Nordstrom 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

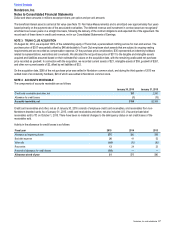

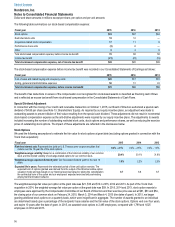

A summary of stock option activity for 2015, which includes awards issued as part of the Trunk Club acquisition in 2014, is presented below:

Fiscal year 2015

Shares

Weighted-

average

exercise€price

Weighted-average

remaining€

contractual

life (years)

Aggregate€

intrinsic€

value€

Outstanding, beginning of year 12.7 $46

Granted 1.8 75

Special dividend adjustment 0.9 N/A

Exercised (1.8)41

Forfeited or cancelled (0.4)58

Outstanding, end of year 13.2 $47 6 $88

Exercisable, end of year 7.5 $39 5 $81

Vested or expected to vest, end of year 12.8 $47 6 $88

The aggregate intrinsic value of options exercised during 2015, 2014 and 2013 was $62, $97 and $89. The total fair value of stock options

vested during 2015, 2014 and 2013 was $44, $41 and $34. As of January•30, 2016, the total unrecognized stock-based compensation

expense related to nonvested stock options was $57, which is expected to be recognized over a weighted-average period of 27 months.

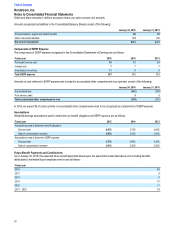

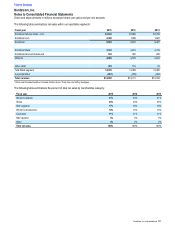

Restricted Stock Units

In 2014 and 2015, we granted our employees restricted stock units that were approved by the Compensation Committee of our Board of

Directors, and determined based upon a percentage of the recipients€ base salaries and the fair value of the restricted stock units. Restricted

stock units typically vest over four years.

A summary of restricted stock unit activity for 2015, which includes awards issued as part of the Trunk Club acquisition in 2014, is presented

below:

Fiscal year 2015

Shares

Weighted-average

grant date fair value

per unit

Outstanding, beginning of year 0.9 $66

Granted 0.5 77

Special dividend adjustment 0.1 N/A

Vested (0.3) 66

Forfeited 0.0 71

Outstanding, end of year 1.2 $71

The total fair value of restricted stock units vested during 2015 was $24. As of January•30, 2016, the total unrecognized stock-based

compensation expense related to nonvested restricted stock units was $56, which is expected to be recognized over a weighted-average

period of 29 months.

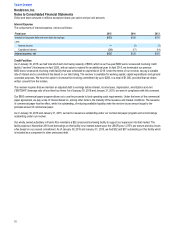

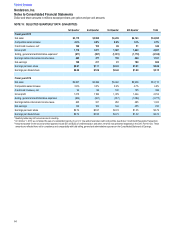

Performance Share Units

We generally grant performance share units to executive officers as one of the ways to align compensation with shareholder interests.

Performance share units are earned after a three-year performance cycle only when our total shareholder return (reflecting daily stock price

appreciation and compounded reinvestment of dividends) outperforms companies in a defined group of competitors determined by the

Compensation Committee of our Board of Directors. Performance share units granted in 2013 also require the total shareholder return to be

positive for any payout. The percentage of units that are earned depends on our relative position at the end of the performance cycle and can

range from 0% to 175% of the number of units granted.Because performance share units are payable in either cash or stock as elected by

the employee, they are classified as a liability award. The liability is remeasured, with a corresponding adjustment to earnings, at each fiscal

quarter-end during the performance cycle. The performance share unit liability is remeasured using the estimated percentage of units earned

multiplied by the closing market price of our common stock on the current period-end date and is pro-rated based on the amount of time that

has passed in the vesting period. The price used to determine the amount of cash or stock settled for the performance share units upon

vesting is the closing market price of our common stock on the last day of the performance cycle.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 57