Nordstrom 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

56

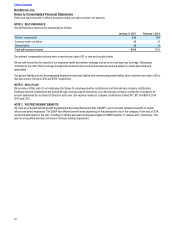

NOTE 13: STOCK-BASED COMPENSATION

We currently have three stock-based compensation plans: the 2010 Equity Incentive Plan (“2010 Plan”), the Employee Stock Purchase Plan

(“ESPP”) and the 2002 Nonemployee Director Stock Incentive Plan. Additionally, as part of our acquisitions of HauteLook in 2011 and Trunk

Club in 2014, we replaced and/or granted awards from shares available that were not allocated to a specific plan, as well as created an

additional long-term incentive plan for certain Trunk Club employees.

In 2010, our shareholders approved the adoption of the 2010 Plan, which replaced the 2004 Equity Incentive Plan (“2004 Plan”). The 2010

Plan authorizes the grant of stock options, performance share units, restricted stock units, stock appreciation rights and both restricted and

unrestricted shares of common stock to employees. The aggregate number of shares to be issued under the 2010 Plan may not exceed 27.6

plus any shares currently outstanding under the 2004 Plan which are forfeited or which expire during the term of the 2010 Plan. No future

grants will be made under the 2004 Plan. As of January 31, 2015, we have 70.4 shares authorized, 40.4 shares issued and outstanding and

16.7 shares remaining available for future grants under the 2010 Plan.

Under the ESPP, employees may make payroll deductions of up to 10% of their base and bonus compensation. At the end of each six-month

offering period, participants may apply their accumulated payroll deductions toward the purchase of shares of our common stock at 90% of

the fair market value on the last day of the offer period. As of January 31, 2015, we had 12.6 shares authorized and 3.3 shares available for

issuance under the ESPP. We issued 0.3 shares under the ESPP during 2014. At the end of both 2014 and 2013, we had current liabilities of

$6 for future purchases of shares under the ESPP.

The 2002 Nonemployee Director Stock Incentive Plan authorizes the grant of stock awards to our nonemployee directors. These awards may

be deferred or issued in the form of restricted or unrestricted stock, non-qualified stock options or stock appreciation rights. As of January 31,

2015, we had 0.9 shares authorized and 0.5 shares available for issuance under this plan. In 2014, we deferred shares with a total expense

of less than $1.

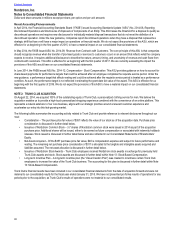

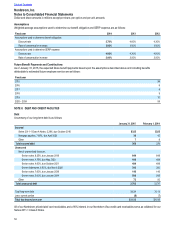

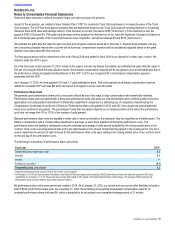

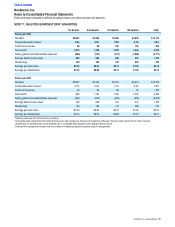

The following table summarizes our stock-based compensation expense:

Fiscal year 2014 2013 2012

Stock options $37 $44 $36

Acquisition-related stock compensation 11 8 9

Restricted stock units 10 — —

Performance share units 6— 3

Other 46 5

Total stock-based compensation expense, before income tax benefit 68 58 53

Income tax benefit (23) (19) (17)

