Nordstrom 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

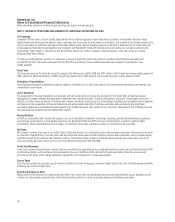

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

NOTE 1: NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company

Founded in 1901 as a shoe store in Seattle, today Nordstrom is a fashion specialty retailer that offers customers a well-edited selection of high-

quality fashion brands focused on apparel, shoes, cosmetics and accessories for men, women and children. This breadth of merchandise allows us to

serve a wide range of customers who appreciate quality fashion and a superior shopping experience. We offer a wide selection of brand name and

private label merchandise through multiple retail channels: our ‘Nordstrom’ branded 112 full-line stores and online store at www.nordstrom.com

(collectively, “multi-channel”), 69 off-price ‘Nordstrom Rack’ stores, two ‘Jeffrey’ boutiques, and one clearance store. Our stores are located

throughout the United States.

Through our Credit segment, we offer our customers a variety of payment products and services, including a Nordstrom private label card,

two Nordstrom VISA credit cards and a debit card for Nordstrom purchases. These products also allow our customers to participate in our

loyalty program.

Fiscal Year

Our fiscal year ends on the Saturday closest to January 31st. References to 2009, 2008 and 2007 relate to the 52-week fiscal years ended January 30,

2010, January 31, 2009 and February 2, 2008, respectively. References to 2010 relate to the 52-week fiscal year ending January 29, 2011.

Principles of Consolidation

The consolidated financial statements include the balances of Nordstrom, Inc. and its subsidiaries. All intercompany transactions and balances are

eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and

liabilities and the reported amounts of revenues and expenses during the reporting period. Uncertainties regarding such estimates and assumptions

are inherent in the preparation of financial statements and actual results may differ from those estimates and assumptions. Our significant

accounting judgments and estimates include allowance for doubtful accounts, sales return reserve, inventory obsolescence and shrinkage reserves,

deferred tax asset valuation and unrecognized tax benefits.

Reclassification

In 2009, we reclassified other income and expense, net in our consolidated statement of earnings to selling, general and administrative expenses

and earnings on investment in asset-backed securities, net. Results for 2008 and 2007 have been reclassified for consistency with the 2009

presentation. These reclassifications do not impact our reported net earnings, earnings per share or cash flows for these periods.

Net Sales

We recognize revenue from sales at our retail stores at the point of sale, net of estimated returns and excluding sales taxes. Revenue from our sales

to customers shipped directly from our stores and our online and catalog sales includes shipping revenue, when applicable, and is recognized upon

estimated receipt by the customer. We estimate customer merchandise returns based on historical return patterns and reduce sales and cost of

sales accordingly. Our sales return reserves were $76 and $70 at the end of 2009 and 2008.

Credit Card Revenues

Credit card revenues include finance charges, late fees and other fees generated by our combined Nordstrom private label card and Nordstrom VISA

credit card programs, and interchange fees generated by the use of Nordstrom VISA cards at third-party merchants. These fees are assessed

according to the terms of the related cardholder agreements and recognized as revenue when earned.

Cost of Sales

Cost of sales includes the purchase cost of inventory sold (net of vendor allowances), in-bound freight, and certain costs of loyalty program benefits

related to our credit and debit cards.

Buying and Occupancy Costs

Buying costs consist primarily of compensation and other costs incurred by our merchandising and product development groups. Occupancy costs

include rent, depreciation, property taxes and facility operating costs of our retail, corporate center and distribution operations.