Nordstrom 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

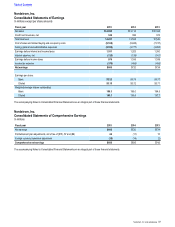

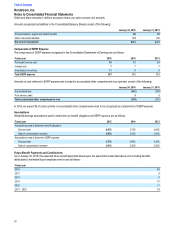

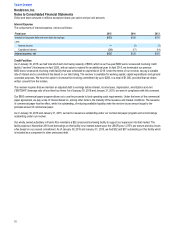

Vendor Allowances

We receive allowances from merchandise vendors for cosmetic expenses, purchase price adjustments, cooperative advertising programs

and various other expenses. Allowances for cosmetic expenses are recorded in selling, general and administrative expenses as a reduction

of the related costs when incurred. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been

earned and the related merchandise has been marked down or sold. Allowances for cooperative advertising programs and other expenses

are recorded in selling, general and administrative expenses as a reduction of the related costs when incurred. Any allowances in excess of

actual costs incurred that are included in selling, general and administrative expenses are recorded as a reduction of cost of sales. Vendor

allowances earned are as follows:

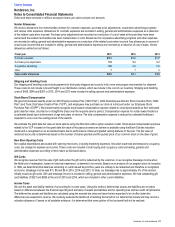

Fiscal year 2015 2014 2013

Cosmetic expenses $161 $140 $137

Purchase price adjustments 178 164 143

Cooperative advertising 109 102 103

Other 77 6

Total vendor allowances $455 $413 $389

Shipping and Handling Costs

Our shipping and handling costs include payments to third-party shippers and costs to hold, move and prepare merchandise for shipment.

These costs do not include in-bound freight to our distribution centers, which we include in the cost of our inventory. Shipping and handling

costs of $428, $348 and $267 in 2015, 2014 and 2013 were included in selling, general and administrative expenses.

Stock-Based Compensation

We grant stock-based awards under our 2010 Equity Incentive Plan (‚2010 Planƒ), 2002 Nonemployee Director Stock Incentive Plan (‚2002

Planƒ) and Trunk Club Value Creation Plan (‚VCPƒ), and employees may purchase our stock at a discount under our Employee Stock

Purchase Plan (‚ESPPƒ). We predominantly recognize stock-based compensation expense related to stock-based awards at their estimated

grant date fair value, recorded on a straight-line basis over the requisite service period. Compensation expense for certain award holders is

accelerated based upon achievement of age and years of service. The total compensation expense is reduced by estimated forfeitures

expected to occur over the vesting period of the awards.

We estimate the grant date fair value of stock options using the Binomial Lattice option valuation model. Stock-based compensation expense

related to the VCP is based on the grant date fair value of the payout scenario we believe is probable using the Black-Scholes valuation

model and is recognized on an accelerated basis due to performance criteria and graded vesting features of the plan. The fair value of

restricted stock units is determined based on the number of shares granted and the quoted price of our common stock on the date of grant.

New Store Opening Costs

Non-capital expenditures associated with opening new stores, including marketing expenses, relocation expenses and temporary occupancy

costs, are charged to expense as incurred. These costs are included in both buying and occupancy costs and selling, general and

administrative expenses according to their nature as disclosed above.

Gift Cards

We recognize revenue from the sale of gift cards when the gift card is redeemed by the customer, or we recognize breakage income when

the likelihood of redemption, based on historical experience, is deemed to be remote. Based on an analysis of our program since its inception

in 1999, we determined that balances remaining on cards issued beyond five years are unlikely to be redeemed and therefore is recognized

as income. Breakage income was $11, $8 and $9 in 2015, 2014 and 2013. To date, our breakage rate is approximately 3% of the amount

initially issued as gift cards. Gift card breakage income is included in selling, general and administrative expenses. We had outstanding gift

card liabilities of $327 and $286 at the end of 2015 and 2014, which are included in other current liabilities.

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded

based on differences between the financial reporting and tax basis of assets and liabilities and for operating loss and tax credit carryforwards.

The deferred tax assets and liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the

differences are expected to reverse. We routinely evaluate the likelihood of realizing the benefit of our deferred tax assets and may record a

valuation allowance if, based on all available evidence, it is determined that some portion of the tax benefit will not be realized.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 43