Nordstrom 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

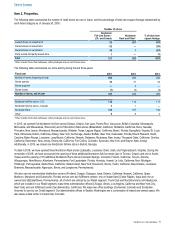

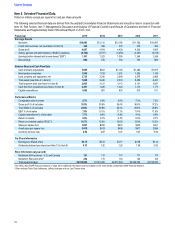

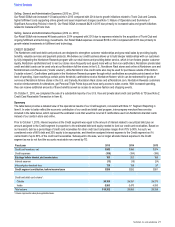

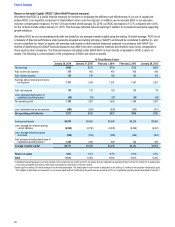

Selling, General and Administrative Expenses (2015 vs. 2014)

Our Retail SG&A rate increased 112 basis points in 2015 compared with 2014 due to growth initiatives related to Trunk Club and Canada,

higher fulfillment costs supporting online growth and asset impairment charges (see Note 1: Nature of Operations and Summary of

Significant Accounting Policies in Item 8). Our Retail SG&A increased $428 in 2015 due primarily to increased sales and growth initiatives

related to Canada and Trunk Club.

Selling, General and Administrative Expenses (2014 vs. 2013)

Our Retail SG&A rate increased 48 basis points in 2014 compared with 2013 due to expenses related to the acquisition of Trunk Club and

ongoing fulfillment and technology investments. Our Retail SG&A expenses increased $316 in 2014 compared with 2013 due primarily to

growth-related investments in fulfillment and technology.

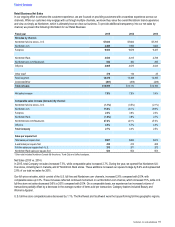

CREDIT SEGMENT

The Nordstrom credit and debit card products are designed to strengthen customer relationships and grow retail sales by providing loyalty

benefits, valuable services and payment products. We believe our credit business allows us to build deeper relationships with our customers

by fully integrating the Nordstrom Rewards program with our retail stores and providing better service, which in turn fosters greater customer

loyalty. Nordstrom cardholders tend to visit our stores more frequently and spend more with us than non-cardholders. Nordstrom private label

credit and debit cards can be used only at our Nordstrom full-line stores in the U.S., Nordstrom Rack stores and online at Nordstrom.com and

Nordstromrack.com/HauteLook (‚inside volumeƒ), while Nordstrom Visa credit cards also may be used for purchases outside of Nordstrom

(‚outside volumeƒ). Cardholders participate in the Nordstrom Rewards program through which cardholders accumulate points based on their

level of spending. Upon reaching a certain points threshold, cardholders receive Nordstrom Notesˆ, which can be redeemed for goods or

services at Nordstrom full-line stores in the U.S. and Canada, Nordstrom Rack stores and at Nordstrom.com. Nordstrom Rewards customers

receive reimbursements for alterations, get Personal Triple Points days and have early access to sales events. With increased spending,

they can receive additional amounts of these benefits as well as access to exclusive fashion and shopping events.

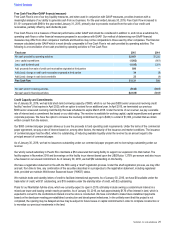

On•October•1, 2015, we completed the sale of a substantial majority of our U.S. Visa and private label credit card portfolio to TD (see Note 2:

Credit Card Receivable Transaction in Item•8).

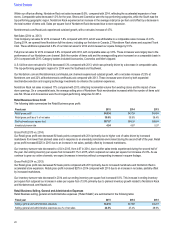

Summary

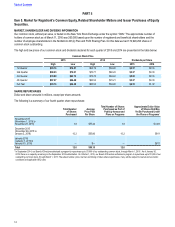

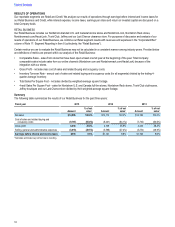

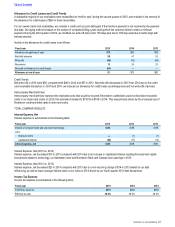

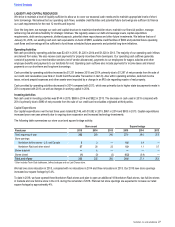

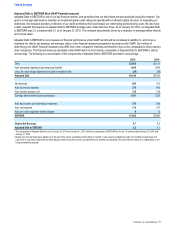

The table below provides a detailed view of the operational results of our Credit segment, consistent with Note 17: Segment Reporting in

Item•8. In order to better reflect the economic contribution of our credit and debit card program, intercompany merchant fees are also

included in the table below, which represent the estimated costs that would be incurred if cardholders used non-Nordstrom-branded cards

instead of our cards in store and online.

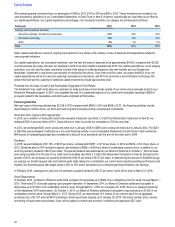

Prior to•October•1, 2015, interest expense at the Credit segment was equal to the amount of interest related to securitized debt plus an

amount assigned to the Credit segment in proportion to the estimated debt and equity needed to fund our credit card receivables. Based on

our research, debt as a percentage of credit card receivables for other credit card companies ranges from 70% to 90%. As such, we

considered a mix of 80% debt and 20% equity to be appropriate, and therefore assigned interest expense to the Credit segment as if it

carried debt of up to 80% of the credit card receivables. Subsequent to the sale, we no longer allocate interest expense to the Credit

segment as we do not fund the accounts receivable now owned by TD.

Fiscal year 2015 2014 2013

Credit card revenues, net $342 $396 $374

Credit expenses (159)(194)(186)

Earnings before interest and income taxes 183 202 188

Interest expense (13)(18)(24)

Intercompany merchant fees 118 108 97

Credit segment contribution, before income taxes $288 $292 $261

Credit and debit card volume1:

Outside $4,309 $4,331 $4,273

Inside 5,953 5,475 4,935

Total volume $10,262 $9,806 $9,208

1 Volume represents sales plus applicable taxes.

Table of Contents

Nordstrom, Inc. and subsidiaries 21