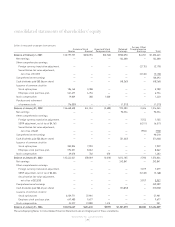

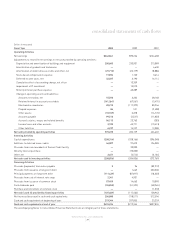

Nordstrom 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Available Credit

We have an unsecured revolving credit facility totaling $300 million that

expires in November 2004. Under the terms of the agreement, we pay a

variable rate of interest based on LIBOR plus a margin of 0.50%

(1.6% at January 31, 2004.) The margin increases to 0.63% if more than

$150 million is outstanding on the facility. The line of credit agreement

contains restrictive covenants, which include maintaining certain financial

ratios. We also pay a commitment fee for the line based on our debt rating.

As of January 31, 2004, no borrowings have been made against this

revolving credit facility. We plan to renew this credit facility or replace it

with a similar facility prior to its expiration. Based on the factors above,

we do not believe the expiration of this credit facility will have an impact

on our liquidity.

Also in November 2001, we issued a variable funding note backed by

Nordstrom private label receivables with a $200 million capacity that we

renew annually. Interest on this facility varies based on the actual cost

of commercial paper plus specified fees. As of January 31, 2004, no

borrowings were outstanding against this note.

Additionally, we have universal shelf registrations on file with the Securities

and Exchange Commission that permit us to offer an additional $450

million of securities to the public. These registration statements allow

us to issue various types of securities, including debt, common stock, warrants

to purchase common stock, warrants to purchase debt securities and warrants

to purchase or sell foreign currency.

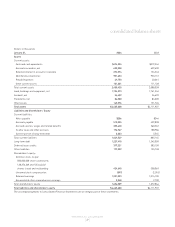

Debt Ratings

The following table shows our credit ratings at the date of this report.

Standard

Credit Ratings Moody’s and Poor’s

Senior unsecured debt Baa1 A-

Commercial paper P-2 A-2

Outlook Stable Stable

These ratings could change depending on our performance and other factors.

A significant ratings drop could result in the termination of the $200

million Nordstrom private label receivables variable funding note and

an interest rate change on the $300 million revolving credit facility. The

remainder of our outstanding debt is not subject to termination or interest

rate adjustments based on changes in credit ratings.

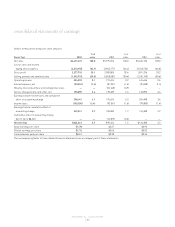

Contractual Obligations

The following table summarizes our contractual obligations and the

expected effect on our liquidity and cash flows. We expect to fund these

commitments primarily with operating cash flows generated in the normal

course of business and credit available to us under existing and potential

future facilities.

Less More

than 1-3 3-5 than 5

Fiscal Year Total 1 year years years years

Long-term debt $1,234.3 $5.4 $405.4 $457.2 $366.3

Capital lease

obligations 16.2 2.4 3.5 3.1 7.2

Operating leases 718.2 73.3 134.7 119.5 390.7

Purchase

obligations 341.8 231.9 100.3 7.3 2.3

Other long-term

liabilities 86.2 4.1 12.9 7.3 61.9

Total $2,396.7 $317.1 $656.8 $594.4 $828.4

Long-term debt includes $200 million in off-balance sheet financing

related to our VISA securitization, which comes due in April 2007 and does

not include the $196.8 million of debt repurchased in the first quarter of

2004. In addition to the required debt repayment disclosed above, we estimate

total interest payments of approximately $669 million being paid over

the remaining life of the debt.

This table excludes the short-term liabilities, other than the current

portion of long-term debt, disclosed on our balance sheets as the amounts

recorded for these items will be paid in the next year. Purchase orders

totaling $681.2 million have also been excluded from this table.

Other long-term liabilities include estimated repayment schedules

primarily for postretirement benefits based on their current payout rates.

Other long-term liabilities not requiring cash payments, such as deferred

revenue, were excluded from the table above.

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[21 ]