Nordstrom 2003 Annual Report Download - page 22

Download and view the complete annual report

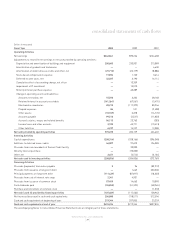

Please find page 22 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financing Activities

Financing activities primarily consist of proceeds from the exercise of stock

options, dividend payments and principal payments on debt.

Dividends

In 2003, we paid $0.41 per share in common stock dividends, the seventh

consecutive annual dividend increase. We paid $0.38 and $0.36 per share

of common stock in fiscal 2002 and 2001.

Debt Buyback

During 2003, we purchased $103.2 million of our 8.95% senior notes and

$2.5 million of our 6.7% medium-term notes for a total cash payment of

$120.8 million. Approximately $14.3 million of expense was recognized

during the year related to these purchases.

During the first quarter of 2004, we retired $196.8 million of our 8.95%

senior notes for a total cash payment of $218.6 million. Approximately

$20.8 million of expense has been recorded in first quarter of 2004. This

expense and the related interest savings is expected to reduce first

quarter earnings per share by approximately $0.08 per share.

Debt to Capital Ratio

At the end of 2003, our debt to capital ratio decreased to 43.0% from

49.6% in 2002 and a high of 52.1% in 2001. This was primarily due to the

repurchase of $105.7 million in debt during 2003. Our first quarter 2004

repurchase of $196.8 million in debt brings our debt to capital ratio to about

39%, exceeding our near-term debt to capital goal of 40% to 45%.

Off-Balance Sheet Financing

We have $200 million in outstanding term notes collateralized by our

Nordstrom VISA credit card receivables. On an ongoing basis, our

Nordstrom VISA receivables are transferred to a master note trust, which

has issued Class A and B notes to third party investors. We hold securities

that represent our retained interests in the trust. Based on SFAS No. 140

“Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities,” this debt and the related receivables are

not reflected in our consolidated balance sheets, however the carrying amount

of our retained interests is included on our balance sheet.

Our off-balance sheet financing allows us to obtain financing at rates lower

than our conventional unsecured debt, adding another option to diversify our

financing sources. Additionally, our exposure to credit losses on the underlying

VISA receivables is limited to our retained interests. The details of our off-balance

sheet financing are disclosed in Note 9: Off-balance Sheet Financing.

Class A and B notes total $200 million and were issued by the trust in May

2002. These are 5-year term notes backed by our VISA credit card

receivables. The proceeds from these notes were used to retire $200

million outstanding on a previous off-balance sheet securitization also backed

by our VISA credit card receivables.

Debt

In November 2001, we issued $300 million of Class A notes backed by

Nordstrom private label receivables. These notes bear a fixed interest rate

of 4.82% and have a maturity of five years. Both the debt and related

assets are included in our consolidated balance sheets. A portion of the

proceeds was used to pay-down approximately $77 million in medium-

term notes and the purchase of Nordstrom.com, Inc.'s preferred stock for

$70 million. The remaining proceeds will be used for general corporate

purposes and capital expansion.

Interest Rate Swaps

To manage our interest rate risk, we had interest rate swaps with a fair

value of ($8.1) million and $3.2 million outstanding at January 31, 2004

and 2003. Both interest rate swaps were designated as fully effective fair

value hedges. Our current swap has a $250 million notional amount, expiring

in 2009. Under the agreement, we received a fixed rate of 5.63% and paid

a variable rate based on LIBOR plus a margin of 2.3% set at six-month intervals

(3.945% at January 31, 2004).

In 2002 and 2003, we received $4.9 million and $2.3 million for the sale

of two interest rate swaps. The first swap converted our $300 million, 8.95%

fixed-rate debt to variable rate, while the second swap converted our

$250 million, 5.63% fixed-rate debt to variable rate. The cash proceeds

from each of the swap terminations will be recognized as interest income

evenly over the remaining life of the related debt.

Noncash Financing

We own 49% of a limited partnership which constructed a new corporate

office building in which we are the primary occupant. During the first quarter

of 2002, the limited partnership refinanced its construction loan obligation

with an $85 million mortgage secured by the property, of which $79.2 million

was included in our balance sheet at January 31, 2004. The obligation has

a fixed interest rate of 7.68% and a term of 18 years.

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[20 ]