Nordstrom 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

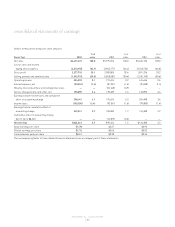

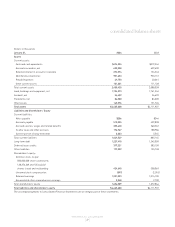

Diluted Earnings per Share

In 2002, our earnings per share included the write down of a supply chain

tool, the Nordstrom.com minority interest purchase and reintegration

costs and the cumulative effect of accounting change, for a total impact

of $71.0 million or $0.53 per share. We believe that excluding these

charges provides a more comparable basis from which to evaluate

performance between years. Without the impact of these charges, 2002

earnings per share would have been $1.19.

Our earnings per share in 2003 increased to $1.76 from $0.66 in 2002.

Excluding the prior year charges noted above, 2003 earnings per share

increased $0.57 or 48%. This increase was primarily driven by a strong

increase in comparable store sales, significant improvement in gross

profit percent and a moderate decrease in selling, general and administrative

expenses as a percent of sales.

Earnings per share decreased in 2002 compared to 2001 due to the

charges described above. Excluding the impact of these charges, earnings

per share would have been $1.19, an increase from 2001 of 28.0%. This

increase was primarily driven by an increase in comparable store sales,

an improvement in gross profit percent and a decrease in selling, general

and administrative expenses as a percent of sales.

Diluted earnings per share are expected to increase 15% - 18% in 2004.

Fourth Quarter Results

Fourth quarter 2003 earnings were $104.3 million compared with $60.0

million in 2002. Total sales for the quarter increased by 10.4% versus the

same quarter in the prior year and comparable store sales increased by

8.5%. The increase in total sales resulted from an increase in comparable

store sales for the quarter and the opening of four full-line stores and two

Nordstrom Rack stores during the year.

Gross profit as a percentage of sales showed strong improvement,

increasing to 36.8% from 33.3% last year. Significant improvements in

markdowns and shrinkage combined with a small improvement in buying

and occupancy expenses substantially increased gross profit as a

percent of sales.

Selling, general and administrative expenses as a percent of sales

increased to 29.1% from 28.6% last year primarily due to higher incentive

compensation offset by improved selling costs, lower distribution costs,

lower marketing costs and lower information systems expense.

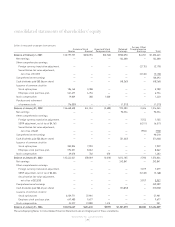

GAAP Sales Reconciliation (in millions)

We converted to a 4-5-4 Retail Calendar at the beginning of 2003. Sales

performance numbers included in this document have been calculated

on a comparative 4-5-4 basis. We believe that adjusting for the difference

in days provides a more comparable basis (4-5-4 vs 4-5-4) from which to

evaluate sales performance. The following reconciliation bridges the

reported GAAP sales to the 4-5-4 comparable sales.

% Change % Change

Dollar Total Comp

Sales Reconciliation QTD 2003 QTD 2002 Increase Sales Sales

Number of Days

Reported GAAP 91 92

Reported GAAP sales $1,932.5 $1,750.6 $181.9 10.4% 7.0%

Less Nov. 1-2, 2002 sales - $(43.7)

Plus Feb. 1, 2003 sales - $18.2

Reported 4-5-4 sales $1,932.5 $1,725.1 $207.4 12.0% 8.5%

4-5-4 Adjusted Days 91 91

% Change % Change

Dollar Total Comp

Sales Reconciliation YTD 2003 YTD 2002 Increase Sales Sales

Number of Days

Reported GAAP 365 365

Reported GAAP sales $6,491.7 $5,975.1 $516.6 8.6% 4.1%

Less Feb. 1, 2003 sales $(18.2) -

Less Feb. 1-2, 2002 sales - $(30.9)

Plus Feb. 1, 2003 sales - $18.2

Reported 4-5-4 sales $6,473.5 $5,962.4 $511.1 8.6% 4.3%

4-5-4 Adjusted Days 364 364

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[18 ]

99 00 01 02 03

$1.46

$0.78

$0.93

$0.66

$1.76