Nordstrom 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc. and subsidiaries 25

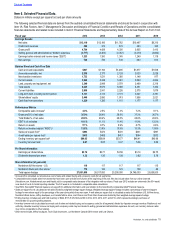

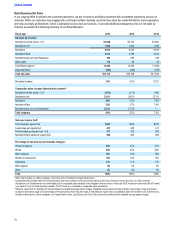

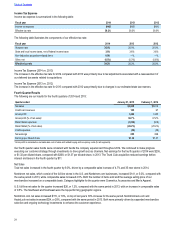

Nordstrom Rack net sales for the quarter increased $130, or 17%, reflecting 27 new Nordstrom Rack store openings since the fourth quarter

of 2013, while comparable sales increased 3.2%. On a comparable basis, the average selling price of Nordstrom Rack merchandise

increased while the number of items sold was flat. Shoes and Accessories were the category highlights for Nordstrom Rack.

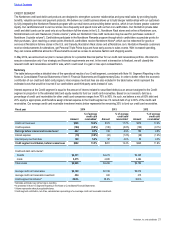

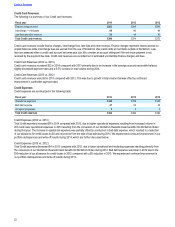

Gross Profit

Our total company gross profit rate decreased 53 basis points compared with the same period in the prior year, primarily due to increased

markdowns at Nordstrom Rack.

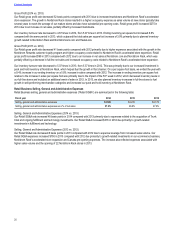

Retail Selling, General, and Administrative Expenses

Our Retail SG&A rate increased 80 basis points primarily due to expenses related to the acquisition of Trunk Club and ongoing technology

and fulfillment expenses.

Credit Expenses

In the fourth quarter, expenses for our Credit segment of $54 increased from $38 in the prior year. The increase was primarily driven by

higher operational expenses resulting from a 6% increase in credit volume during the fourth quarter of 2014. The fourth quarter of 2013 also

included the impact of the conversion of our Nordstrom Rewards travel benefit into Nordstrom Notes, which decreased operational expenses

in the prior year.

For further information on our quarterly results in 2014 and 2013, refer to Note 17: Selected Quarterly Data in the Notes to Consolidated

Financial Statements in Item 8: Financial Statements and Supplementary Data.

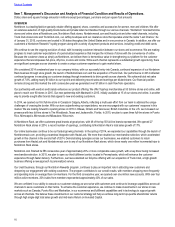

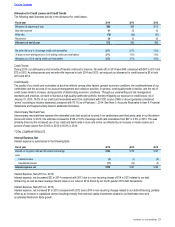

2015 Outlook

Our expectations for 2015 are as follows:

Net sales 7 percent to 9 percent increase

Comparable sales 2 percent to 4 percent increase

Earnings per diluted share1$3.65 to $3.80

1 This outlook does not include the impact of any future share repurchases.

Capital expenditures, net of property incentives, of approximately $1.2 billion are expected in 2015, an increase from $751 in 2014. The

increase relates to store expansion, including Canada and Manhattan, and ongoing investments to improve the customer experience through

flagship store remodels and a third fulfillment center expected to open in the second half of the year. To date in 2015, we have opened our

second full-line store in Canada. We plan to open 27 Nordstrom Rack stores, three additional Nordstrom full-line stores in the U.S. and

another full-line store in Canada during 2015. Planned net store openings are expected to increase our retail square footage by

approximately 6.1%.