Nordstrom 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

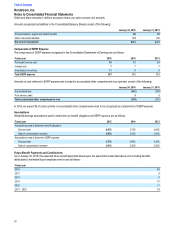

We regularly evaluate the likelihood of realizing the benefit for income tax positions we have taken in various federal, state and foreign filings

by considering all relevant facts, circumstances and information available. If we believe it is more likely than not that our position will be

sustained, we recognize a benefit at the largest amount that we believe is cumulatively greater than 50% likely to be realized. Interest and

penalties related to income tax matters are classified as a component of income tax expense.

Income taxes require significant management judgment regarding applicable statutes and their related interpretation, the status of various

income tax audits and our particular facts and circumstances. Also, as audits are completed or statutes of limitations lapse, it may be

necessary to record adjustments to our taxes payable, deferred taxes, tax reserves or income tax expense.

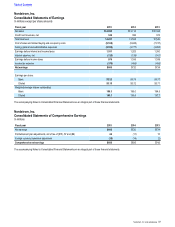

Comprehensive Net Earnings

Comprehensive net earnings consist of net earnings and other gains and losses affecting equity that are excluded from net earnings. These

consist of postretirement plan adjustments, net of related income tax effects and foreign currency translation adjustments.

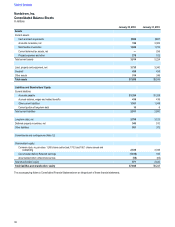

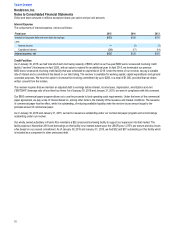

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase and are carried at amortized

cost, which approximates fair value. Our cash management system provides for the reimbursement of all major bank disbursement accounts

on a daily basis. Accounts payable at the end of 2015 and 2014 included $152 and $129 of checks not yet presented for payment drawn in

excess of our bank deposit balances.

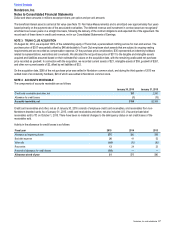

Accounts Receivable

Prior to the close of the credit card receivable transaction, accounts receivable included credit card receivables from our Nordstrom private

label and U.S. Visa credit cards, as well as credit and debit card receivables due from third parties. Following the close of the credit card

receivable transaction (see Note 2: Credit Card Receivable Transaction), our remaining accounts receivable, net includes employee credit

card receivables and receivables from non-Nordstrom-branded cards.

We continue to record accounts receivable on our Consolidated Balance Sheets, net of an allowance for credit losses. The allowance for

credit losses reflects our best estimate of the losses inherent in our receivables as of the balance sheet date.

Nordstrom private label credit and debit cards can be used only at our Nordstrom full-line stores in the U.S., Nordstrom Rack stores,

Nordstrom.com and Nordstromrack.com/HauteLook, while Nordstrom Visa credit cards also may be used for purchases outside of

Nordstrom. Cash flows from the use of both the private label and Nordstrom Visa credit cards for sales originating at our stores and our

website are treated as an operating activity within the Consolidated Statements of Cash Flows, as they relate to sales at Nordstrom. Prior to

the credit card receivable transaction, we treated cash flows arising from the use of Nordstrom Visa credit cards outside of our stores as an

investing activity within the Consolidated Statements of Cash Flows, as they represented loans made to our customers for purchases at third

parties.

Merchandise Inventories

Merchandise inventories are generally stated at the lower of cost or market value using the retail inventory method (weighted-average cost).

Under the retail method, the valuation of inventories are determined by applying a calculated cost-to-retail ratio to the retail value of ending

inventory. The value of our inventory on the balance sheet is then reduced by a charge to cost of sales for retail inventory markdowns taken

on the selling floor. To determine if the retail value of our inventory should be marked down, we consider current and anticipated demand,

customer preferences, age of the merchandise and fashion trends. We reserve for obsolescence based on historical trends and specific

identification.

Land, Property and Equipment

Land is recorded at historical cost, while property and equipment are recorded at cost less accumulated depreciation and amortization.

Capitalized software includes the costs of developing or obtaining internal-use software, including external direct costs of materials and

services and internal payroll costs related to the software project.

We capitalize interest on construction in progress and software projects during the period in which expenditures have been made, activities

are in progress to prepare the asset for its intended use and actual interest costs are being incurred.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

44