Nordstrom 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 47

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

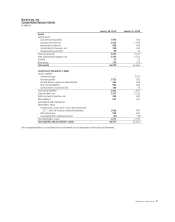

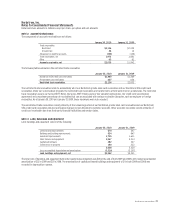

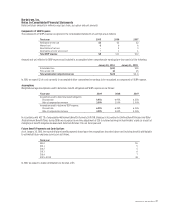

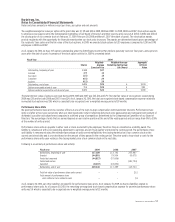

Components of SERP Expense

The components of SERP expense recognized in the consolidated statements of earnings are as follows:

Fiscal year 2009 2008 2007

Participant service cost $2 $2 $2

Interest cost 6 6 6

Amortization of net loss – 2 3

Amortization of prior service cost – 1 1

Total SERP expense $8 $11 $12

Amounts not yet reflected in SERP expense and included in accumulated other comprehensive earnings (pre-tax) consist of the following:

January 30, 2010 January 31, 2009

Accumulated loss $(22) $(9)

Prior service cost (2) (2)

Total accumulated comprehensive loss $(24) $(11)

In 2010, we expect $2 of costs currently in accumulated other comprehensive earnings to be recognized as components of SERP expense.

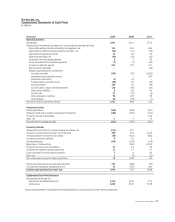

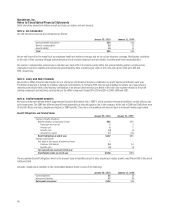

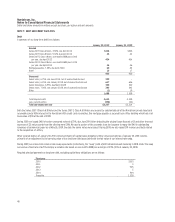

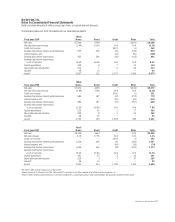

Assumptions

Weighted-average assumptions used to determine benefit obligation and SERP expense are as follows:

Fiscal year 2009 2008 2007

Assumptions used to determine benefit obligation:

Discount rate 5.95% 6.95% 6.35%

Rate of compensation increase 3.00% 3.00% 3.00%

Assumptions used to determine SERP expense:

Discount rate 6.95% 6.35% 6.00%

Rate of compensation increase 3.00% 3.00% 4.00%

In accordance with ASC 715,

Compensation-Retirement Benefits

(formerly SFAS 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Benefit Plans

), during 2008, we recognized a one-time adjustment of ($3) to retained earnings in shareholders’ equity as a result of

changing our benefit obligation measurement date from October 31 to our fiscal year-end.

Future Benefit Payments and Contributions

As of January 30, 2010, the expected future benefit payments based upon the assumptions described above and including benefits attributable

to estimated future employee service are as follows:

Fiscal year

2010 $5

2011 5

2012 5

2013 6

2014 7

2015-2019 38

In 2010, we expect to make contributions to the plan of $5.