Nordstrom 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

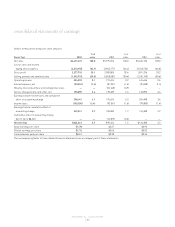

Gross Profit

Fiscal Year 2001 2002 2003

Gross profit as a percent

of net sales 33.2% 33.6% 35.1%

Inventory per square foot $52.10 $51.72 $47.11

Inventory turnover 4.10 4.31 4.54

We saw an improvement in our 2003 gross profit as a percentage of net

sales due to strong sales, substantially lower markdowns and improved

shrinkage numbers as well as an improvement in expenses related to our

private label business. Merchandise division gross profit was led by

Accessories, Women's Specialized Apparel, Women’s Contemporary/Juniors

and Men's Apparel. Our new perpetual inventory system gives us greater

visibility into our inventory, allowing us to more effectively manage this

capital. Better inventory management has enabled us to reduce the

markdowns needed to turn slow-moving merchandise and decrease

overall inventory levels in spite of new store additions. Inventory per

square foot declined 8.9% due to improved performance at both the full-

line stores and our Nordstrom Rack division. Buying and occupancy

expenses benefited from leverage on a higher sales base resulting in a

small improvement on a percent of sales basis.

Gross profit as a percentage of net sales improved in 2002 due to better

inventory management. In our merchandising divisions, improvement in

gross profit rate offset lower sales in certain categories. Merchandise division

gross profit was led by both Women's and Men's Apparel. Additionally,

costs related to our private label operations improved. This was partially

offset by increased markdowns in certain categories due to excess

inventories. Total inventory increased as we added new stores, however,

inventory per square foot declined due to improved performance at full-

line stores partially offset by inventory increases at our Nordstrom Rack

division. Total shrinkage as a percentage of sales was even with the

previous year.

In 2004, we expect to see continuing improvement in our gross profit

performance through lower markdowns and increased inventory turnover.

Additionally we plan a slight improvement in our buying and occupancy

expenses on a percent of sales basis.

Selling, General and Administrative

Fiscal Year 2001 2002 2003

Selling, general and administrative

expense as a percent of sales 30.6% 30.4% 30.0%

The 2002 selling, general and administrative expense includes an

impairment charge of $15.6 million related to the write-down of an

information technology investment in a supply chain tool in our private label

division. We believe that excluding this charge provides a more comparable

basis from which to evaluate performance between years. Without this

charge, 2002 selling, general and administrative expenses as a percentage

of sales would have been 30.2%.

Excluding the effects of the 2002 impairment charge, selling, general

and administrative expenses as a percentage of net sales decreased in

2003 to 30.0% from 30.2% in the prior year. This improvement is primarily

the result of leverage on better-than-planned sales and overall expense

improvements. The most notable expense improvements were:

•Information technology expense declined this year after the completion

of our perpetual inventory implementation.

•Distribution costs improved as a result of efficiencies gained from our

new warehouse management system.

•Nordstrom Direct continued to execute planned reductions in

catalog size consistent with their catalog sales trends, reducing

overall catalog costs.

•Selling expense as a percent to sales improved due to effective

management of our staffing levels.

These improvements were partially offset by the following:

•Incentive compensation expense increased as our financial

performance improved.

•Our credit and collection expense increased primarily due to additional

loyalty program expense resulting from higher credit sales.

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[16 ]