Nordstrom 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of January•30, 2016, our state and foreign net operating loss carryforwards for income tax purposes were approximately $12 and $23,

respectively. As of January•31, 2015, our state and foreign net operating loss carryforwards for income tax purposes were approximately $3

and $11, respectively. The net operating loss carryforwards are subject to certain statutory limitations of the Internal Revenue Code,

applicable state laws and applicable foreign laws. If not utilized, a portion of our state and foreign net operating loss carryforwards will begin

to expire in 2031 and 2033, respectively. Management believes it is more likely than not that certain state and foreign net operating loss

carryforwards will not be used in the foreseeable future. As such, a valuation allowance of $1 has been recorded on the deferred tax assets

related to certain state and foreign net operating loss carryforwards.

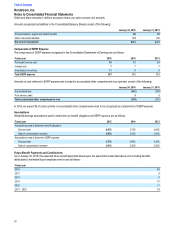

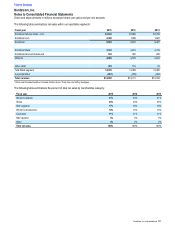

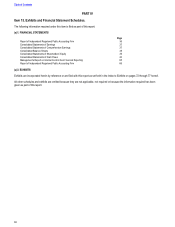

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Fiscal year 2015 2014 2013

Unrecognized tax benefit at beginning of year $15 $14 $15

Gross increase to tax positions in prior periods 69 3

Gross decrease to tax positions in prior periods (2)(2)(1)

Gross increase to tax positions in current period 22 1

Lapses in statute (2)(3)…

Settlements —(5)(4)

Unrecognized tax benefit at end of year $19 $15 $14

At the end of 2015 and 2014, $15 and $13 of the ending gross unrecognized tax benefit related to items which, if recognized, would affect the

effective tax rate.

There were no significant changes to expense in 2015, 2014 and 2013 for tax-related interest and penalties. At the end of 2015 and 2014, our

liability for interest and penalties was $2.

We file income tax returns in the U.S. and a limited number of foreign jurisdictions. With few exceptions, we are no longer subject to federal,

state and local, or non-U.S. income tax examinations for years before 2011. Unrecognized tax benefits related to federal, state and local tax

positions may decrease by $7 by January•28, 2017, due to the completion of examinations and the expiration of various statutes of

limitations.

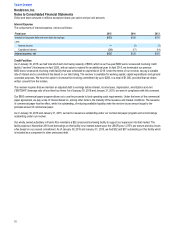

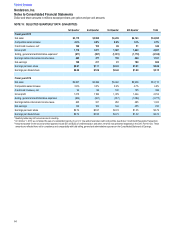

NOTE 16:€€EARNINGS PER SHARE

Earnings per basic share is computed using the weighted-average number of common shares outstanding during the year. Earnings per

diluted share uses the weighted-average number of common shares outstanding during the year plus dilutive common stock equivalents,

primarily stock options. Dilutive common stock reflects the issuance of stock for all outstanding options that could be exercised and would

also reduce the amount of earnings for which each share is entitled. Anti-dilutive shares (including stock options and other shares) are

excluded from the calculation of diluted shares and earnings per diluted share because their impact could increase earnings per diluted

share.

The computation of earnings per share is as follows:

Fiscal year 2015 2014 2013

Net earnings $600 $720 $734

Basic shares 186.3 190.0 194.5

Dilutive effect of stock options and other 3.8 3.6 3.2

Diluted shares 190.1 193.6 197.7

Earnings per basic share $3.22 $3.79 $3.77

Earnings per diluted share $3.15 $3.72 $3.71

Anti-dilutive stock options and other 2.3 2.1 4.1

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

60