeling of existing bakery-cafes and remodeling and expansion of existing fresh dough facilities. The

24