Nordstrom 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 21

In 2010, credit card revenues are expected to increase $35 to $45, due to moderate growth in our accounts receivable.

In May 2009, the Credit Card Accountability Responsibility and Disclosure Act of 2009 (the “Credit CARD Act”) was passed. In January 2010, final rules

implementing portions of the Credit CARD Act were issued, including new restrictions on credit card pricing, finance charges and fees, customer billing

practices and payment application. These rules are requiring us to make changes to our credit card business practices and systems. We have

completed and implemented the necessary changes and new procedures to enable compliance with those rules that had a mandatory effective date of

February 22, 2010. However, the Credit CARD Act’s full impact on our business is unknown at this time. Additional proposed rules implementing other

portions of the Credit CARD Act, effective in August 2010, were published in early March, and interpretations of the new and proposed rules continue to

emerge. Depending on the nature and extent of the full impact from these rules, any interpretations or additional rules, the practices, revenues and

profitability of our credit business could be adversely affected.

Interest expense decreased to $41 in 2009 from $50 in 2008 and $64 in 2007. These year-over-year decreases were due to declining variable interest

rates, partially offset by higher average borrowings.

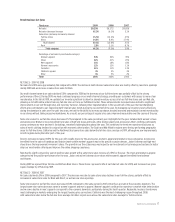

Credit Segment Cost of Sales and Related Buying and Occupancy Costs

Cost of sales and related buying and occupancy costs, which includes the estimated cost of Nordstrom Notes that will be issued and redeemed under

our Fashion Rewards program, increased to $55 in 2009 compared with $50 in 2008. The increase was primarily due to increased use of Nordstrom

credit cards, resulting in additional expense related to the Fashion Rewards program. Cost of sales and related buying and occupancy costs of $50 in

2008 increased slightly from $47 in 2007 due to growth in volume.

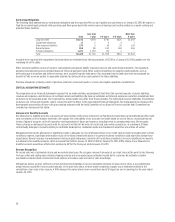

Credit Segment Selling, General and Administrative Expenses

Selling, general and administrative expenses for our Credit segment are made up of operational and marketing expenses and bad debt. These expenses

are summarized in the following table:

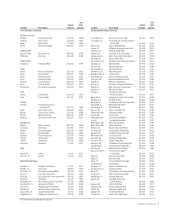

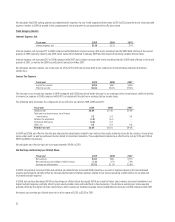

Fiscal year 2009 2008 2007

Operational and marketing expense $105

$101 $91

Bad debt expense 251 173 107

Total credit selling, general and administrative expense $356 $274 $198

Operational and marketing expenses are incurred to support and service our credit card products and the related rewards programs, and are included

in selling, general and administrative expenses in the consolidated statement of earnings. Operational and marketing expense remained relatively

constant at $105 in 2009 compared with $101 in 2008. This reflects expenses that are relatively fixed when compared to portfolio growth and our

continued focus on controlling expenses. The increase to $101 in 2008 compared with $91 in 2007 was due to additional marketing expenses as a result

of an increase in promotions related to our loyalty program in 2008.

Bad debt expense increased to $251 in 2009 from $173 in 2008 due to increased write-offs reflecting consumer credit trends.

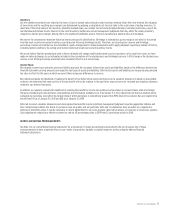

The following table illustrates the allowance for doubtful accounts activity for the past three fiscal years:

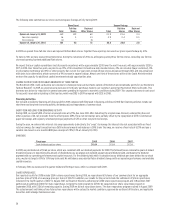

Fiscal year 2009 2008 2007

Allowance at beginning of period $138 $73 $17

Bad debt provision1 251 173 86

Net write–offs (on–balance sheet) (199) (108) (30)

Allowance at end of period $190 $138 $73

Allowance as a percentage of ending accounts receivable 8.8% 6.8% 4.1%

Delinquent balances over thirty days as a percentage of

accounts receivable 5.3%

3.7% 2.5%

Bad debt provision as a percentage of average on-balance sheet

accounts receivable 11.9%

9.1% 5.8%

Net write-offs as a percentage of average receivables2 9.5%

5.6% 3.5%

1 In 2007, the one-time transitional charge-offs on the Nordstrom VISA receivables of $21 are included in bad debt expense in selling, general and administrative expenses. These charge-offs

represent actual write-offs on the Nordstrom VISA credit card portfolio during the eight-month transitional period and are not included in the allowance for doubtful accounts activity in the

table above for 2007.

2 Calculated as net write-offs for the combined Nordstrom private label and Nordstrom VISA portfolio as a percentage of average receivables, including average off-balance sheet receivables

in 2007 of $182.

Delinquency rates and write-offs ran at elevated levels throughout 2009. As of January 30, 2010, our delinquency rate was 5.3%, an increase from 3.7%

in 2008 and 2.5% in 2007. Write-offs increased $91 to $199, or 9.5% of average receivables in 2009 compared with $108, or 5.6% of average receivables

in 2008. Our write-offs have a strong long-term correlation with national unemployment rates, and this trend continued during 2009 as U.S.

unemployment increased from 7.6% to 9.7%. In California, unemployment rates in 2009 trended above the national unemployment rate. California

continues to experience particular weakness relative to our other geographic regions and accounts for approximately 50% of our total write-offs. We

are currently planning our business assuming an average unemployment rate of approximately 10.5% in 2010. In light of this economic environment

and based on our delinquency and write-off trends, we increased our allowance for doubtful accounts by $52 to $190 in 2009 compared with an

increase of $65 to $138 in 2008.