Nordstrom 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc. and subsidiaries 23

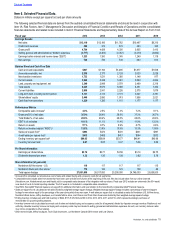

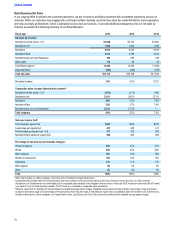

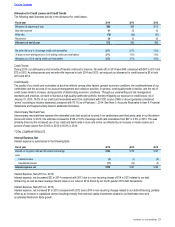

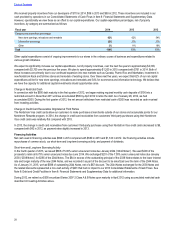

Allowance for Credit Losses and Credit Trends

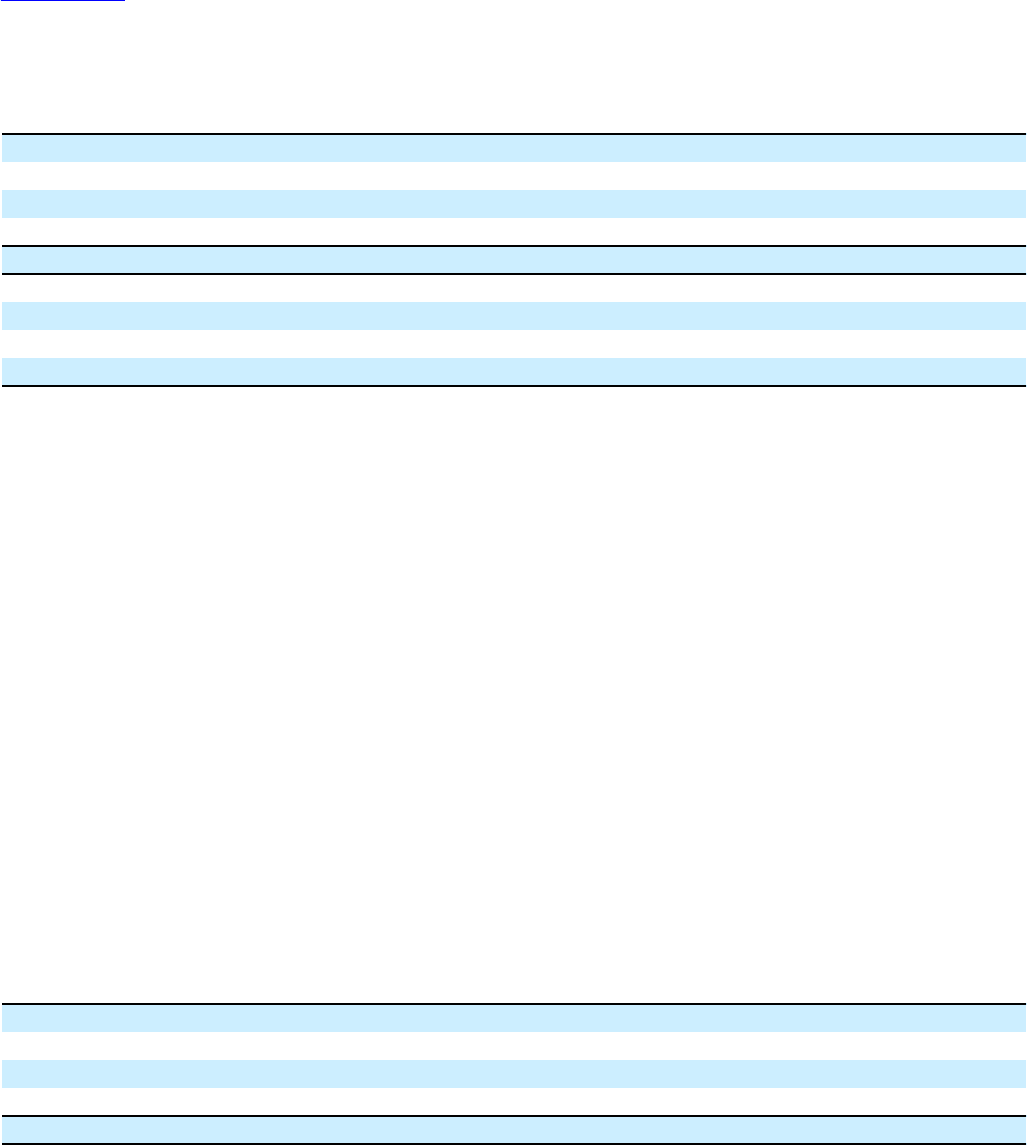

The following table illustrates activity in the allowance for credit losses:

