Nordstrom 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

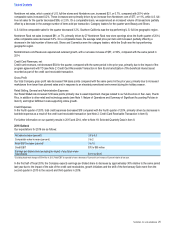

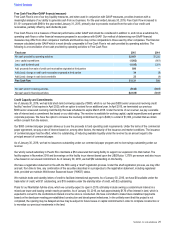

Impact of Credit Ratings

Under the terms of our revolver, any borrowings we may enter into will accrue interest for Euro-Dollar Rate Loans at a floating base rate tied

to LIBOR, for Canadian Dealer Offer Rate Loans at a floating rate tied to CDOR, and for Base Rate Loans at the highest of: (i) the Euro-

Dollar rate plus 100 basis points, (ii)•the federal funds rate plus 50 basis points and (iii)•the prime rate.

The rate depends upon the type of borrowing incurred, plus in each case an applicable margin. This applicable margin varies depending

upon the credit ratings assigned to our long-term unsecured debt. At the time of this report, our long-term unsecured debt ratings, outlook

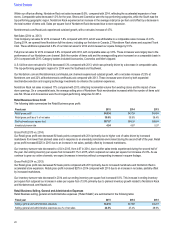

and resulting applicable margin were as follows:

Credit€Ratings Outlook

Moody€s Baa1 Stable

Standard & Poor€s BBB+ Stable

Base€Interest

Rate

Applicable

Margin

Euro-Dollar Rate Loan LIBOR 1.02%

Canadian Dealer Offer Rate Loan CDOR 1.02%

Base Rate Loan various …

Should the ratings assigned to our long-term unsecured debt improve, the applicable margin associated with any such borrowings may

decrease, resulting in a slightly lower borrowing cost under this facility. Should the ratings assigned to our long-term unsecured debt worsen,

the applicable margin associated with our borrowings may increase, resulting in a slightly higher borrowing cost under this facility.

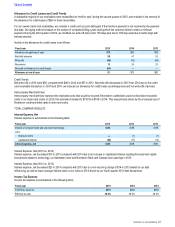

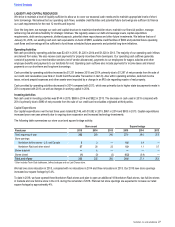

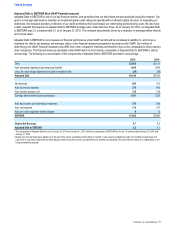

Debt Covenants

The revolver requires that we maintain an adjusted debt to earnings before interest, income taxes, depreciation, amortization and rent

(‚EBITDARƒ) leverage ratio of less than four times (see the following additional discussion of Adjusted Debt to EBITDAR). As of January•30,

2016, we were in compliance with this covenant.

Table of Contents

30