Nordstrom 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[45 ]

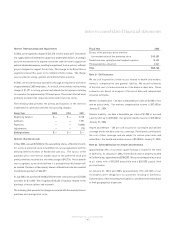

Note 19: Restructurings and Impairments

In 2002, we recognized a charge of $15,570 to write-down an IT investment

in a supply chain tool intended to support our private label division. A strategic

decision was made not to expand our private label division to support an

external wholesale business, resulting in impairment to an in-process software

project designed to support this activity. This charge to the Retail Stores

segment reduced this asset to its estimated market value. The charge

was recorded in selling, general and administrative expense.

In 2001, we streamlined our operations through a reduction in workforce

of approximately 2,600 employees. As a result, we recorded a restructuring

charge of $1,791 in selling, general and administrative expenses relating

to severance for approximately 195 employees. Personnel affected were

primarily located in the corporate center and in full-line stores.

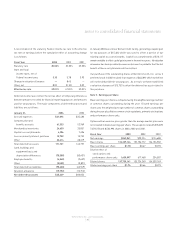

The following table presents the activity and balances of the reserves

established in connection with the restructuring charges:

Fiscal Year 2003 2002 2001

Beginning balance $ — $ — $178

Additions — — 1,791

Payments — — (1,890)

Adjustments — — (79)

Ending balance $ —$ —$ —

Note 20: Nordstrom.com

In May 2002, we paid $70,000 for the outstanding shares of Nordstrom.com,

Inc. series C preferred stock in fulfillment of our put agreement with the

minority interest holders of Nordstrom.com LLC. The excess of the

purchase price over the fair market value of the preferred stock and

professional fees resulted in a one-time charge of $42,736. No tax benefit

was recognized, as we do not believe it is probable that this benefit will

be realized. Purchase of the minority interest of Nordstrom.com also resulted

in additional goodwill of $24,057.

In July 2002, we purchased 3,608,322 Nordstrom.com options and 470,000

warrants for $11,802. We recognized $10,432 of expense related to the

purchase of these options and warrants.

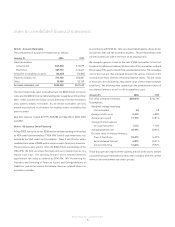

The following table presents the charges associated with the minority interest

purchase and reintegration costs:

Fiscal Year 2002

Excess of the purchase price over the

fair market value of the preferred stock $40,389

Nordstrom.com option/warrant buyback expense 10,432

Professional fees incurred 2,347

Total $53,168

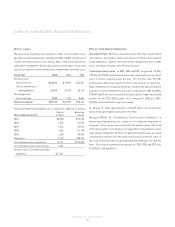

Note 21: Self Insurance

We are self insured for certain losses related to health and welfare,

workers' compensation and general liability. We record estimates

of the total cost of claims incurred as of the balance sheet date. These

estimates are based on analysis of historical data and independent

actuarial estimates.

Workers Compensation – we have a deductible per claim of $1,000 or less

and no policy limits. Our workers compensation reserve is $57,400 at

January 31, 2004.

General Liability – we have a deductible per claim of $1,000 or less and

a policy limit up to $150,000. Our general liability reserve is $10,300 at

January 31, 2004.

Health and Welfare – We are self insured for our health and welfare

coverage and do not have stop-loss coverage. Participants contribute to

the cost of their coverage and are subject to certain plan limits and

deductibles. Our health and welfare reserve is $10,000 at January 31, 2004.

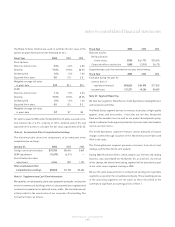

Note 22: Vulnerability Due to Certain Concentrations

Approximately 29% of our retail square footage is located in the state

of California. At January 31, 2004, the net book value of property located

in California was approximately $284,000. We carry earthquake insurance

in all states with a $50,000 deductible and a $50,000 payout limit

per occurrence.

At January 31, 2004 and 2003, approximately 37% and 38% of our

receivables were obligations of customers residing in California.

Concentration of the remaining receivables is considered to be limited due

to their geographical dispersion.

notes to consolidated financial statements