Panera Bread 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

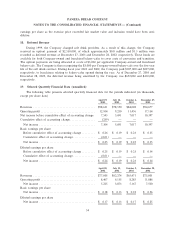

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

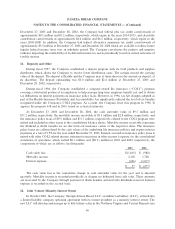

markets. The agreement entitles the minority interest owner to a speciÑed percentage of the cash Öows from

the bakery-cafes developed and operated by the LLC. He is required to make mandatory capital contributions

toward each bakery-cafe developed under the agreement. In addition, he may make additional voluntary

contributions towards each bakery-cafe developed under the agreement and receive a proportionate increase in

his share of the cash Öows. Although he receives no salary for his services, he receives an operating fee equal

to the diÅerence between (a) the sum of 4% of the gross sales and $40,000 (increased by 3.5% annually

beginning in 2003) for each bakery-cafe opened by the LLC, and (b) expenses incurred by the LLC in

connection with bakery-cafe operations other than license and administrative fees and expenses which relate

solely to an individual bakery-cafe. Applicable expenses include, without limitation, all costs relating to

district, regional, and area supervision above the store level, bakery supervision, Ñeld training, training

functions, neighborhood marketing, and recruiting and relocation. Operating fee payments were $1.4 million,

$0.5 million, and $0.1 million in 2003, 2002, and 2001, respectively, and were classiÑed as ""Other Expense'' in

the Consolidated Statements of Operations. He may not sell or transfer his LLC interest to another party

without the Company's consent. If his employment with the LLC terminates within the Ñrst Ñve years of the

operating agreement, the Company has the right to purchase his LLC interest. The purchase price is

established either by appraisal or by one of several formulas, depending upon the timing and reason for

termination of his employment. After Ñve years, the Company and the minority interest owner each have

rights which could, if exercised, permit/require the Company to purchase the bakery-cafes at contractually

determined values based on multiples of cash Öows. The results of operations of these bakery-cafes have been

included in the Consolidated Financial Statements since the date of formation. The former president's interest

in the LLC is reÖected as minority interest.

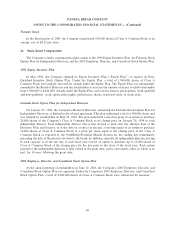

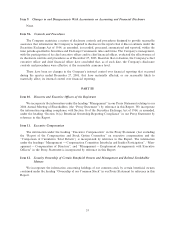

13. Stockholders' Equity

Common Stock

On June 6, 2002, the stockholders approved an increase in the number of authorized shares of the

Company's Class A and Class B common stock enabling the Company to complete a two-for-one common

stock split in the form of a stock dividend. On June 24, 2002, stockholders received one additional share of

common stock for each share of common stock held of record on June 10, 2002. The stock split has been

reÖected in the Consolidated Financial Statements, Notes to the Consolidated Financial Statements, and

Management's Discussion and Analysis of Financial Condition and Results of Operations. All applicable

references to the number of common shares and per share information have been restated to reÖect the two-

for-one split on a retroactive basis.

Each share of Class B Common Stock has the same dividend and liquidation rights as each share of

Class A Common Stock. The holders of Class B Common Stock are entitled to three votes for each share

owned. The holders of Class A Common Stock are entitled to one vote for each share owned. Each share of

Class B Common Stock is convertible, at the stockholder's option, into Class A Common Stock on a one-for-

one basis. The Company had reserved at December 27, 2003 5,887,075 shares of its Class A Common Stock

for issuance upon conversion of Class B Common Stock and exercise of awards granted under the Company's

1992 Equity Incentive Plan, Formula Stock Option Plan for Independent Directors, and 2001 Employee,

Director, and Consultant Stock Option Plan.

Registration Rights

Certain holders of Class A and Class B Common Stock, pursuant to stock subscription agreements, can

require the Company, under certain circumstances, to register their shares under the Securities Exchange Act

of 1933, or have included in certain registrations all or part of such shares, at the Company's expense.

47