Nordstrom 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and per unit amounts

Nordstrom, Inc. and subsidiaries 47

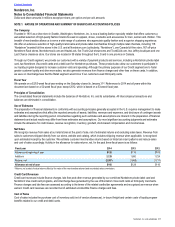

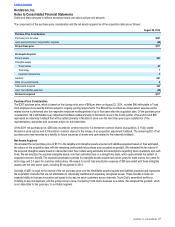

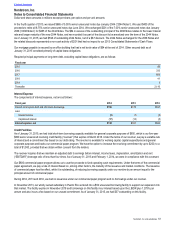

The components of the purchase price consideration and the net assets acquired as of the acquisition date are as follows:

August 22, 2014

Purchase Price Consideration

Purchase price fair value $357

Less: post-combination compensation expense (46)

Net purchase price $311

Net Assets Acquired

Current assets $21

Intangible assets:

Trade names 47

Technology 7

Customer relationships 5

Goodwill 261

Other non-current assets 2

Total assets acquired 343

Less: total liabilities assumed (32)

Net assets acquired $311

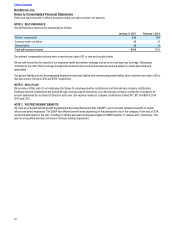

Purchase Price Consideration

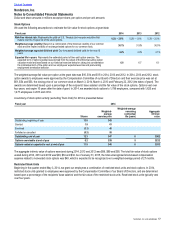

The $357 purchase price, which is based on the closing stock price of $69 per share on August 22, 2014, includes $46 attributable to Trunk

Club employee stock awards that are subject to ongoing vesting requirements. The $46 will be recorded as compensation expense as the

related service is performed over the respective employee vesting periods of up to four years after the acquisition date. Of the purchase price

consideration, $9 is attributable to an adjustment holdback settled primarily in Nordstrom stock in the fourth quarter of fiscal 2014 and $35

represents an indemnity holdback that will be settled primarily in Nordstrom stock over the next three years upon satisfaction of the

representations, warranties and covenants subject to the indemnities.

Of the $311 net purchase price, $280 was recorded to common stock for 3.6 Nordstrom common shares at acquisition, 0.1 fully vested

Nordstrom stock options and 0.1 Nordstrom common shares for the release of an acquisition adjustment holdback. The remaining $31 of net

purchase price was recorded as a liability for future issuances of shares and cash related to the indemnity holdback.

Net Assets Acquired

We allocated the net purchase price of $311 to the tangible and intangible assets acquired and liabilities assumed based on their estimated

fair values on the acquisition date, with the remaining unallocated net purchase price recorded as goodwill. We estimated the fair values of

the acquired intangible assets based on discounted cash flow models using estimates and assumptions regarding future operations and cash

flows. We will amortize the acquired intangible assets over their estimated lives on a straight-line basis, which approximates the pattern of

expected economic benefit. The expected amortization periods for intangible assets acquired are seven years for trade names, two years for

technology and 2.5 years for customer relationships. We expect to record total amortization expense of $59 associated with these intangible

assets over the next seven years, including $5 recognized in 2014.

Goodwill of $261 is equal to the excess of the net purchase price over the identifiable assets acquired and liabilities assumed and represents

the acquisition’s benefits that are not attributable to individually identified and separately recognized assets. These benefits include our

expected ability to increase innovation and speed in the way we serve customers across channels, Trunk Club’s assembled workforce,

including its key management, and the going-concern value of acquiring Trunk Club’s business as a whole. We assigned this goodwill, which

is not deductible for tax purposes, to our Retail segment.