Panera Bread 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company expects future bakery-cafes will require, on average, an investment per bakery-cafe (excluding pre-

opening expenses which are expensed as incurred) of approximately $870,000, which is net of landlord

allowance. The Company expects to fund these expenditures principally through internally generated cash Öow

and cash from the exercise of employee stock options supplemented, where necessary, by borrowings on its

revolving line of credit.

In addition to our capital expenditure requirements, the Company has certain other contractual and

committed cash obligations. Our contractual cash obligations consist of noncancelable operating leases for

trucks, administrative oÇces, fresh dough facilities, and bakery-cafes. We expect cash expenditures under

these lease obligations to be as follows:

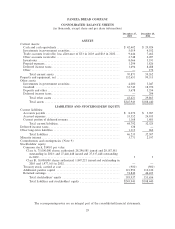

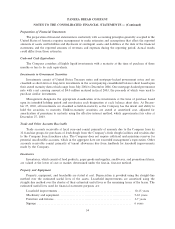

Payments due by period as of December 27, 2003 (in thousands)

In 2004 2005-2006 2007-2008 After 2008 Total

Operating Leases(1) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $22,912 $44,773 $41,548 $62,623 $171,856

(1) See Note 9 to the Consolidated Financial Statements for further information.

Our commercial commitments consist of guarantees for certain of the operating leases of four franchise

locations and 74 locations of the former Au Bon Pain Division, or its franchisees. The leases have terms

expiring on various dates from January 31, 2004 to February 1, 2014, and the guarantees have a potential

amount of future rental payments of approximately $38.5 million. The obligation from leases or guarantees

will continue to decrease over time as these operating leases expire or are not renewed. As these guarantees

were initiated prior to December 31, 2002, the Company has not recorded a liability for these leases or

guarantees. Also, the Company has not had to make any payments related to the leases or guarantees. Au Bon

Pain and the respective franchisees continue to have primary liability for these operating leases. Potential

future commitments consist of:

Amounts committed as of December 27, 2003 (in thousands)

In 2004 2005-2006 2007-2008 After 2008 Total

Lease Guarantees(1) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $9,220 $14,416 $9,401 $5,528 $38,565

(1) Represents aggregate minimum requirement Ì see Note 9 to the Consolidated Financial Statements for

further information.

Our capital requirements, including development costs related to the opening or acquisition of additional

bakery-cafes and fresh dough facilities and maintenance and remodel expenditures, have and will continue to

be signiÑcant. Our future capital requirements and the adequacy of available funds will depend on many

factors, including the pace of expansion, real estate markets, site locations, and the nature of the arrangements

negotiated with landlords. The Ñnancial success or lack thereof on the part of our franchisees and minority

interest owner could also aÅect our ability to fund our capital requirements. We believe that our cash Öow

from operations and the exercise of employee stock options, supplemented, where necessary, by borrowings on

our revolving line of credit, will be suÇcient to fund our capital requirements for the foreseeable future.

Impact of InÖation

In the past, the Company has been able to recover inÖationary cost and commodity price increases

through increased menu prices. There have been, and there may be in the future, delays in implementing such

menu price increases, and competitive pressures may limit the Company's ability to recover such cost

increases in their entirety. Historically, the eÅects of inÖation on the Company's net income have not been

materially adverse.

A majority of the Company's employees are paid hourly rates related to federal and state minimum wage

laws. Although the Company has and will continue to attempt to pass along any increased labor costs through

food price increases, there can be no assurance that all such increased labor costs can be reÖected in its prices

or that increased prices will be absorbed by consumers without diminishing to some degree consumer spending

25