Nordstrom 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[33 ]

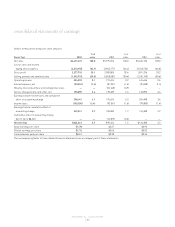

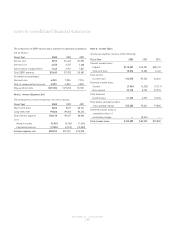

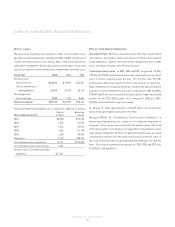

The changes in the carrying amount of our intangible assets for the year

ended January 31, 2004 and 2003 are as follows:

Catalog/

Retail Stores Internet

Segment Segment

Goodwill Tradename Goodwill Total

February 1, 2002 $38,198 $100,133 $— $138,331

Impairment (5,767) (16,133) — (21,900)

Goodwill acquired

through purchase of

minority interest

(see Note 20) 8,462 — 15,716 24,178

January 31, 2004 and 2003 $40,893 $84,000 $15,716 $140,609

The following table shows the actual results of operations as well as

pro-forma results adjusted to exclude intangible amortization and the

cumulative effect of the accounting change.

Fiscal Year 2003 2002 2001

Reported net earnings $242,841 $90,224 $124,688

Intangible amortization, net of tax — — 2,824

Cumulative effect of the

accounting change,

net of tax — 13,359 —

Adjusted net earnings $242,841 $103,583 $127,512

Basic and diluted earnings per share:

Fiscal Year 2003 2002 2001

Earnings per share: Basic &

Basic Diluted Basic Diluted Diluted

Reported net earnings $1.78 $1.76 $0.67 $0.66 $0.93

Intangible amortization,

net of tax ——— — 0.02

Cumulative effect of

accounting change,

net of tax ——0.10 0.10 —

Adjusted net earnings $1.78 $1.76 $0.77 $0.76 $0.95

Before adoption of SFAS No. 142, we amortized our intangible assets

over their estimated useful lives on a straight-line basis ranging from 10

to 35 years. Accumulated amortization of intangible assets was $5,881

as of January 31, 2004 and 2003.

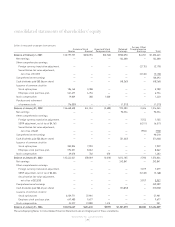

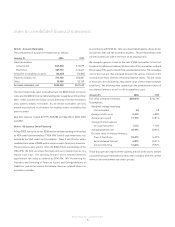

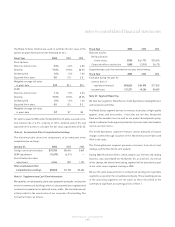

Note 3: Employee Benefits

We provide a profit sharing plan and 401(k) plan for our employees. The

profit sharing plan is non-contributory and is fully funded by us. The

Board of Directors establishes our contribution to the profit sharing plan

each year. The 401(k) plan is funded by voluntary employee contributions.

In addition, we provide matching contributions up to a stipulated percentage

of employee contributions. Our contributions to the profit sharing plan

and matching contributions to the 401(k) plan totaled $52,030, $35,162

and $28,525 in 2003, 2002 and 2001.

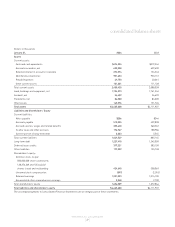

Note 4: Postretirement Benefits

We have an unfunded Supplemental Executive Retirement Plan ("SERP"),

which provides retirement benefits to certain officers and select employees.

During 2003, the SERP was amended to change the target benefit, provide

transition benefits, eliminate the offset of our contributions to the 401(k)

and profit sharing plans and increase the retirement age. Certain

grandfathered participants will remain under the previous plan provisions.

The following provides a reconciliation of benefit obligations and funded

status of the SERP:

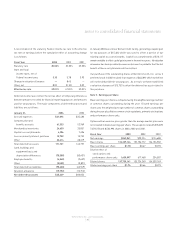

January 31, 2004 2003

Change in benefit obligation:

Accumulated benefit obligation

at beginning of year $47,573 $34,411

Service cost 819 1,447

Interest cost 3,420 3,537

Amortization of adjustments 1,444 2,941

Change in additional minimum liability 9,046 7,760

Distributions (2,689) (2,523)

Accumulated benefit obligation

at end of year $59,613 $47,573

Funded status of plan:

Under funded status $(64,870) $(50,125)

Unrecognized prior service cost 6,228 3,805

Unrecognized loss 24,403 15,074

Accrued pension cost $(34,239) $(31,246)

Balance sheet amounts:

Additional minimum liability $(25,373) $(16,327)

Intangible asset 6,228 3,805

notes to consolidated financial statements