Nordstrom 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

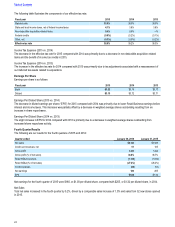

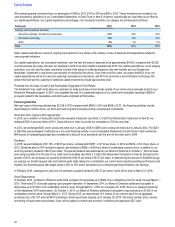

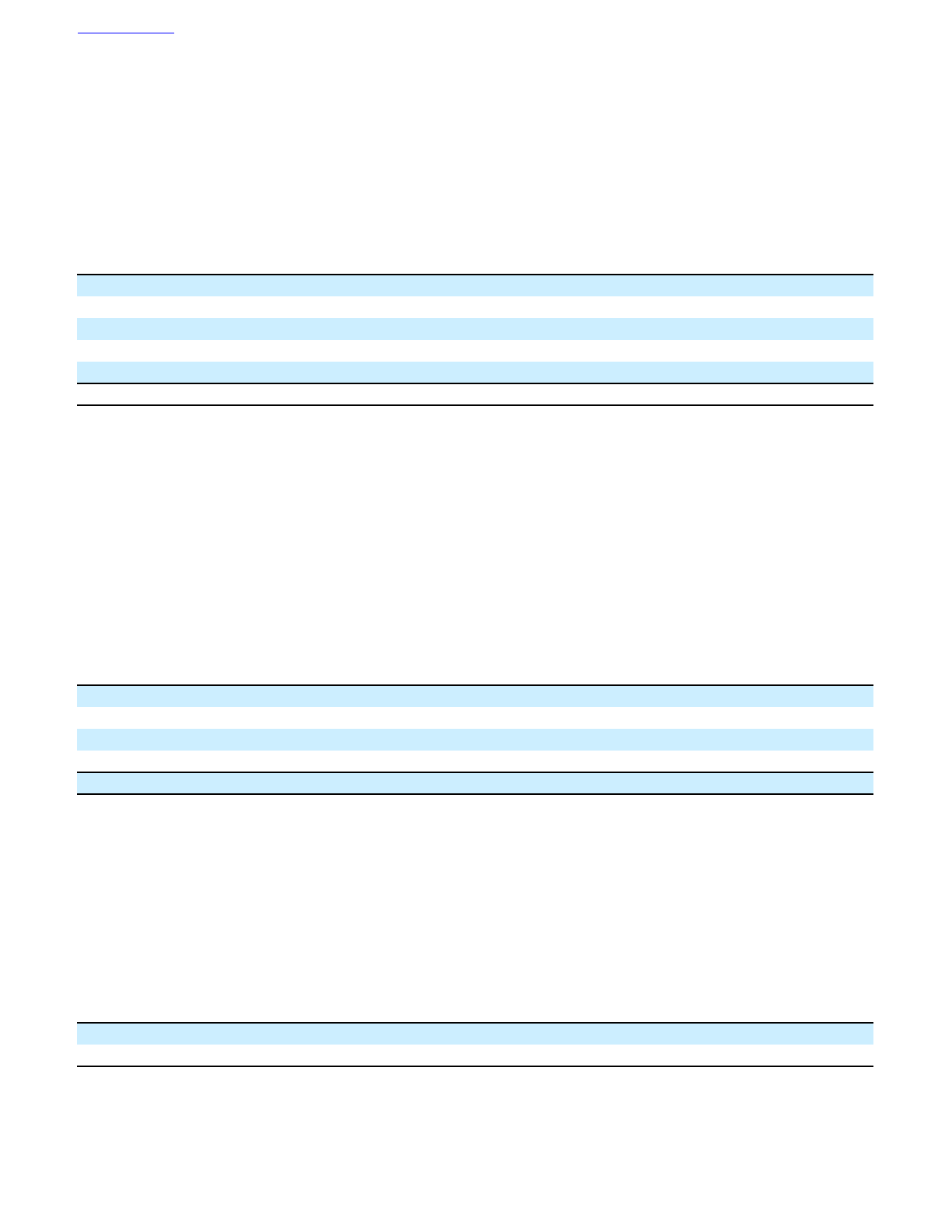

Allowance for Credit Losses and Credit Trends

A substantial majority of our receivables were reclassified as ‚held for saleƒ during the second quarter of 2015, and resulted in the reversal of

the allowance for credit losses of $64 on those receivables.

