Nordstrom 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Nordstrom, Inc. and subsidiaries 31

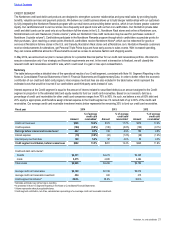

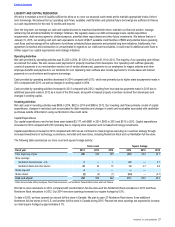

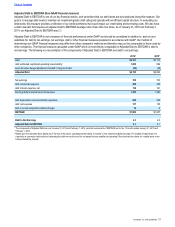

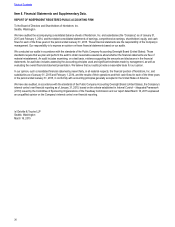

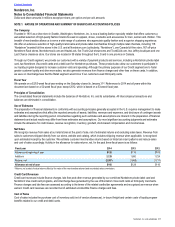

Adjusted Debt to EBITDAR (Non-GAAP financial measure)

Adjusted Debt to EBITDAR is one of our key financial metrics, and we believe that our debt levels are best analyzed using this measure. Our

goal is to manage debt levels to maintain an investment-grade credit rating and operate with an efficient capital structure. In evaluating our

debt levels, this measure provides a reflection of our credit worthiness that could impact our credit rating and borrowing costs. We also have

a debt covenant that requires an adjusted debt to EBITDAR leverage ratio of less than four times. As of January 31, 2015 and February 1,

2014, our Adjusted Debt to EBITDAR was 2.1.

Adjusted Debt to EBITDAR is not a measure of financial performance under GAAP and should be considered in addition to, and not as a

substitute for, debt to net earnings, net earnings, debt or other financial measures prepared in accordance with GAAP. Our method of

determining non-GAAP financial measures may differ from other companies’ methods and therefore may not be comparable to those used by

other companies. The financial measure calculated under GAAP which is most directly comparable to Adjusted Debt to EBITDAR is debt to

net earnings. The following is a reconciliation of the components of Adjusted Debt to EBITDAR and debt to net earnings:

2014120131

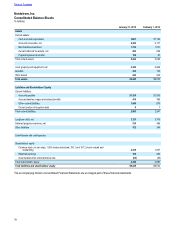

Debt $3,131 $3,113

Add: estimated capitalized operating lease liability21,095 999

Less: fair value hedge adjustment included in long-term debt (36) (48)

Adjusted Debt $4,190 $4,064

Net earnings 720 734

Add: income tax expense 465 455

Add: interest expense, net 138 161

Earnings before interest and income taxes 1,323 1,350

Add: depreciation and amortization expenses 508 454

Add: rent expense 137 125

Add: non-cash acquisition-related charges 12 8

EBITDAR $1,980 $1,937

Debt to Net Earnings 4.3 4.2

Adjusted Debt to EBITDAR 2.1 2.1

1 The components of Adjusted Debt are as of January 31, 2015 and February 1, 2014, while the components of EBITDAR are for the 12 months ended January 31, 2015 and

February 1, 2014.

2 Based upon the estimated lease liability as of the end of the period, calculated as the trailing 12 months of rent expense multiplied by eight. The multiple of eight times rent

expense is a commonly used method of estimating the debt we would record for our leases that are classified as operating if they had met the criteria for a capital lease or we

had purchased the property.