Nordstrom 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[36 ]

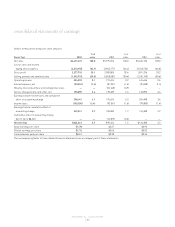

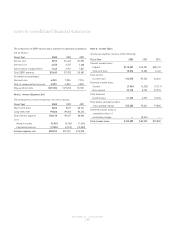

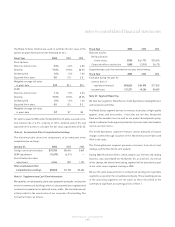

Note 8: Accounts Receivable

The components of accounts receivable are as follows:

January 31, 2004 2003

Trade receivables:

Unrestricted $25,228 $15,599

Restricted 589,992 613,647

Allowance for doubtful accounts (20,320) (22,385)

Trade receivables, net 594,900 606,861

Other 38,958 32,769

Accounts receivable, net $633,858 $639,630

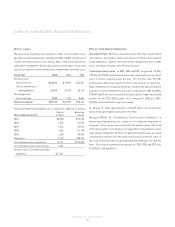

The restricted private label receivables back the $300 million of Class A

notes and the $200 million variable funding note issued by us in November

2001. Other accounts receivable consist primarily of vendor receivables

and cosmetic rebates receivable. As all vendor receivables are fully

earned at period end, no allowance for doubtful vendor receivables has

been recorded.

Bad debt expense totaled $27,975, $29,080 and $34,750 in 2003, 2002

and 2001.

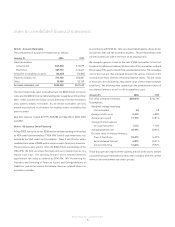

Note 9: Off-balance Sheet Financing

In May 2002, we replaced our $200 million variable funding note backed

by VISA credit card receivables ("VISA VFN") with 5-year term notes also

backed by the VISA credit card receivables. Class A and B notes with a

combined face value of $200 million were issued to third party investors.

These proceeds were used to retire the $200 million outstanding on the

VISA VFN. We hold securities that represent our retained interests in a

master note trust. The carrying amounts of the retained interests

approximate fair value as defined by SFAS No. 140 “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities” and are included in the balance sheets as retained interest in

accounts receivable.

In accordance with SFAS No. 140, our consolidated balance sheets do not

include this debt and the related receivables. These related VISA credit

card receivables are sold to the trust on an ongoing basis.

We recognize gains or losses on the sale of VISA receivables to the trust

based on the difference between the face value of the receivables sold and

the fair value of the assets created in the securitization process. The receivables

sold to the trust are then allocated between the various interests in the

trust based on those interests' relative fair market values. The fair values

of the assets are calculated as the present value of their expected future

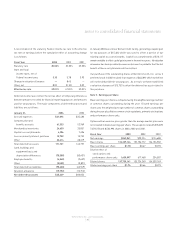

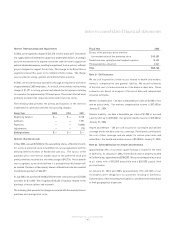

cash flows. The following table summarizes the estimated fair values of

our retained interests as well as the assumptions used:

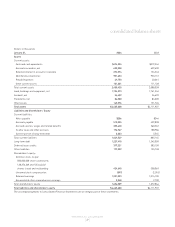

January 31, 2004 2003

Fair value of retained interests: $270,570 $124,791

Assumptions:

Weighted average remaining

life (in months) 2.5 2.8

Average credit losses 5.45% 6.38%

Average gross yield 17.79% 17.81%

Average interest expense

on issued securities 1.41% 1.70%

Average payment rate 23.39% 20.94%

Discount rates of retained interests:

Class C Certificate 10.67% 16.79%

Seller Retained Interest 6.80% 10.51%

Interest Only Strip 12.60% 19.92%

These discount rates represent the volatility and risk of the assets and are

calculated using an established formula that considers both the current

interest rate environment and credit spreads.

notes to consolidated financial statements