Fiscal year 2014 2013 2012

Allowance at beginning of year $80 $85 $115

Bad debt expense 41 52 42

Write-offs (70) (80) (97)

Recoveries 24 23 25

Allowance at end of year $75 $80 $85

Net write-offs as a % of average credit card receivables 2.1% 2.7% 3.5%

30 days or more delinquent as a % of ending credit card receivables 2.1% 1.8% 1.9%

Allowance as a % of ending credit card receivables 3.3% 3.7% 4.0%

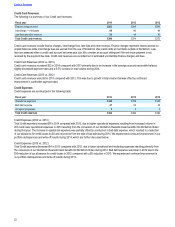

Credit Trends

During 2014, our delinquency and net write-off results continued to improve. Net write-offs in 2014 were $46, compared with $57 in 2013 and

$72 in 2012. As delinquencies and net write-offs improved in both 2014 and 2013, we reduced our allowance for credit losses by $5 in both

2014 and 2013.

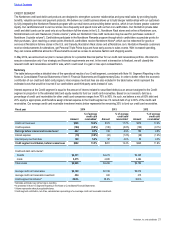

Credit Quality

The quality of our credit card receivables at any time reflects, among other factors, general economic conditions, the creditworthiness of our

cardholders and the success of our account management and collection activities. In general, credit quality tends to decline, and the risk of

credit losses tends to increase, during periods of deteriorating economic conditions. Through our underwriting and risk management

standards and practices, we seek to maintain a high-quality cardholder portfolio, thereby mitigating our exposure to credit losses. As of

January 31, 2015, 79.0% of our credit card receivables were from cardholders with FICO scores of 660 or above (generally considered

“prime” according to industry standards) compared with 78.1% as of February 1, 2014. See Note 3: Accounts Receivable in Item 8: Financial

Statements and Supplementary Data for additional information.

Intercompany Merchant Fees

Intercompany merchant fees represent the estimated costs that would be incurred if our cardholders used third-party cards in our Nordstrom

stores and online. In 2014, this estimate increased to $108 or 5.0% of average credit card receivables from $97 or 4.6% in 2013. This was

primarily driven by the increased use of our credit and debit cards in store and online, as reflected by an increase in inside volume as a

percent of total volume from 53.6% in 2013 to 55.8% in 2014.

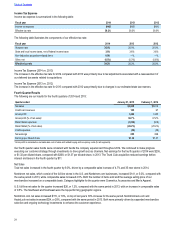

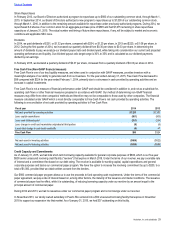

TOTAL COMPANY RESULTS

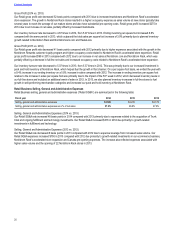

Interest Expense, Net

Interest expense is summarized in the following table:

Fiscal year 2014 2013 2012

Interest on long-term debt and short-term borrowings $156 $176 $167

Less:

Interest income (1) (1) (2)

Capitalized interest (17) (14) (5)

Interest expense, net $138 $161 $160

Interest Expense, Net (2014 vs. 2013)

Interest expense, net decreased $23 in 2014 compared with 2013 due to a non-recurring charge of $14 in 2013 related to our debt

refinancing, as well as lower average interest rates on our notes in 2014 driven by our fourth quarter 2013 debt transactions.

Interest Expense, Net (2013 vs. 2012)

Interest expense, net increased $1 in 2013 compared with 2012 due to $14 in non-recurring charges related to our debt refinancing, partially

offset by an increase in capitalized interest resulting primarily from planned capital investments related to our Manhattan store and

accelerated Nordstrom Rack growth.