Nordstrom 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

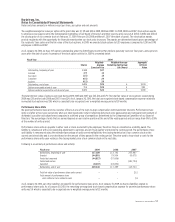

Impairment

When facts and circumstances indicate that the carrying values of long-lived tangible assets may be impaired, we perform an evaluation of

recoverability by comparing the carrying values of the net assets to their related projected undiscounted future cash flows in addition to other

quantitative and qualitative analyses. Upon indication that the carrying values of long-lived assets may not be recoverable, we recognize an

impairment loss. We estimate the fair value of the assets using the expected present value of future cash flows of the assets. Property, plant and

equipment assets are grouped at the lowest level at which there are identifiable cash flows when assessing impairment. Cash flows for our retail

store assets are identified at the individual store level.

We review our goodwill annually for impairment as of the first day of the first quarter or when circumstances indicate its carrying value may not be

recoverable. We perform this evaluation at the reporting unit level, comprised of the principal business units within our Retail and Direct segments,

through the application of a two-step fair value test. The first step of the test compares the carrying value of the reporting unit to its estimated fair

value, which is based on the expected present value of future cash flows. If fair value does not exceed carrying value then a second step is

performed to quantify the amount of the impairment. Based on the results of our tests, fair value substantially exceeds carrying value, therefore we

had no goodwill impairment in 2009, 2008 or 2007.

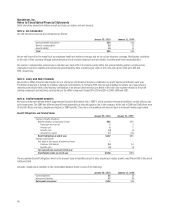

Self Insurance

We retain a portion of the risk for certain losses related to employee health and welfare, workers’ compensation and general liability claims.

Liabilities associated with these losses include undiscounted estimates of both losses reported and losses incurred but not yet reported. We

estimate our ultimate cost based on an actuarially based analysis of claims experience, regulatory changes and other relevant factors.

Derivatives

Our interest rate swap agreements (collectively, the “swap”) are designated as fully effective fair value hedges. As such, we recognize our swap as

either an asset or liability at fair value in our consolidated balance sheet, with an offsetting adjustment to the carrying value of our long-term debt.

See Note 7: Debt and Credit Facilities for additional information related to our swap.

We periodically enter into foreign currency purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to

hedge against fluctuations in foreign currency prices. These forward contracts do not qualify for derivative hedge accounting; therefore any

changes in the fair value of financial contracts are reflected in the statement of earnings. The notional amounts of our foreign currency forward

contracts at the contract rates were $1 and $3 at the end of 2009 and 2008.

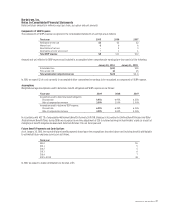

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable approximate fair value due to their short-term

nature. The estimated fair value of long-term debt, including current maturities, based on quoted market prices of the same or similar issues, was

$2,809 and $1,743 at the end of 2009 and 2008, compared to carrying values of $2,613 and $2,238, respectively.

The fair value of our swap was a $1 liability as of January 30, 2010. This fair value is estimated based upon open-market quotes for identical or

comparable assets from reputable third-party brokers using market-based inputs, adjusted for credit risk, and as such is considered a Level 2 fair

value measurement.

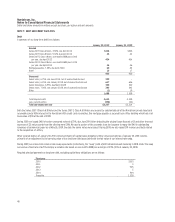

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2009-01,

Generally Accepted Accounting

Principles

(ASC 105,

Generally Accepted Accounting Principles

), which established the FASB Accounting Standards Codification (“the Codification” or

“ASC”) as the official single source of authoritative U.S. generally accepted accounting principles (“GAAP”). All existing accounting standards were

superseded and all other accounting guidance not included in the Codification is now considered non-authoritative. The Codification is not intended

to change GAAP, but is meant to organize and simplify authoritative GAAP literature. The Codification became effective for interim and annual

periods ending after September 15, 2009.

Following the Codification, the FASB no longer issues new standards in the form of Statements, FASB Staff Positions or Emerging Issues Task Force

Abstracts. Instead, it issues Accounting Standards Updates (“ASU”) which serve to update the Codification, provide background information about

the guidance and the basis for conclusions on the changes to the Codification.

The impact on our consolidated financial statements is disclosure-only in nature as all references to authoritative accounting literature will be made

in accordance with the Codification. In order to ease the transition to the Codification, we are providing the Codification cross-reference alongside

the references to the standards issued and adopted prior to the effective date of the Codification.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161,

Disclosures about Derivative Instruments and Hedging

Activities — an amendment of FASB Statement No. 133

(“SFAS 161”) (contained within ASC 815,

Derivatives and Hedging

). SFAS 161 expanded the

disclosure requirements in SFAS 133 about an entity’s derivative instruments and hedging activities. This statement became effective for us as of the

beginning of fiscal year 2009 and did not impact our consolidated financial position or results of operations, as its requirements are disclosure-only

in nature.