Nordstrom 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Even if we take appropriate measures to safeguard our information security and privacy environment from security breaches, our

customers and our business could still be exposed to risk.

Our Retail and Credit segments involve the collection, storage and transmission of customers€ personal information, consumer preferences

and credit card information. In addition, our operations involve the collection, storage and transmission of employee information and

Company financial and strategic data. Any measures we implement to prevent a security or cybersecurity threat may not be totally effective

and may have the potential to harm relations with our customers or decrease activity on our websites by making them more difficult to use. In

addition, the regulatory environment surrounding information security, cybersecurity and privacy is increasingly demanding, with new and

constantly changing requirements. Security breaches and cyber incidents and their remediation, whether at our Company, our third-party

providers or other retailers, could expose us to a risk of loss or misappropriation of this information, litigation, potential liability, reputation

damage and loss of customers€ trust and business, which could adversely impact our sales. Any such breaches or incidents could subject us

to investigation, notification and remediation costs, and if there is additional information that is later discovered related to such security

breach or incident, there could be further loss of customers€ trust and business based upon their reactions to this additional information.

Additionally, we could be subject to credit card fraud losses due to external credit card fraud.

If we fail to appropriately manage our capital, we may negatively impact our operations and shareholder return.

We utilize capital to finance our operations, make capital expenditures and acquisitions, manage our debt levels and return value to our

shareholders through dividends and share repurchases. If our access to capital is restricted or our borrowing costs increase, our operations

and financial condition could be adversely impacted. Further, if we do not properly allocate our capital to maximize returns, our operations,

cash flows and returns to shareholders could be adversely affected.

Ownership and leasing real estate exposes us to possible liabilities and losses.

We own or lease the land and/or building for all of our stores and are therefore subject to all of the risks associated with owning and leasing

real estate. In particular, the value of the assets could decrease and their operating costs could increase, due to changes in the real estate

market, demographic trends, site competition and overall economic trends. Additionally, we are potentially subject to liability for

environmental conditions, exit costs associated with disposal of a store, commitments to pay base rent for the entire lease term or operate a

store for the duration of an operating covenant.

Our customer and employee relationships could be negatively affected if we fail to maintain our corporate culture and reputation.

We have a well-recognized culture and reputation that consumers may associate with a high level of integrity, customer service and quality

merchandise, and it is one of the reasons customers shop with us and employees choose us as a place of employment. Any significant

damage to our reputation could negatively impact sales, diminish customer trust, reduce employee morale and productivity and lead to

difficulties in recruiting and retaining qualified employees.

The transaction related to the sale of our credit card receivables and resulting program agreement with TD could adversely impact

our business.

In October 2015, we completed the sale of a substantial majority of our U.S. Visa and private label credit card portfolio to TD. While this

transaction was consummated on terms that allow us to maintain customer-facing activities, if we fail to meet certain service levels under the

program agreement with TD, TD has the right to assume certain individual servicing functions. If we lose control of such activities and

functions, if we do•not successfully respond to potential risks and appropriately manage potential costs associated with the program

agreement with TD, or if this transaction negatively impacts the customer service associated with our cards, our operations, cash flows and

returns to shareholders could be adversely affected, which could also harm our business reputation and competitive positioning.

The concentration of stock ownership in a small number of our shareholders could limit your ability to influence corporate matters.

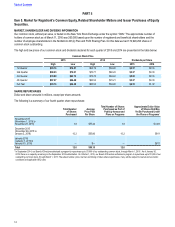

We have regularly reported in our annual proxy statements the holdings of members of the Nordstrom family, including Bruce A. Nordstrom,

our former Co-President and Chairman of the Board, his sister Anne E. Gittinger and members of the Nordstrom family within our Executive

Team. In our proxy statement as of March•11, 2016, for the 2016 Annual Meeting of Shareholders, these individuals beneficially owned an

aggregate of approximately 30% of our common stock. As a result, either individually or acting together, they may be able to exercise

considerable influence over matters requiring shareholder approval. As reported in our periodic filings, our Board of Directors has from time

to time authorized share repurchases. While these share repurchases may be offset in part by share issuances under our equity incentive

plans and as consideration for acquisitions, the repurchases may nevertheless have the effect of increasing the overall percentage

ownership held by these shareholders. The corporate law of the State of Washington, where the Company is incorporated, provides that

approval of a merger or similar significant corporate transaction requires the affirmative vote of two-thirds of a company€s outstanding

shares. The beneficial ownership of these shareholders may have the effect of discouraging offers to acquire us, delay or otherwise prevent

a significant corporate transaction because the consummation of any such transaction would likely require the approval of these

shareholders. As a result, the market price of our common stock could be affected.

Table of Contents

8