Nordstrom 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

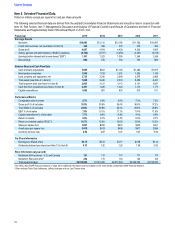

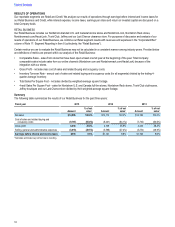

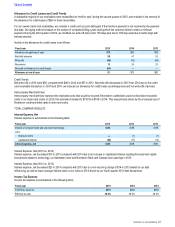

Item€7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

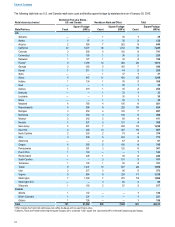

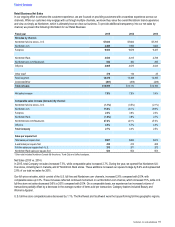

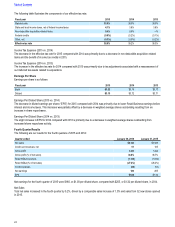

Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts

OVERVIEW

Nordstrom is a leading fashion specialty retailer offering apparel, shoes, cosmetics and accessories for women, men, young adults and

children. We offer an extensive selection of high-quality brand-name and private label merchandise through our various channels, including

Nordstrom U.S. and Canada full-line stores, Nordstrom.com, Nordstrom Rack stores, Nordstromrack.com/HauteLook, Trunk Club clubhouses

and TrunkClub.com, our Jeffrey boutiques and our Last Chance clearance store. As of January 30, 2016, our stores are located in 39 states

throughout the United States and in three provinces in Canada. In addition, we offer our customers a Nordstrom Rewards† loyalty program

along with a variety of payment products and services, including credit and debit cards.

In 2015, we continued to grow our business despite a more challenging retail environment in the second half of the year. We added nearly $1

billion to our top line, delivering total net sales growth of 7.5% and a comparable sales increase of 2.7%. During the year, we achieved the

following milestones in executing our customer strategy:

„ opened our first international flagship store in Vancouver, British Columbia, the most successful opening in our Company history

„ grew Nordstromrack.com/HauteLook by 47%, reaching over $500 in sales

„ expanded our fulfillment network with our third fulfillment center in Elizabethtown, Pennsylvania, located within two-day delivery of

approximately half the U.S. population

„ returned $2.4 billion to shareholders through share repurchase and dividends, of which $1.8 billion resulted from the sale of our

credit card receivables

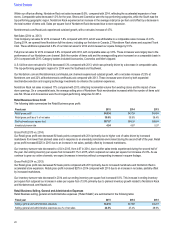

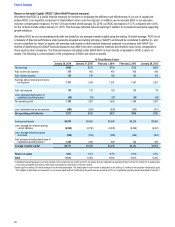

From a merchandising perspective, we€re constantly pursuing newness and fashion to increase our relevance with customers. Brands like

Topshop, Madewell, Brandy Melville and Charlotte Tilbury have contributed to the strength of our younger customer-focused departments

and attracted new customers to Nordstrom. Additionally, we saw continued momentum in Beauty, which has been among our top-performing

categories for the fourth straight year.

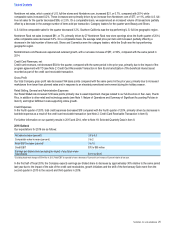

On October 1st, we completed the sale of our credit card portfolio to TD. Our mutual commitment to having Nordstrom employees serve our

customers directly was paramount to this partnership. We are able to retain all aspects of customer-facing activities, aligning with our

strategy of enhancing the customer experience while allowing for improvement in capital efficiency.

In addition, we consider our loyalty program as an enabler of growth to increase our engagement with customers and attract new customers.

With sales to Rewards members representing 40% of our sales volume, we look forward to expanding our program with a tender-neutral offer

in 2016.

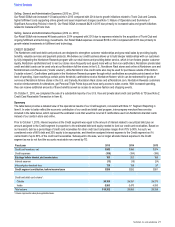

Over the past several years, we€ve made significant investments to enable customers to shop seamlessly across stores and online as well as

to grow our business through new markets. Our investments in HauteLook, Canada and Trunk Club added over $400 to our top-line growth

in 2015, while Nordstrom Rack€s expansion of 27 new stores contributed nearly $230 to our top-line growth. These investments have resulted

in market share gains, but also represent an evolution of our business resulting in expenses growing faster than sales in recent years.

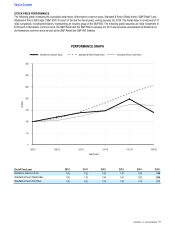

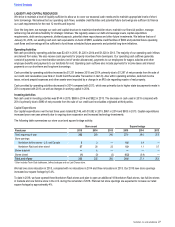

As we look ahead to 2016, we continue to view 2015 as our peak investment year. While we have successfully increased market share, we

are also committed to increasing efficiency, lowering costs while increasing effectiveness and gaining profitability. With our investments

moderating, we expect 2016 to represent an inflection point of earnings growth improvement.

As our business evolves, our focus continues to be guided by customer expectations around speed, convenience and personalization. We

believe that we are well positioned with the right strategies in place to successfully serve our customers, which will in turn lead to long-term

profitable growth and top-quartile total shareholder return.

Table of Contents

Nordstrom, Inc. and subsidiaries 17