Nordstrom 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

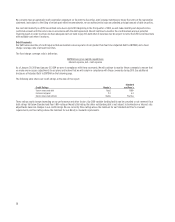

28

We currently have an automatic shelf registration statement on file with the Securities and Exchange Commission. Under the terms of the registration

statement, and subject to the filing of certain post-effective amendments, we are authorized to issue an unlimited principal amount of debt securities.

Our next debt maturity is a $350 securitized note due in April 2010. Beginning in the first quarter of 2010, we will make monthly cash deposits into a

restricted account until the note is due in accordance with the debt agreement. We will continue to monitor the credit markets and our potential

financing needs in order to ensure we have adequate cash on hand to pay this debt when it becomes due. We expect to retire the $350 securitized note

with available cash when it matures.

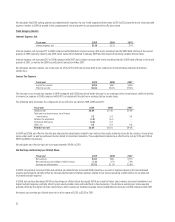

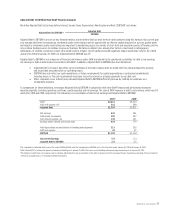

Debt Covenants

Our $650 unsecured line of credit requires that we maintain a leverage ratio of not greater than four times Adjusted Debt to EBITDAR, and a fixed

charge coverage ratio of at least two times.

The fixed charge coverage ratio is defined as:

EBITDAR less gross capital expenditures

Interest expense, net + rent expense

As of January 30, 2010 and January 31, 2009 we were in compliance with these covenants. We will continue to monitor these covenants to ensure that

we make any necessary adjustments to our plans and believe that we will remain in compliance with these covenants during 2010. See additional

disclosure of Adjusted Debt to EBITDAR on the following page.

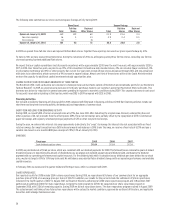

The following table shows our credit ratings at the date of this report:

Credit Ratings Moody’s

Standard

and Poor’s

Senior unsecured debt Baa2 BBB+

Commercial paper P-2 A-2

Senior unsecured outlook Stable Positive

These ratings could change depending on our performance and other factors. Our $100 variable funding facility can be cancelled or not renewed if our

debt ratings fall below Standard and Poor’s BB+ rating or Moody’s Ba1 rating. Our other outstanding debt is not subject to termination or interest rate

adjustments based on changes in our credit ratings. We are currently three ratings above the minimum for our Standard and Poor’s covenant

requirements, and two ratings above the minimum for our Moody’s covenant requirements.