Nordstrom 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 15

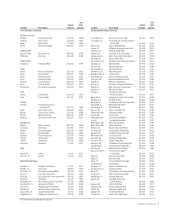

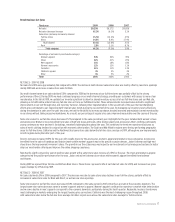

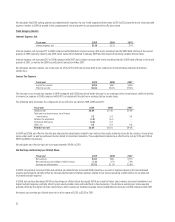

Item 6. Selected Financial Data.

(Dollars in millions except sales per square foot and per share amounts)

The following selected financial data are derived from the audited Consolidated Financial Statements and should be read in conjunction with Item 1A

“Risk Factors,” Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the Consolidated Financial

Statements and related notes included in Item 8 of this Annual Report on Form 10-K.

Fiscal year 2009 2008

20076 20067 2005

Earnings Results

Net sales $8,258 $8,272 $8,828 $8,561 $7,723

Credit card revenues 369 301 252 105 97

Gross profit1 2,930 2,855 3,302 3,207 2,835

Selling, general and administrative (“SG&A”) expenses:2

Retail stores, direct and other segments (“Retail”)2 (2,109) (2,103) (2,161) (2,180) (2,006)

Credit segment2 (356) (274) (198) (92) (85)

Earnings on investment in asset-backed securities, net2,3 - - 18 109 89

Earnings before interest and income taxes (“EBIT”) 834 779 1,247 1,149 930

Interest expense, net (138) (131) (74) (43) (45)

Earnings before income taxes (“EBT”) 696 648 1,173 1,106 885

Net earnings 441 401 715 678 551

Balance Sheet and Cash Flow Data

Accounts receivable, net $2,035 $1,942 $1,788 $684 $640

Investment in asset-backed securities - - - 428 561

Merchandise inventories 898 900 956 997 956

Current assets 4,054 3,217 3,361 2,742 2,874

Land, buildings and equipment, net 2,242 2,221 1,983 1,757 1,774

Total assets 6,579 5,661 5,600 4,822 4,921

Current liabilities 2,014 1,601 1,635 1,433 1,623

Long-term debt, including current portion 2,613 2,238 2,497 631 934

Shareholders’ equity 1,572 1,210 1,115 2,169 2,093

Cash flow from operations 1,251 848 312 1,142 776

Performance Metrics

Same-store sales percentage (decrease) increase4

(4.2%) (9.0%) 3.9% 7.5% 6.0%

Gross profit % of net sales

35.5% 34.5% 37.4% 37.5% 36.7%

SG&A % of net sales:

Retail 25.5% 25.4% 24.5% 25.5% 26.0%

Total 29.8% 28.7% 26.7% 26.5% 27.1%

EBIT as a percentage of total revenues 9.7% 9.1% 13.7% 13.3% 11.9%

EBT as a percentage of total revenues 8.1% 7.6% 12.9% 12.8% 11.3%

Net earnings as a percentage of total revenues 5.1% 4.7% 7.9% 7.8% 7.1%

Return on average shareholders’ equity 31.7% 34.5% 43.6% 31.8% 28.4%

Sales per square foot5 $368 $388 $435 $423 $392

Retail SG&A expense per square foot5 $94 $99 $106 $108 $102

Per Share Information

Earnings per diluted share $2.01 $1.83 $2.88 $2.55 $1.98

Dividends per share 0.64 0.64 0.54 0.42 0.32

Book value per share 7.22 5.62 5.05 8.43 7.76

Store Information (at year end)

Full-line stores 112 109 101 98 98

Rack and other stores6 72 60 55 57 57

International Façonnable boutiques6 - - - 36 32

Total square footage 22,773,000 21,876,000 20,502,000 20,170,000 20,070,000

1Gross profit is calculated as net sales less cost of sales and related buying and occupancy costs (for all segments).

2In 2009, we reclassified other income and expense, net in our consolidated statement of earnings, which was previously presented separately. A portion of other income and expense, net

has been reclassified to earnings on investment in asset-backed securities, net, and the remaining portion has been reclassified to selling, general and administrative expenses.

3On May 1, 2007, we combined our Nordstrom private label credit card and Nordstrom VISA credit card programs into one securitization program. At that time the Nordstrom VISA credit card

receivables were brought on-balance sheet.

4Same-stores include stores that have been open at least one full year at the beginning of the year and sales from our Direct segment.

5Sales per square foot and Retail SG&A expense per square foot are calculated as net sales and Retail SG&A expense, respectively, divided by weighted average square footage.

6During the third quarter of 2007, we completed the sale of our Façonnable business and realized a gain on sale of $34 ($21, net of tax). Results of operations for fiscal year 2007 include the

international Façonnable boutiques through August 31, 2007 and the domestic Façonnable boutiques through October 31, 2007. Prior to the sale, the domestic Façonnable boutiques were

included in “Rack and other stores.”

7Fiscal year 2006 includes an extra week (the 53rd week) as a result of our 4-5-4 retail reporting calendar. The 53rd week is not included in our calculation of same-store sales.