Nordstrom 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

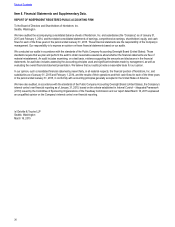

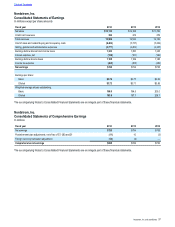

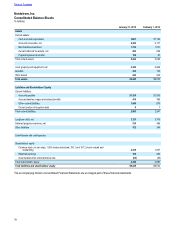

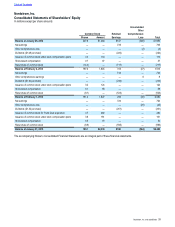

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

46

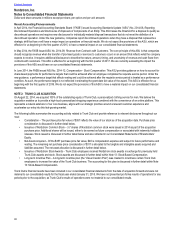

Recent Accounting Pronouncements

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-08, Reporting

Discontinued Operations and Disclosures of Disposals of Components of an Entity. This ASU raises the threshold for a disposal to qualify as

discontinued operations and requires new disclosures for individually material disposal transactions that do not meet the definition of a

discontinued operation. Under the new guidance, companies report discontinued operations when they have a disposal that represents a

strategic shift that has or will have a major impact on operations or financial results. We do not expect the provisions of this ASU, which are

effective for us beginning in the first quarter of 2015, to have a material impact on our consolidated financial statements.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers. The core principle of this ASU is that companies

should recognize revenue when the transfer of promised goods or services to customers occurs in an amount that reflects what the company

expects to receive. It requires additional disclosures to describe the nature, amount, timing, and uncertainty of revenue and cash flows from

contracts with customers. This ASU is effective for us beginning with the first quarter of 2017. We are currently evaluating the impact the

provisions of this ASU would have on our consolidated financial statements.

In June 2014, the FASB issued ASU No. 2014-12, Compensation - Stock Compensation. This ASU provides guidance on how to account for

share-based payments for performance targets that could be achieved after an employee completes the requisite service period. Under the

new guidance, a performance target that affects vesting and could be achieved after the requisite service period is treated as a performance

condition. As such, the performance target is not reflected in estimating the grant-date fair value of the award. This ASU is effective for us

beginning with the first quarter of 2016. We do not expect the provisions of this ASU to have a material impact on our consolidated financial

statements.

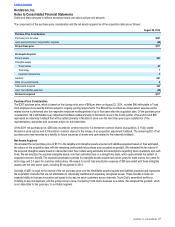

NOTE 2: TRUNK CLUB ACQUISITION

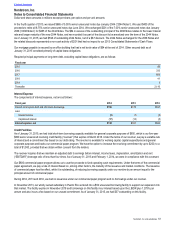

On August 22, 2014, we acquired 100% of the outstanding equity of Trunk Club, a personalized clothing service for men. We believe the

acquisition enables us to provide a high-touch personalized shopping experience combined with the convenience of an online platform. This

represents a natural extension of our core business, aligns with our strategic priorities around a relevant customer experience and

accelerates our entry into this fast-growing market.

The following bullets summarize the accounting activity related to Trunk Club and provide reference to relevant disclosures throughout our

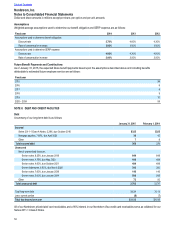

10-K:• Consideration – The purchase price fair value of $357 reflects the value of our stock as of the acquisition date. Purchase price

consideration is discussed in further detail below.

• Issuance of Nordstrom Common Stock – 3.7 shares of Nordstrom common stock were issued in 2014 as part of the acquisition

purchase price. Additional shares will be issued, either to be earned as future compensation or associated with indemnity holdback

releases. Stock issued is discussed in further detail below and also reflected in our Consolidated Statements of Shareholders’

Equity.

• Net Assets Acquired – Of the $357 purchase price fair value, $46 is compensation expense and subject to future performance and

vesting. The remaining net purchase price consideration of $311 is allocated to the tangible and intangible assets acquired and

liabilities assumed. The net asset allocation is discussed in further detail below.

• Issuance of Nordstrom Stock Awards – Trunk Club employees received Nordstrom stock awards in exchange for previously held

Trunk Club awards and stock. Stock awards are discussed in further detail within Note 13: Stock-Based Compensation.

• Long-term Incentive Plan – A long-term incentive plan (the “Value Creation Plan”) was created to incentivize certain Trunk Club

employees to increase the value of the Trunk Club business. The accounting for this plan is discussed in further detail within Note

13: Stock-Based Compensation.

Trunk Club’s financial results have been included in our consolidated financial statements from the date of acquisition forward and were not

material to our consolidated results for the fiscal year ended January 31, 2015. We have not presented pro forma results of operations for any

periods prior to the acquisition, as Trunk Club’s results of operations were not material to our consolidated results.