For our owned credit card receivables, we consider a credit card account delinquent if the minimum payment is not received by the payment

due date. Our aging method is based on the number of completed billing cycles during which the customer failed to make a minimum

payment. During the third quarter of 2014, we modified our write-off policy from 150 days past due to 180 days past due to better align with

industry practice.

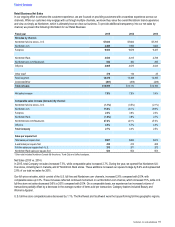

Activity in the allowance for credit losses is as follows:

Fiscal year 2015 2014 2013

Allowance at beginning of year $75 $80 $85

Bad debt expense 26 41 52

Write-offs (49)(70)(80)

Recoveries 13 24 23

Reversal of allowance for credit losses (64)… …

Allowance at end of year $1 $75 $80

Credit Trends

Net write-offs in 2015 were $36, compared with $46 in 2014 and $57 in 2013. Net write-offs decreased in 2015 from 2014 due to the credit

card receivable transaction. In 2015 and 2014, we reduced our allowance for credit losses as delinquencies and net write-offs improved.

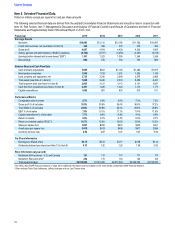

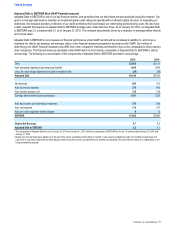

Intercompany Merchant Fees

Intercompany merchant fees represent the estimated costs that would be incurred if Nordstrom cardholders used non-Nordstrom-branded

cards in our stores and online. In 2015, this estimate increased to $118 from $108 in 2014. This was primarily driven by the increased use of

Nordstrom credit and debit cards in store and online.

TOTAL COMPANY RESULTS

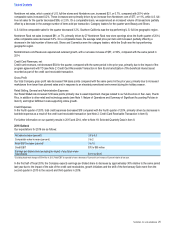

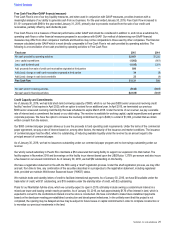

Interest Expense, Net

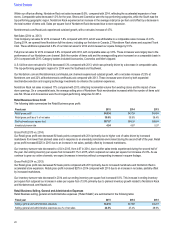

Interest expense is summarized in the following table:

Fiscal year 2015 2014 2013

Interest on long-term debt and short-term borrowings $153 $156 $176

Less:

Interest income —(1)(1)

Capitalized interest (28)(17)(14)

Interest expense, net $125 $138 $161

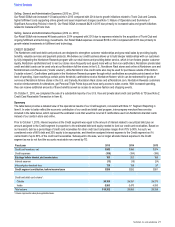

Interest Expense, Net (2015 vs. 2014)

Interest expense, net decreased $13 in 2015 compared with 2014 due to an increase in capitalized interest resulting from planned capital

investments related to technology, our Manhattan store and Nordstrom Rack and Canada store openings in 2015.

Interest Expense, Net (2014 vs. 2013)

Interest expense, net decreased $23 in 2014 compared with 2013 due to a non-recurring charge of $14 in 2013 related to our debt

refinancing, as well as lower average interest rates on our notes in 2014 driven by our fourth quarter 2013 debt transactions.

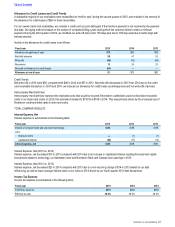

Income Tax Expense

Income tax expense is summarized in the following table:

Fiscal year 2015 2014 2013

Income tax expense $376 $465 $455

Effective tax rate 38.6%39.2%38.3%

Table of Contents

Nordstrom, Inc. and subsidiaries 23