Nordstrom 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

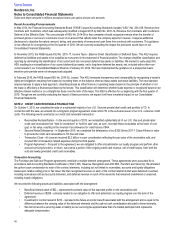

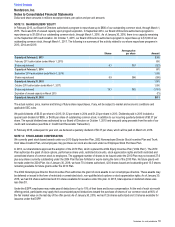

The following table summarizes our stock-based compensation expense:

Fiscal year 2015 2014 2013

Stock options $33 $37 $44

Restricted stock units 18 10 …

Acquisition-related stock compensation 17 11 8

Performance share units (3)6 …

Other 54 6

Total stock-based compensation expense, before income tax benefit 70 68 58

Income tax benefit (21)(23)(19)

Total stock-based compensation expense, net of income tax benefit $49 $45 $39

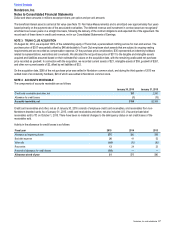

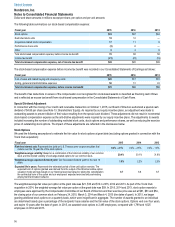

The stock-based compensation expense before income tax benefit was recorded in our Consolidated Statements of Earnings as follows:

Fiscal year 2015 2014 2013

Cost of sales and related buying and occupancy costs $20 $17 $15

Selling, general and administrative expenses 50 51 43

Total stock-based compensation expense, before income tax benefit $70 $68 $58

The benefit of tax deductions in excess of the compensation cost recognized for stock-based awards is classified as financing cash inflows

and is reflected as excess tax benefit from stock-based compensation in the Consolidated Statements of Cash Flows.

Special Dividend Adjustment

In connection with the closing of our credit card receivable transaction on October 1, 2015, our Board of Directors authorized a special cash

dividend of $4.85 per share (see Note 13: Shareholders€ Equity). As required by our equity incentive plans, an adjustment was made to

outstanding awards to prevent dilution of their value resulting from the special cash dividend. These adjustments did not result in incremental

stock-based compensation expense as the anti-dilutive adjustments were required by our equity incentive plans. The adjustments to awards

included increasing the number of outstanding restricted stock units, stock options and performance shares, as well as reducing the exercise

prices of outstanding stock options. The impact of these adjustments are reflected in the disclosures below.

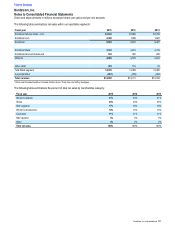

Stock Options

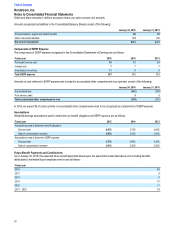

We used the following assumptions to estimate the fair value for stock options at grant date (excluding options granted in connection with the

Trunk Club acquisition):

Fiscal year 2015 2014 2013

Risk-free interest rate: Represents the yield on U.S. Treasury zero-coupon securities that

mature over the 10-year life of the stock options. 0.2% – 2.1% 0.2% ‡ 2.6% 0.2% ‡ 1.8%

Weighted-average volatility: Based on a combination of the historical volatility of our common

stock and the implied volatility of exchange-traded options for our common stock. 29.4%30.1%31.8%

Weighted-average expected dividend yield: Our forecasted dividend yield for the next 10

years. 1.8%2.2%2.0%

Expected life in years: Represents the estimated period of time until option exercise. The

expected term of options granted was derived from the output of the Binomial Lattice option

valuation model and was based on our historical exercise behavior, taking into consideration

the contractual term of the option and our employees€ expected exercise and post-vesting

employment termination behavior.

6.7 6.8 6.7

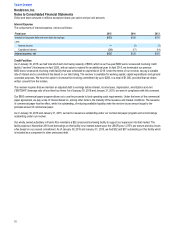

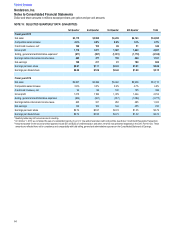

The weighted-average fair value per option at the grant date was $21, $16 and $14 in 2015, 2014 and 2013. As part of the Trunk Club

acquisition in 2014, the weighted-average fair value per option at the grant date was $59. In 2015, 2014 and 2013, stock option awards to

employees were approved by the Compensation Committee of our Board of Directors and their exercise price was set at $81, $61 and $54,

the closing price of our common stock on February•24, 2015, March•3, 2014 and March•4, 2013 (the dates of grant). In 2015, we began

granting additional stock options on a quarterly basis, which were insignificant in aggregate. The number of awards granted to an individual

are determined based upon a percentage of the recipients€ base salaries and the fair value of the stock options. Options vest over four years,

and expire 10 years after the date of grant. In 2015, we awarded stock options to 2,495 employees, compared with 1,799 and 1,625

employees in 2014 and 2013.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

56