Nordstrom 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

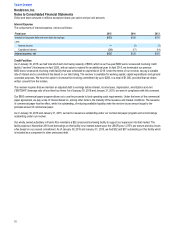

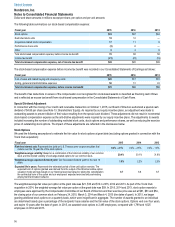

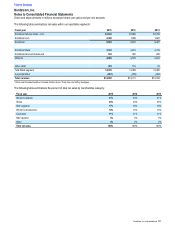

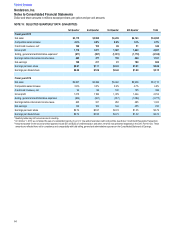

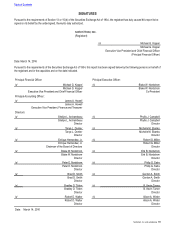

NOTE 17:€€SEGMENT REPORTING

Segments

We have two reportable segments, which include Retail and Credit.

Our Retail segment includes our Nordstrom operating segment, which is composed of our Nordstrom U.S. full-line stores and

Nordstrom.com. Both of these divisions earn revenue by offering customers a wide range of apparel, shoes, cosmetics and accessories for

women, men, young adults and children. Through our multi-channel initiatives, we have integrated the operations, merchandising and

technology of our Nordstrom full-line and online stores, consistent with our customers€ expectations of a seamless shopping experience

regardless of channel. Our internal reporting to our principal executive officer, who is our chief operating decision maker, is consistent with

these multi-channel initiatives. Our Nordstrom Rack, Nordstromrack.com/HauteLook, Jeffrey, Canadian operations and Trunk Club operating

segments have similar economic and qualitative characteristics, including nature of products, method of distribution and type of customer or

the segment results are not significant to the operating results of Nordstrom. Therefore, the results of these operating segments have been

aggregated with our Nordstrom operating segment into the Retail reportable segment.

Through our Credit segment, our customers can access a variety of payment products and services, including a Nordstrom private label

card, two Nordstrom Visa credit cards and a debit card for Nordstrom purchases. These credit and debit cards also allow our customers to

participate in our loyalty program which provides benefits to cardholders based on their level of spending.

Amounts in the Corporate/Other column include unallocated corporate expenses and assets (including unallocated assets in corporate

headquarters, consisting primarily of cash, land, buildings and equipment and deferred tax assets), sales return reserve, inter-segment

eliminations and other adjustments to segment results necessary for the presentation of consolidated financial results in accordance with

generally accepted accounting principles.

Total Retail Business represents a subtotal of the Retail segment and Corporate/Other, and is consistent with our presentation in Item 7:

Management€s Discussion and Analysis of Financial Condition and Results of Operations. Total Retail Business is not a reportable segment.

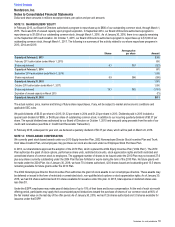

Accounting Policy

In general, we use the same measurements to compute earnings before income taxes for reportable segments as we do for the consolidated

Company. However, redemptions of our Nordstrom Notes are included in net sales for our Retail segment. The sales amount in our

Corporate/Other column includes an entry to eliminate these transactions from our consolidated net sales. The related Nordstrom Notes

expenses are included in our Retail segment at face value. Our Corporate/Other column includes an adjustment to reduce the Nordstrom

Notes expense from face value to their estimated cost. In addition, our sales return reserve and other corporate adjustments are recorded in

the Corporate/Other column. Other than as described above, the accounting policies of the operating segments are the same as those

described in Note 1: Nature of Operations and Summary of Significant Accounting Policies.

Reclassification

Reclassifications were made to our segment reporting to better reflect the way we view and measure our business. We reclassified certain

expenses related to our entry into Canada from our Corporate/Other column to our Retail segment. Historical results were also reclassified to

reflect the current period presentation.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 61