Nordstrom 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 41

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

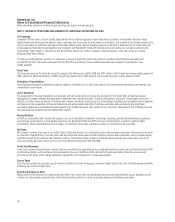

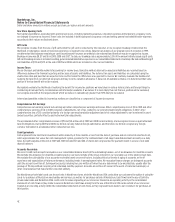

Rent

We recognize minimum rent expense, net of landlord reimbursements, on a straight-line basis over the minimum lease term from the time that we

control the leased property. For leases that contain predetermined, fixed escalations of the minimum rent, we recognize the rent expense on a

straight-line basis and record the difference between the rent expense and the rent payable as a liability. Contingent rental payments, typically

based on a percentage of sales, are recognized in rent expense when payment of the contingent rent is probable.

We receive incentives from landlords to construct stores in certain developments. These incentives are recorded as a deferred credit and recognized as

a reduction of rent expense on a straight-line basis over the lease term. At the end of 2009 and 2008, the deferred credit balance was $518 and $478.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of compensation and benefits costs (other than those included in buying and

occupancy costs), advertising, shipping and handling costs, bad debt expense related to our credit card operations, and other

miscellaneous expenses.

Advertising

Production costs for newspaper, radio and other media are expensed the first time the advertisement is run. Total advertising expenses, net of vendor

allowances, of $85, $98 and $101 in 2009, 2008 and 2007, respectively, were included in selling, general and administrative expenses.

Vendor Allowances

We receive allowances from merchandise vendors for cosmetic selling expenses, purchase price adjustments, cooperative advertising programs and

various other expenses. Allowances for cosmetic selling expenses are recorded in selling, general and administrative expenses as a reduction of the

related costs when incurred. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the

related merchandise has been sold. Allowances for cooperative advertising and promotion programs and other expenses are recorded in cost of

sales and related buying and occupancy costs and selling, general and administrative expenses as a reduction of the related costs when incurred.

Any allowances in excess of actual costs incurred that are included in selling, general and administrative expenses are recorded as a reduction of

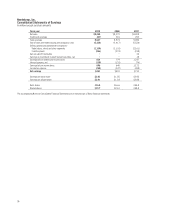

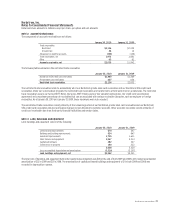

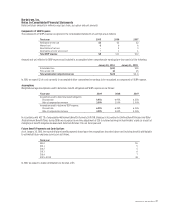

cost of sales. The following table shows vendor allowances earned during the year:

Fiscal year 2009 2008 2007

Cosmetic selling expenses $106 $112 $120

Purchase price adjustments 91 96 86

Cooperative advertising and promotion 63 65 61

Other 2 3 2

Total vendor allowances $262 $276 $269

Shipping and Handling Costs

Our shipping and handling costs include payments to third-party shippers and costs to hold, move and prepare merchandise for shipment.

These costs do not include inbound freight to our distribution centers, which we include in the cost of our inventory. Shipping and handling costs of

$103, $106 and $87 in 2009, 2008 and 2007, respectively, were included in selling, general and administrative expenses.

Loyalty Program

Customers who spend a certain amount with us using our Nordstrom private label cards or our Nordstrom VISA credit cards receive Nordstrom

Notes®, which can be redeemed for goods or services in our stores. We estimate the net cost of the Nordstrom Notes that will be issued and

redeemed and record this cost as rewards points are accumulated. In addition to this long-standing benefit, in 2007 we launched an enhanced

loyalty program, Fashion Rewards®. Under this program, Nordstrom customers receive benefits such as free alterations based on their annual levels

of spending. We record the cost of the loyalty program benefits for Nordstrom Notes and alterations in cost of sales given that we provide

customers with products or services for these rewards. Other costs of the loyalty program, which primarily include shipping and fashion events, are

recorded in selling, general and administrative expenses. These expenses are recorded based on estimates of benefits expected to be accumulated

and redeemed in relation to sales.

Stock-Based Compensation

We recognize stock-based compensation expense related to stock options at their estimated grant-date fair value, recorded on a straight-line basis over

the requisite service period. The total compensation expense is reduced by estimated forfeitures expected to occur over the vesting period of the award.

We estimate the fair value of stock options granted using the Binomial Lattice option valuation model. Stock-based compensation expense also includes

amounts related to performance share units and our Employee Stock Purchase Plan, based on their fair values as of the end of each reporting period.