Nordstrom 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

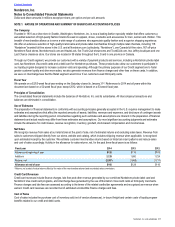

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

44

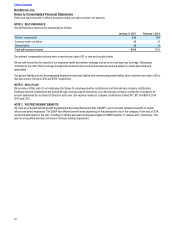

Accounts Receivable

Accounts receivable includes credit card receivables from our Nordstrom private label and Visa credit cards, as well as credit and debit card

receivables due from third parties. We record credit card receivables on our Consolidated Balance Sheets at the outstanding balance, net of

an allowance for credit losses. The allowance for credit losses reflects our best estimate of the losses inherent in our credit card receivables

as of the balance sheet date, including uncollectible finance charges and fees. We estimate such credit losses based on several factors,

including historical aging and delinquency trends, write-off experience, portfolio concentration and risk metrics and general economic

conditions. For purposes of determining impairment and recording the associated allowance for credit losses, we evaluate our credit card

receivables on a collective basis as they are composed of large groups of smaller-balance homogeneous loans and, therefore, are not

individually evaluated for impairment. We record estimated uncollectible principal balances to bad debt expense while estimated uncollectible

finance charges and fees result in a reduction of credit card revenue. Credit card receivables constitute unsecured consumer loans, for which

the risk of cardholder default and associated credit losses tend to increase as general economic conditions deteriorate.

We consider a credit card account delinquent if the minimum payment is not received by the payment due date. Our aging method is based

on the number of completed billing cycles during which the customer has failed to make a minimum payment. Delinquent accounts, including

accrued finance charges and fees, are written off when they are determined to be uncollectible. During the third quarter of 2014, we modified

our write-off policy from 150 days past due to 180 days past due to better align with industry practice. Accounts are written off sooner in the

event of customer bankruptcy or other circumstances that make further collection unlikely.

Concurrent with our write-off policy change discussed above, we now recognize finance charges and fees on delinquent accounts until they

become 150 days past due, after which we place accounts on non-accrual status. Payments received for accounts on non-accrual status are

applied to accrued finance charges, fees and principal balances consistent with other accounts, with subsequent finance charge income

recognized only when actually received. Non-accrual accounts may return to accrual status when we receive three consecutive minimum

payments or the equivalent lump sum.

Our Nordstrom private label credit and debit cards can be used only at our Nordstrom full-line stores in the U.S., Nordstrom Rack stores and

online at Nordstrom.com, Nordstromrack.com and HauteLook, while our Nordstrom Visa credit cards also may be used for purchases outside

of Nordstrom. Cash flows from the use of both the private label and Nordstrom Visa credit cards for sales originating at our stores and our

website are treated as an operating activity within the Consolidated Statements of Cash Flows, as they relate to sales at Nordstrom. Cash

flows arising from the use of Nordstrom Visa credit cards outside of our stores are treated as an investing activity within the Consolidated

Statements of Cash Flows, as they represent loans made to our customers for purchases at third parties.

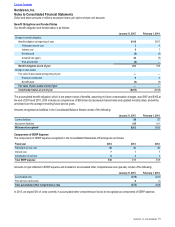

Merchandise Inventories

Merchandise inventories are generally stated at the lower of cost or market value using the retail inventory method (weighted-average cost).

Under the retail method, the valuation of inventories and the resulting gross margins are determined by applying a calculated cost-to-retail

ratio to the retail value of ending inventory. The value of our inventory on the balance sheet is then reduced by a charge to cost of sales for

retail inventory markdowns taken on the selling floor. To determine if the retail value of our inventory should be marked down, we consider

current and anticipated demand, customer preferences, age of the merchandise and fashion trends. We reserve for obsolescence based on

historical trends and specific identification.

Land, Property and Equipment

Land is recorded at historical cost, while property and equipment are recorded at cost less accumulated depreciation. Capitalized software

includes the costs of developing or obtaining internal-use software, including external direct costs of materials and services and internal

payroll costs related to the software project.

We capitalize interest on construction in progress and software projects during the period in which expenditures have been made, activities

are in progress to prepare the asset for its intended use and actual interest costs are being incurred.

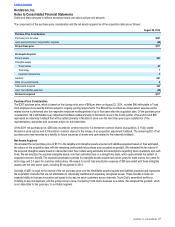

Depreciation is computed using the straight-line method over the asset’s estimated useful life, which is determined by asset category as

follows:

Asset Life (in years)

Buildings and improvements 5 – 40

Store fixtures and equipment 3 – 15

Leasehold improvements 5 – 40

Capitalized software 3 – 7