Nordstrom 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

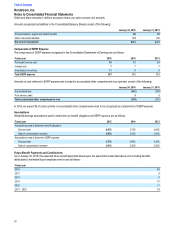

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (‚FASBƒ) issued Accounting Standards Update (‚ASUƒ) No.•2014-09,•Revenue from

Contracts with Customers, which was subsequently modified in August 2015 by ASU No. 2015-14,€Revenue from Contracts with Customers:

Deferral of the Effective Date.•The core principle of ASU No. 2014-09 is that companies should recognize revenue when the transfer of

promised goods or services to customers occurs in an amount that reflects what the company expects to receive. It requires additional

disclosures to describe the nature, amount, timing, and uncertainty of revenue and cash flows from contracts with customers. This guidance

is now effective for us beginning in the first quarter of 2018. We are currently evaluating the impact the provisions would have on our

Consolidated Financial Statements.

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes - Balance Sheet Classification of Deferred Taxes. This ASU requires

deferred tax liabilities and assets to be classified as noncurrent in the statement of financial position. The change simplifies classification and

reporting by eliminating the identification of net current and net noncurrent deferred tax assets or liabilities.•We elected to early adopt this

ASU resulting in a reclassification of our current deferred tax assets, net to long-term deferred tax assets, net, included within other non-

current assets in our Consolidated Balance Sheet as of January 30, 2016. We have implemented the guidance on a prospective basis,

therefore prior periods were not retrospectively adjusted.

In February 2016, the FASB issued ASU No. 2016-02, Leases. This ASU increases transparency and comparability by recognizing a lessee€s

rights and obligations resulting from leases by recording them on the balance sheet as lease assets and lease liabilities. The new standard

requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not

the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an

effective interest method or on a straight-line basis over the term of the lease. This ASU is effective for us beginning with the first quarter of

2019. Though we are currently evaluating the impact of these provisions, we expect it will have a material impact on our Consolidated

Financial Statements.

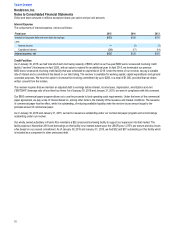

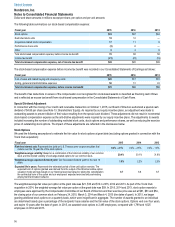

NOTE 2:€€CREDIT CARD RECEIVABLE TRANSACTION

On October•1, 2015, we completed the sale of a substantial majority of our U.S. Visa and private label credit card portfolio to TD. In

connection with the sale, we entered into a long-term program agreement under which TD is the exclusive issuer of our U.S. consumer credit

cards. The following events summarize our credit card receivable transaction:

„ Receivables Reclassification ‡ In the second quarter of 2015, we reclassified substantially all of our U.S. Visa and private label

credit card receivables from ‚held for investmentƒ to ‚held for saleƒ and, as such, recorded these receivables at the lower of cost

(par) or fair value, resulting in the reversal of an allowance for credit losses of $64.

„ Secured Notes Defeasance ‡ In September 2015, we completed the defeasance of our $325 Series 2011-1 Class A Notes in order

to provide the credit card receivables to TD free and clear.

„ Transaction Close ‡ At close we received $2.2 billion in cash consideration reflecting the par value of the receivables sold, and

incurred $32 in transaction-related expenses during the third quarter.

„ Program Agreement ‡ Pursuant to the agreement, we are obligated to offer and administer our loyalty program and perform other

account servicing functions. In return, we receive a portion of the ongoing credit card revenue, net of credit losses, from both the

sold and newly generated credit card receivables.

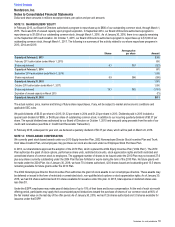

Transaction Accounting

The Purchase and Sale and Program agreements constitute a multiple element arrangement. These agreements were accounted for in

accordance with Accounting Standards Codification (‚ASCƒ) 605, Revenue Recognition and ASC 860, Transfers and Servicing. We allocated

the upfront cash consideration to each of the contract elements, including but not limited to receivables, accounts and loyalty obligations

based upon relative selling price or fair value. We then recognized revenue on each of the contract elements that were delivered or earned,

including receivables sold and accounts delivered, and deferred revenue on each of the elements that remained undelivered or unearned,

including loyalty obligations.

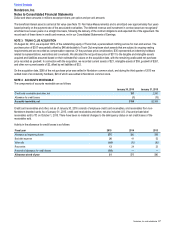

We recorded the following assets and liabilities associated with the arrangement:

„ Beneficial interest asset of $62 ‡ represents the present value of the expected profits on the receivables sold.

„ Deferred revenue of $289 ‡ primarily related to our obligation to offer and administer our loyalty program over the term of the

agreement.

„ Investment in contract asset of $210 ‡ represents the future economic benefit associated with the arrangement and is equal to the

difference between the carrying value of the delivered elements and the upfront cash consideration allocated to those elements.

„ We did not record a servicing asset or liability as our servicing fee approximates that of a market participant and represents

adequate compensation.

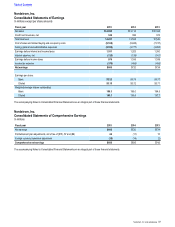

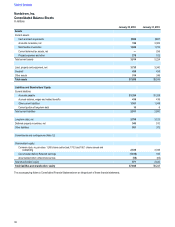

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

46