Nordstrom 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

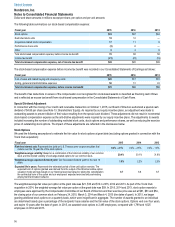

NOTE 10: €FAIR VALUE MEASUREMENTS

We disclose our financial assets and liabilities that are measured at fair value in our Consolidated Balance Sheets by level within the fair

value hierarchy as defined by applicable accounting standards:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Other observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs that cannot be corroborated by market data that reflect the reporting entity€s own

assumptions

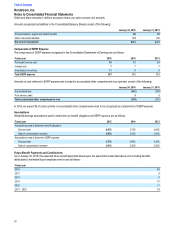

Financial Instruments Measured at Fair Value on a Recurring Basis

We recorded a beneficial interest asset when we completed the sale of a substantial majority of our U.S. Visa and private label credit card

portfolio (see Note 2: Credit Card Receivable Transaction). We determined the fair value of the beneficial interest asset based on a

discounted cash flow model using Level 3 inputs of the fair value hierarchy. Inputs and assumptions include the discount rate, payment rate,

credit loss rate and revenues and expenses associated with the program agreement. Given our review of market participant capital structures

in the banking and credit card industries and our historical and expected portfolio performance, we used the following ranges of input

assumptions to determine the fair value at year end:

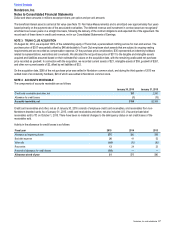

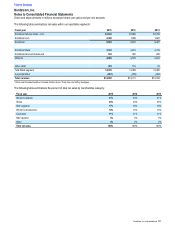

Minimum Maximum

Discount rate 12%12%

Monthly payment rate 6%18%

Annual credit loss rate 2%4%

Annual revenues as a percent to credit card receivables 10%18%

Annual expenses as a percent to credit card receivables 4%9%

We recognized $25 of amortization expense in 2015 on the beneficial interest asset which had a fair value of $37 at January•30, 2016.

Amortization primarily reflects payments received on the receivables sold and is recorded in credit card revenues, net.

We did not have any financial assets or liabilities that were measured at fair value on a recurring basis as of January•31, 2015.

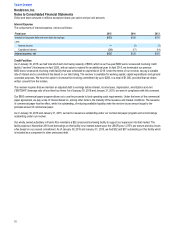

Financial Instruments Not Measured at Fair Value

Financial instruments not measured at fair value on a recurring basis include cash and cash equivalents, accounts receivable and accounts

payable and approximate fair value due to their short-term nature.

We estimate the fair value of long-term debt using quoted market prices of the same or similar issues and, as such, this is considered a Level

2 fair value measurement. The following table summarizes the carrying value and fair value estimate of our long-term debt, including current

maturities:

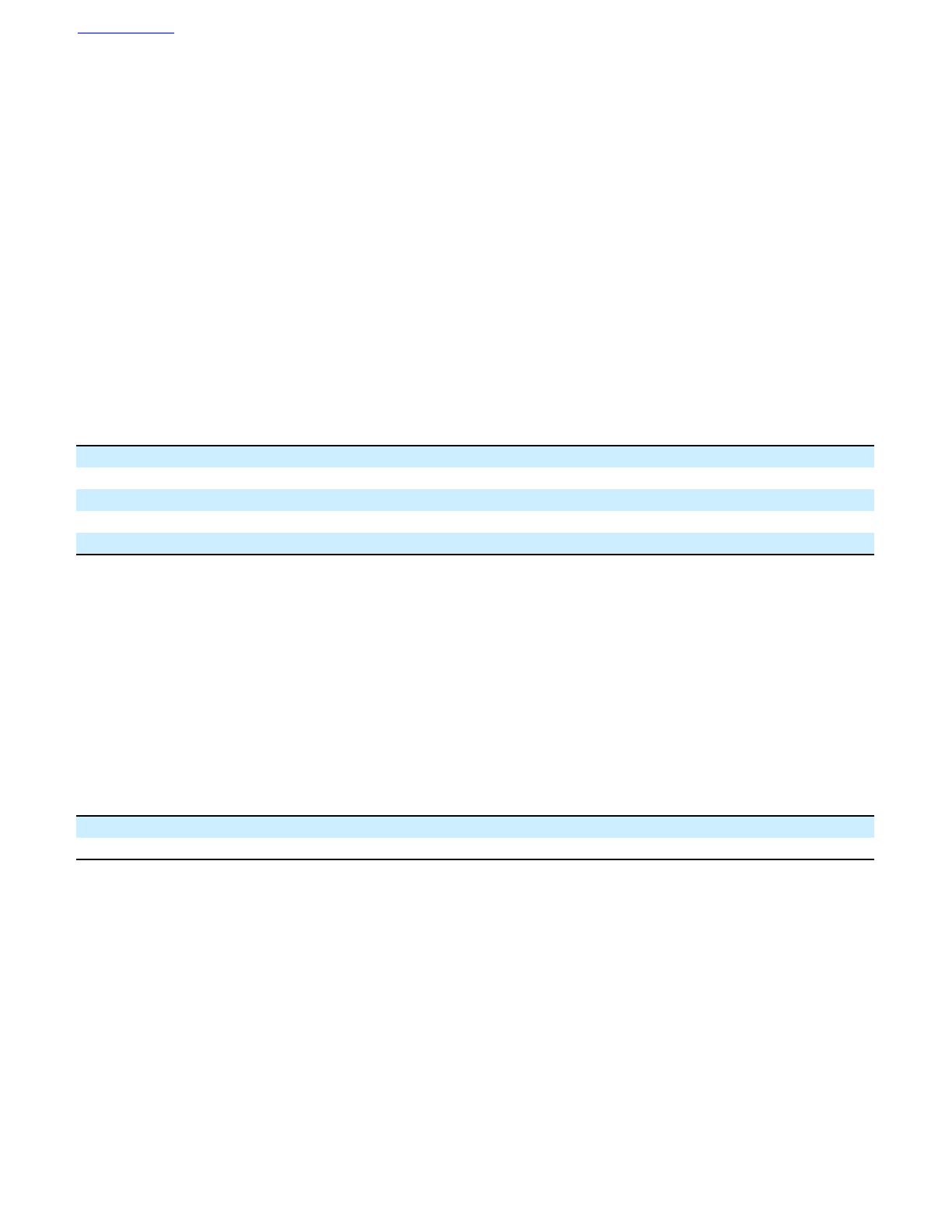

January 30, 2016 January 31, 2015

Carrying value of long-term debt $2,805 $3,131

Fair value of long-term debt 3,077 3,693

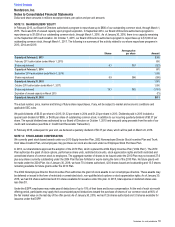

Non-financial Assets Measured at Fair Value on a Nonrecurring Basis

We also measure certain non-financial assets at fair value on a nonrecurring basis, primarily goodwill, investment in contract asset and other

long-lived tangible and intangible assets, in connection with periodic evaluations for potential impairment. In 2015, we recorded asset

impairment charges of $59, which are included in our Retail Business selling, general and administrative expenses (see Note 17: Segment

Reporting). For additional information related to goodwill, intangible assets, long-lived assets and impairments, see Note 1: Nature of

Operations and Summary of Significant Accounting Policies. We did not record any material impairment losses in 2014 and 2013. We

estimate the fair value of goodwill and long-lived tangible and intangible assets using primarily unobservable inputs and, as such, these are

considered Level 3 fair value measurements.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 53