Nordstrom 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[30 ]

notes to consolidated financial statements

Dollars in thousands except per share amounts

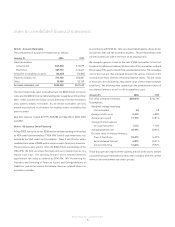

Note 1: Summary of Significant Accounting Policies

The Company: We are a fashion specialty retailer offering high-quality

apparel, shoes and accessories for women, men and children with 148 U.S.

stores located in 27 states.

We also operate 31 Façonnable boutiques located primarily in Europe.

Additionally, we generate catalog and Internet sales through Nordstrom

Direct (formerly known as Nordstrom.com) and service charge income through

Nordstrom Credit, Inc.

Change in Fiscal Year: On February 1, 2003, our fiscal year end changed

from January 31st to the Saturday closest to January 31st. Our new

fiscal year consists of four 13 week quarters, with an extra week added

onto the fourth quarter every five to six years. A one-day transition period

is included in our first quarter 2003 results. Fiscal years 2003, 2002 and

2001 ended on January 31, 2004, 2003 and 2002, respectively.

Basis of Presentation: The consolidated financial statements include

the balances of Nordstrom, Inc. and its subsidiaries for the entire fiscal

year. All significant intercompany transactions and balances are eliminated

in consolidation.

Use of Estimates: We make estimates and assumptions that affect

amounts reported in the financial statements and accompanying notes.

Actual results could differ from those estimates.

Reclassifications: Certain reclassifications of prior year balances have

been made for consistent presentation with the current year.

Revenue Recognition: We record revenues net of estimated returns and

exclude sales tax. Retail stores record revenue at the point of sale.

Catalog and Internet sales include shipping revenue and are recorded upon

delivery to the customer. Our sales return liability is estimated based on

historical return levels.

Buying and Occupancy Costs: Buying costs consist primarily of salaries

and expenses incurred by our merchandise managers, buyers and

private label product development group. Occupancy costs include

rent, depreciation, property taxes and operating costs of our retail and

distribution facilities.

Shipping and Handling Costs: Our shipping and handling costs include

payments to third-party shippers and costs to store, move and prepare

merchandise for shipment. Shipping and handling costs of $47,614,

$42,506 and $30,868 in 2003, 2002 and 2001 were included in selling,

general and administrative expenses.

Advertising:Costs for newspaper, television, radio and other media are

generally expensed as they occur. Direct response advertising costs,

such as catalog book production and printing costs, are expensed over the

life of the catalog, not to exceed six months. Total advertising expenses

were $154,466, $151,368 and $145,341 in 2003, 2002 and 2001.

Store Preopening Costs: Store opening and preopening costs are expensed

as they occur.

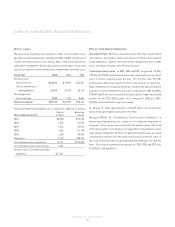

Stock Compensation: We apply APB No. 25, "Accounting for Stock Issued

to Employees," in measuring compensation costs under our stock-based

compensation programs, which are described more fully in Note 15.

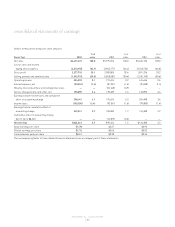

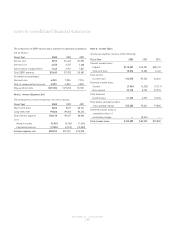

The following table illustrates the effect on net income and earnings per

share if we had applied the fair value recognition provisions of SFAS No.

123, “Accounting for Stock-Based Compensation.”

Fiscal Year 2003 2002 2001

Net earnings, as reported $242,841 $90,224 $124,688

Add: stock-based compensation

expense included in reported

net income, net of tax 9,898 2,240 2,598

Deduct: stock-based compensation

expense determined under fair

value, net of tax (23,749) (21,914) (19,850)

Pro forma net earnings $228,990 $70,550 $107,436

Earnings per share:

Basic — as reported $1.78 $0.67 $0.93

Diluted — as reported $1.76 $0.66 $0.93

Basic — pro forma $1.68 $0.52 $0.80

Diluted — pro forma $1.67 $0.52 $0.80