Nordstrom 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

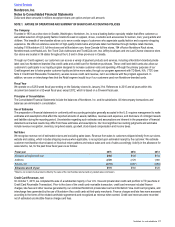

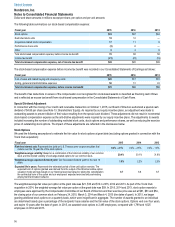

The beneficial interest asset is carried at fair value (see Note 10: Fair Value Measurements) and is amortized over approximately four years

based primarily on the payment rate of the associated receivables. The deferred revenue and investment in contract asset are recognized/

amortized over seven years on a straight line basis, following the delivery of the contract obligations and expected life of the agreement. We

record each of these items in credit card revenue, net in our Consolidated Statements of Earnings.

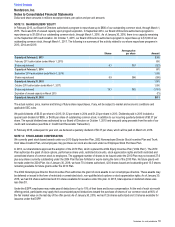

NOTE 3:€€TRUNK CLUB ACQUISITION

On August•22, 2014, we acquired 100% of the outstanding equity of Trunk Club, a personalized clothing service for men and women. The

purchase price of $357 was partially offset by $46 attributable to Trunk Club employee stock awards that are subject to ongoing vesting

requirements and are recorded as compensation expense. Of the purchase price consideration, $35 represented an indemnity holdback

related to representations, warranties and covenants. We allocated the net purchase price of $311 to the tangible and intangible assets

acquired and liabilities assumed based on their estimated fair values on the acquisition date, with the remaining unallocated net purchase

price recorded as goodwill. In connection with the acquisition, we recorded current assets of $21, intangible assets of $59, goodwill of $261,

and other non-current assets of $2, offset by net liabilities of $32.

On the acquisition date, $280 of the net purchase price was settled in Nordstrom common stock, and during the third quarter of 2015 we

settled most of an indemnity holdback, $23 of which was settled in Nordstrom common stock.

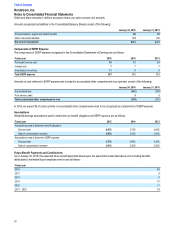

NOTE 4:€€ACCOUNTS RECEIVABLE

The components of accounts receivable are as follows:

January 30, 2016 January 31, 2015

Credit card receivables and other, net 197 2,381

Allowance for credit losses (1)(75)

Accounts receivable, net $196 $2,306

Credit card receivables and other, net as of January•30, 2016 consists of employee credit card receivables, and receivables from non-

Nordstrom-branded cards. As of January•31, 2015, credit card receivables and other, net also included U.S. Visa and private label

receivables sold to TD on October•1, 2015. There have been no material changes to the delinquency status or net credit losses of the

receivables sold.

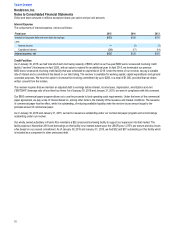

Activity in the allowance for credit losses is as follows:

Fiscal year 2015 2014 2013

Allowance at beginning of year $75 $80 $85

Bad debt expense 26 41 52

Write-offs (49)(70)(80)

Recoveries 13 24 23

Reversal of allowance for credit losses (64)… …

Allowance at end of year $1 $75 $80

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 47