Total stock-based compensation expense, net of income tax benefit $45 $39 $36

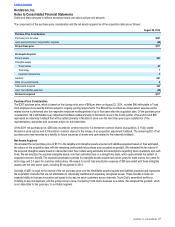

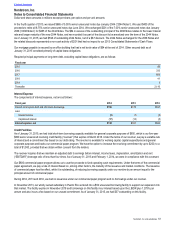

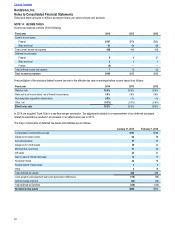

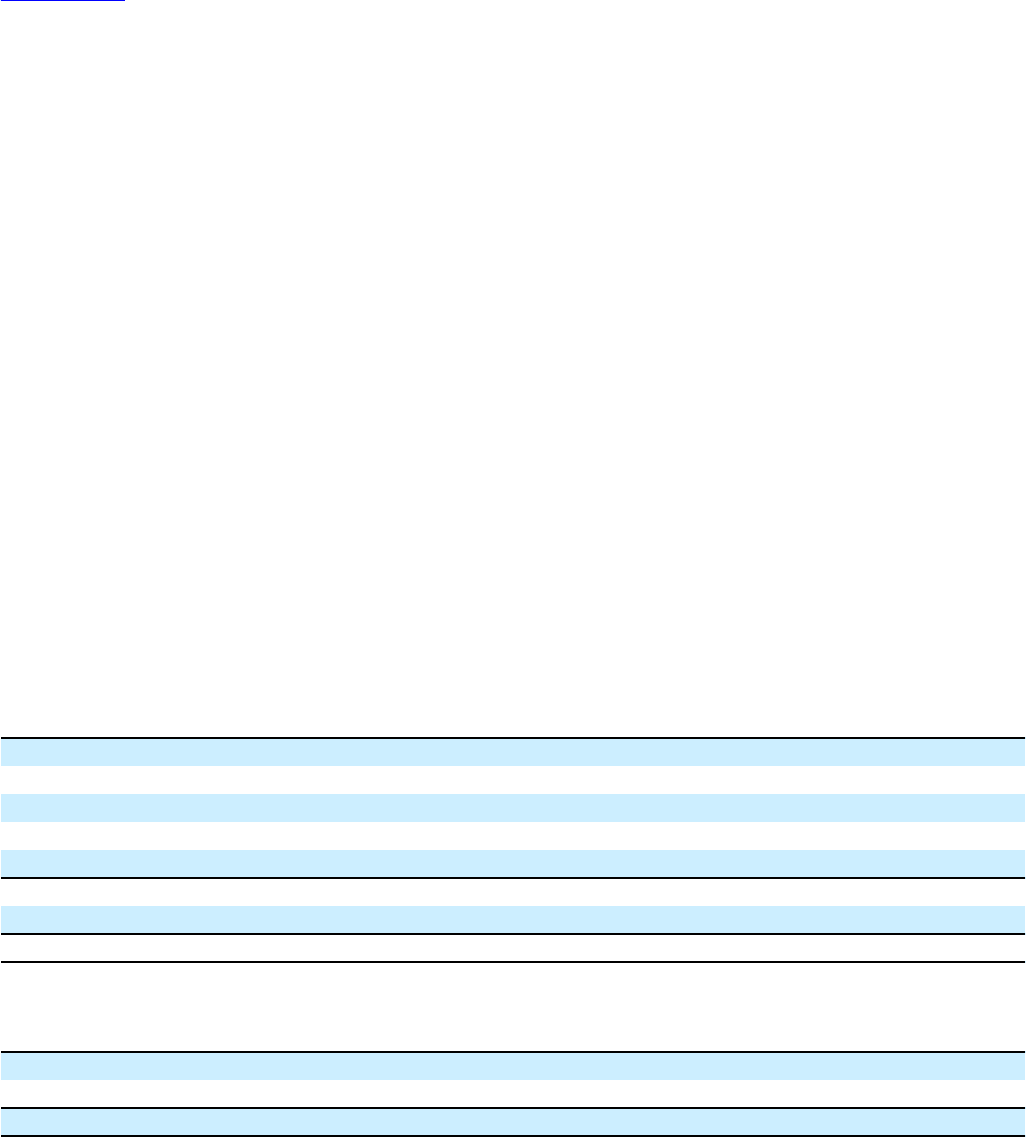

The stock-based compensation expense before income tax benefit was recorded in our Consolidated Statements of Earnings as follows:

Fiscal year 2014 2013 2012

Cost of sales and related buying and occupancy costs $17 $15 $14

Selling, general and administrative expenses 51 43 39

Total stock-based compensation expense, before income tax benefit $68 $58 $53

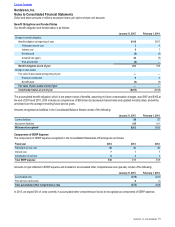

The benefit of tax deductions in excess of the compensation cost recognized for stock-based awards is classified as financing cash inflows

and are reflected as “Excess tax benefit from stock-based compensation” in the Consolidated Statements of Cash Flows.