Nordstrom 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 43

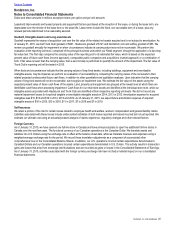

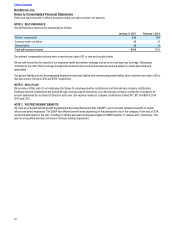

Stock-Based Compensation

We recognize stock-based compensation expense related to stock options and restricted stock at their estimated grant date fair value,

recorded on a straight-line basis over the requisite service period. The total compensation expense is reduced by estimated forfeitures

expected to occur over the vesting period of the award. We estimate the grant date fair value of stock options using the Binomial Lattice

option valuation model. Stock-based compensation expense also includes amounts related to HauteLook and Trunk Club stock

compensation based on the grant date fair value. Stock-based compensation expense related to the Trunk Club Value Creation Plan is based

on the grant date fair value of the payout scenario we believe is probable using the Black-Scholes valuation model and is recognized on an

accelerated basis due to performance criteria and graded vesting features of the plan. We also recognize stock-based compensation

expense for performance share units and our Employee Stock Purchase Plan, which are based on their fair values as of the end of each

reporting period.

New Store Opening Costs

Non-capital expenditures associated with opening new stores, including marketing expenses, relocation expenses and temporary occupancy

costs, are charged to expense as incurred. These costs are included in both buying and occupancy costs and selling, general and

administrative expenses according to their nature as disclosed above.

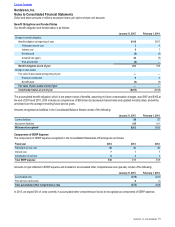

Gift Cards

We recognize revenue from the sale of gift cards when the gift card is redeemed by the customer, or we recognize breakage income when

the likelihood of redemption, based on historical experience, is deemed to be remote. Based on an analysis of our program since its inception

in 1999, we determined that balances remaining on cards issued beyond five years are unlikely to be redeemed and therefore may be

recognized as income. Breakage income was $8, $9 and $10 in 2014, 2013 and 2012. To date, our breakage rate is approximately 3% of the

amount initially issued as gift cards. Gift card breakage income is included in selling, general and administrative expenses in our

Consolidated Statements of Earnings. We had outstanding gift card liabilities of $286 and $255 at the end of 2014 and 2013, which are

included in other current liabilities.

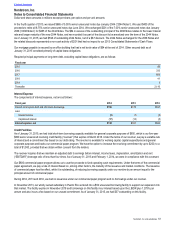

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded

based on differences between the financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are

calculated using the enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. We routinely

evaluate the likelihood of realizing the benefit of our deferred tax assets and may record a valuation allowance if, based on all available

evidence, it is determined that some portion of the tax benefit will not be realized.

We regularly evaluate the likelihood of realizing the benefit for income tax positions we have taken in various federal, state and foreign filings

by considering all relevant facts, circumstances and information available. If we believe it is more likely than not that our position will be

sustained, we recognize a benefit at the largest amount that we believe is cumulatively greater than 50% likely to be realized.

Interest and penalties related to income tax matters are classified as a component of income tax expense.

Comprehensive Net Earnings

Comprehensive net earnings consist of net earnings and other gains and losses affecting equity that are excluded from net earnings. These

consist of postretirement plan adjustments, net of related income tax effects and foreign currency translation adjustments.

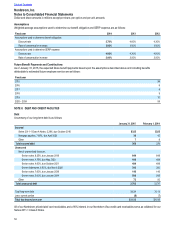

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase and are carried at amortized

cost, which approximates fair value. Our cash management system provides for the reimbursement of all major bank disbursement accounts

on a daily basis. Accounts payable at the end of 2014 and 2013 included $129 and $133 of checks not yet presented for payment drawn in

excess of our bank deposit balances.