Nordstrom 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

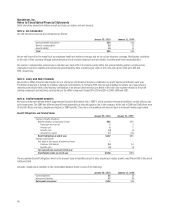

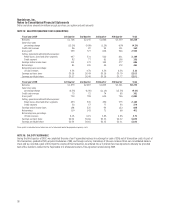

NOTE 14: SEGMENT REPORTING

As of January 30, 2010, we have identified four reportable segments: Retail Stores, Direct, Credit and Other. Our Retail Stores segment includes our

Nordstrom full-line stores and our Nordstrom Rack off-price stores, which meet the aggregation criteria set forth in ASC 280,

Segment Reporting

.

Through our Direct segment, we operate our Nordstrom branded online store. With our multi-channel initiative, we are increasingly integrating our

Nordstrom full-line stores and online store. Our goal is to create a seamless, consistent merchandise offering and service experience for our

customers regardless of how they choose to shop.

Through our Credit segment, we offer our customers a variety of payment products and services, including a Nordstrom private label card, two

Nordstrom VISA credit cards and a debit card for Nordstrom purchases. Our card products also include a loyalty program that provides benefits to

our cardholders based on their level of spending.

The Other segment includes our product development group, which coordinates the design and production of private label merchandise sold in our

retail stores, and our distribution network. This segment also includes our corporate center operations. During the time that we owned it, this

segment also included the operations of our Façonnable business.

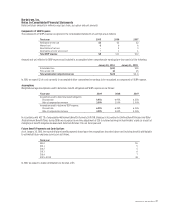

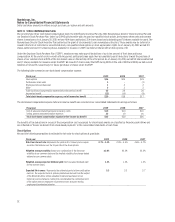

The following table summarizes net sales by merchandise category:

Fiscal year 2009 2008 2007

Women’s apparel $2,845 $2,812 $3,063

Shoes 1,787 1,721 1,784

Men’s apparel 1,262 1,362 1,571

Women’s accessories 970 963 941

Cosmetics 895 921 950

Children’s apparel 283 269 285

Other 216 224 234

Total $8,258 $8,272 $8,828

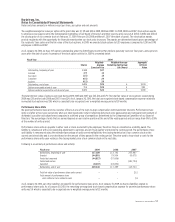

The following table presents our sales by merchandise category as a percentage of net sales:

Fiscal year 2009 2008 2007

Women’s apparel 34% 34% 35%

Shoes 22% 21% 20%

Men’s apparel 15% 16% 18%

Women’s accessories 12% 12% 11%

Cosmetics 11% 11% 11%

Children’s apparel 3% 3% 3%

Other 3% 3% 2%

Total 100% 100% 100%

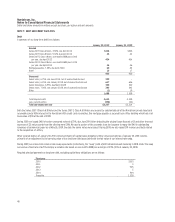

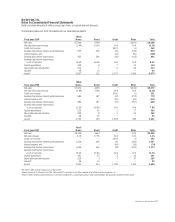

In general, we use the same measurements to compute earnings before income taxes for reportable segments as we do for the consolidated

company. However, redemptions of our Nordstrom Notes® are included in net sales for our Retail Stores segment. The sales amount in our Other

segment includes an entry to eliminate these transactions from our consolidated net sales. There is no impact to consolidated earnings before

income taxes for this adjustment. In addition, our sales return reserve and other corporate adjustments are recorded in the Other segment. Other

than described above, the accounting policies of the operating segments are the same as those described in the summary of significant accounting

policies in Note 1.