Nordstrom 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Selling, general and administrative expenses as a percentage of net sales

decreased in 2002 to 30.2% from 30.6% in the prior year, excluding the

effect of the 2002 write-down. This decrease is the result of improvements

in bad debt and selling expense and reductions in sales promotion. These

costs were partially offset by higher distribution costs and higher information

systems expense. Bad debt expense decreased as both delinquency and

write-off trends stabilized. Selling expense decreased primarily due to

continued efficiencies in shipping costs at Nordstrom Direct. Sales

promotion decreased as Nordstrom Direct executed planned reductions

in catalog size and number of mailings consistent with sales trends.

Distribution costs increased primarily due to higher merchandise volumes

and temporary inefficiencies caused by the implementation of our perpetual

inventory system. The information systems expense increase resulted from

depreciation and rollout costs of our new perpetual inventory system.

In 2004, selling, general and administrative expenses as a percent of

sales are expected to continue to improve as we identify and pursue

expense reduction opportunities. Some of the key areas we are targeting

include Supply Chain and Information Technology. Our distribution centers

are beginning to reduce the merchandise ticketing needed and are focusing

on freight costs. We plan on streamlining our information technology,

eliminating old systems and leveraging off of new systems. In addition,

we continue to focus on maximizing productivity improvements resulting

from our new technologies.

Interest Expense, Net

Interest expense, net increased 11.0% in 2003 primarily due to the

repurchase of $105.7 million in debt and lower capitalized interest. The

debt repurchase resulted in additional expense of $14.3 million. These

expenses were partially offset by lower interest expense resulting from

the reduced debt balance outstanding. Capitalized interest decreased due

to lower average construction and software in progress balances resulting

primarily from the completion of several software projects.

Interest expense, net increased 9.2% in 2002 primarily due to lower

capitalized interest. Capitalized interest decreased due to lower average

balances during the year for construction and software in progress.

Interest expense for 2004 is expected to increase in the first quarter of

2004 as we repurchased $196.8 million in debt. The debt repurchase

resulted in $20.8 million of additional expense. Interest expense will

decline for the rest of the year due to our reduced debt balance

outstanding. We expect to see a year-over-year reduction in interest

expense of $11.0 - $13.0 million.

Minority Interest Purchase and Reintegration Costs

During 2002, we purchased the outstanding shares of Nordstrom.com, Inc.

series C preferred stock for $70.0 million. The excess of the purchase price

over the fair market value of the preferred stock and professional fees

resulted in a one-time charge of $42.7 million. No tax benefit was

recognized on the share purchase, as we do not believe it is probable that

this benefit will be realized. The impact of not recognizing this income

tax benefit increased our 2002 effective tax rate to 47% before the

cumulative effect of accounting change.

Also in 2002, $10.4 million of expense was recognized related to the

purchase of the outstanding Nordstrom.com options and warrants.

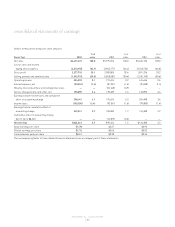

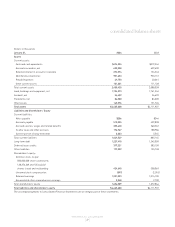

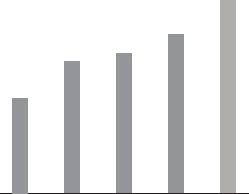

Service Charge Income and Other, Net (in millions)

We continued to see improvements in our 2003 service charge income and

other, net primarily due to higher VISA securitization income. Our

securitization income benefited from substantial increases in our VISA credit

sales and receivables during the year, as well as a small improvement in

the cost of funds and bad debt write-offs. This increase was partially offset

by a decline in service charge and late fee income resulting from a decline

in our private label accounts receivable.

Service charge income and other, net increased in 2002 primarily due to

income recorded from our VISA securitization. Securitization income

increased this year as credit spreads improved, the cost of funds decreased

and bad debt write-offs stabilized. This increase was partially offset by

a decline in service charge and late fee income resulting from a decline

in our private label accounts receivable.

In 2004, service charge income and other, net is expected to increase

$7.0 - $9.0 million as we continue to see growth in our VISA credit sales

and corresponding securitization income, offset by a small decline in

service charge and late fee income from our private label credit card.

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[17 ]

99 00 01 02 03

$117

$131 $134

$141

$155