Nordstrom 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

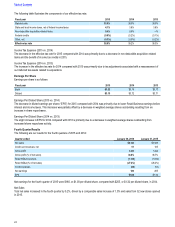

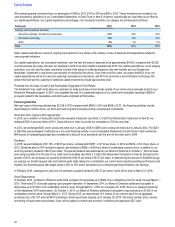

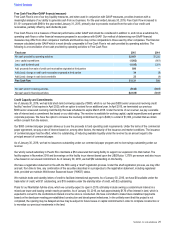

Stock-Based Compensation Expense

We grant stock-based awards under our 2010 Equity Incentive Plan (‚2010 Planƒ), 2002 Nonemployee Director Stock Incentive Plan (‚2002

Planƒ) and Trunk Club Value Creation Plan (‚VCPƒ), and employees may purchase our stock at a discount under our Employee Stock

Purchase Plan (‚ESPPƒ). We predominantly recognize stock-based compensation expense related to stock-based awards at their estimated

grant date fair value, recorded on a straight-line basis over the requisite service period. Compensation expense for certain award holders is

accelerated based upon achievement of age and years of service. The total compensation expense is reduced by estimated forfeitures

expected to occur over the vesting period of the awards.

We estimate the grant date fair value of stock options using the Binomial Lattice option valuation model. Stock-based compensation expense

related to the VCP is based on the grant date fair value of the payout scenario we believe is probable using the Black-Scholes valuation

model and is recognized on an accelerated basis due to performance criteria and graded vesting features of the plan. The fair value of

restricted stock units is determined based on the number of shares granted and the quoted price of our common stock on the date of grant.

Calculating the grant date fair value of stock-based awards is based on certain assumptions and requires judgment, including estimating

stock price volatility, forfeiture rates, expected life and performance criteria. A 10% change in stock-based compensation expense would have

a $4 impact on our net earnings for the year ended January•30, 2016.

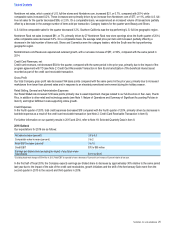

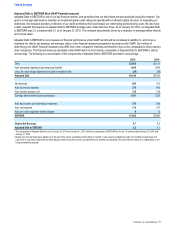

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded

based on differences between the financial reporting and tax basis of assets and liabilities and for operating loss and tax credit carryforwards.

The deferred tax assets and liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the

differences are expected to reverse. We routinely evaluate the likelihood of realizing the benefit of our deferred tax assets and may record a

valuation allowance if, based on all available evidence, it is determined that some portion of the tax benefit will not be realized.

We regularly evaluate the likelihood of realizing the benefit for income tax positions we have taken in various federal, state and foreign filings

by considering all relevant facts, circumstances and information available. If we believe it is more likely than not that our position will be

sustained, we recognize a benefit at the largest amount that we believe is cumulatively greater than 50% likely to be realized. Our

unrecognized tax benefit was $19 as of January•30, 2016 and $15 as of January•31, 2015. Interest and penalties related to income tax

matters are classified as a component of income tax expense.

Income taxes require significant management judgment regarding applicable statutes and their related interpretation, the status of various

income tax audits and our particular facts and circumstances. Also, as audits are completed or statutes of limitations lapse, it may be

necessary to record adjustments to our taxes payable, deferred taxes, tax reserves or income tax expense. Such adjustments did not

materially impact our effective income tax rate in 2015 or 2014.

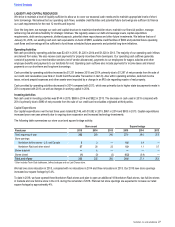

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 1: Nature of Operations and Summary of Significant Accounting Policies in Item•8 for a discussion of recent accounting

pronouncements and the impact these standards are anticipated to have on our results of operations, liquidity or capital resources.

Table of Contents

34