Nordstrom 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NORDSTROM, INC. and SUBSIDIARIES

[32 ]

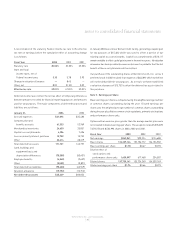

Derivatives Policy: We limit our use of derivative financial instruments

to the management of foreign currency and interest rate risks. Our

derivative financial instruments for foreign currency are not material to

our financial condition or results of operations and we have no material

off-balance sheet credit risk. See Note 13 for a further description of our

interest rate swaps.

Recent Accounting Pronouncements: In April 2003, the FASB issued

SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments

and Hedging Activities.” SFAS No. 149 amends SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities” for certain decisions

made by the FASB as part of the Derivatives Implementation Group

process. SFAS No. 149 also amends SFAS No. 133 to incorporate

clarifications of the definition of a derivative. SFAS No. 149 is effective for

contracts entered into or modified after June 30, 2003, and should be applied

prospectively. The adoption of this statement did not have a material

impact on our financial statements.

In January 2003, the FASB issued Interpretation No. 46 (Revised 2003) or

FIN 46, “Consolidation of Variable Interest Entities,” which requires the

consolidation of variable interest entities (VIEs). An entity is considered

to be a VIE when its equity investors lack controlling financial interest or

the entity has insufficient capital to finance its activities without additional

subordinated financial support. Consolidation of a VIE by an investor is

required when it is determined that the majority of the entity’s expected

losses or residual returns will be absorbed by that investor. FIN 46 is effective

for variable interest entities created or acquired after January 31, 2003.

For variable interest entities created before February 1, 2003, FIN 46

must be applied for the first interim or annual period ending after

December 15, 2003. The adoption of FIN 46 did not have an impact on our

financial statements.

During November 2003, the EITF reached a consensus on Issue 03-10,

"Application of Issue No. 02-16 by Resellers to Sales Incentives Offered

to Consumers by Manufacturers." EITF 03-10 addresses the accounting

and disclosure treatment for a retailer’s reimbursement receipt from a

vendor for coupons offered directly to consumers by the vendor. EITF 03-

10 is effective for coupons distributed to consumers for fiscal years

beginning after December 15, 2003. We do not believe the adoption of EITF

03-10 will have an impact on our financial statements.

In December 2003, the FASB revised SFAS No. 132, "Employers' Disclosures

about Pensions and other Postretirement Benefits," establishing additional

annual disclosure requirements about plan assets, investment strategy,

measurement date, plan obligations and cash flows. The revised standard

also establishes interim disclosure requirements related to the benefit

cost recognized and contributions paid. Our adoption of the revised SFAS

No. 132 as of January 2004 did not have an impact on our results of

operation or financial condition.

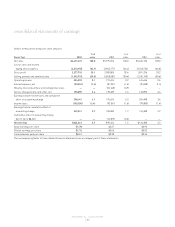

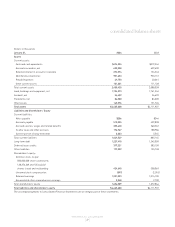

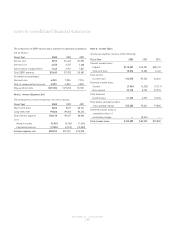

Note 2: Cumulative Effect of Accounting Change

In 2002, we adopted SFAS No. 142, "Goodwill and Other Intangible Assets,"

which establishes new accounting and reporting requirements for goodwill

and other intangible assets. Under SFAS No. 142, goodwill and intangible

assets having indefinite lives are no longer amortized but will be subject

to annual impairment tests. Our intangible assets were determined to be

either goodwill or indefinite lived tradename.

We have three reporting units that we evaluate. At the beginning of 2002,

we had $138,331 of intangibles associated with our Façonnable Business

Unit, one level below our reportable Retail Stores segment. The purchase

of the minority interest of Nordstrom.com in the first quarter of 2002

resulted in additional goodwill of $24,178 of which $8,462 was

allocated to the Retail Stores reporting unit and $15,716 to the Catalog/Internet

reporting unit.

We test our intangible assets for impairment by comparing the fair value

of the reporting unit with its carrying value. Fair value was determined

using a discounted cash flow methodology. We perform our impairment

test annually during our first quarter or when circumstances indicate

we should do so. Our initial impairment test of the Façonnable Business

Unit resulted in an impairment charge to tradename of $16,133 and to

goodwill of $5,767. These impairments resulted from a reduction in

management's estimate of future growth for this reporting unit. The

impairment charge is reflected as a cumulative effect of accounting

change. No further impairments have occurred to date.

notes to consolidated financial statements