Nordstrom 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

60

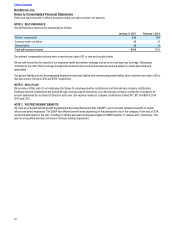

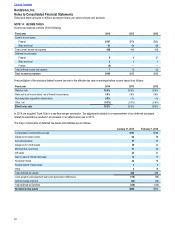

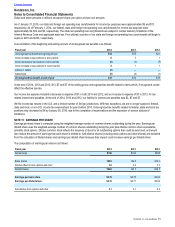

NOTE 14: INCOME TAXES

Income tax expense consists of the following:

Fiscal year 2014 2013 2012

Current income taxes:

Federal $397 $379 $362

State and local 61 64 66

Total current income tax expense 458 443 428

Deferred income taxes:

Federal 99 21

State and local 23 1

Foreign (4) — —

Total deferred income tax expense 712 22

Total income tax expense $465 $455 $450

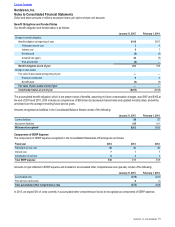

A reconciliation of the statutory federal income tax rate to the effective tax rate on earnings before income taxes is as follows:

Fiscal year 2014 2013 2012

Statutory rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal income taxes 3.8% 3.6% 3.6%

Non-deductible acquisition-related items 0.9% —% —%

Other, net (0.5%) (0.3%) (0.6%)

Effective tax rate 39.2% 38.3% 38.0%

In 2014, we acquired Trunk Club in a tax-free merger transaction. Tax adjustments related to a reassessment of our deferred tax assets

related to acquisitions resulted in an increase in our effective tax rate in 2014.

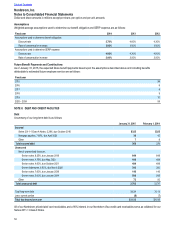

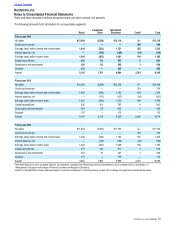

The major components of deferred tax assets and liabilities are as follows:

January 31, 2015 February 1, 2014

Compensation and benefits accruals $191 $182

Allowance for sales returns 62 56

Accrued expenses 51 48

Allowance for credit losses 29 32

Merchandise inventories 31 28

Gift cards 23 21

Gain on sale of interest rate swap 12 19

Nordstrom Notes 22 18

Federal benefit of state taxes 36

Other 416

Total deferred tax assets 428 426

Land, property and equipment basis and depreciation differences (116) (98)

Debt exchange premium (22) (24)

Total deferred tax liabilities (138) (122)

Net deferred tax assets $290 $304