Nordstrom 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

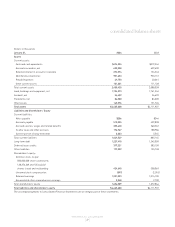

LIQUIDITY AND CAPITAL RESOURCES

We finance our working capital needs, capital expenditures, acquisitions,

debt repurchase and share repurchase activity with a combination of

cash flows from operations and borrowings.

We believe that our operating cash flows, existing cash and available

credit facilities are sufficient to finance our cash requirements for the next

12 months. Additionally, we believe our operating cash flows, existing cash

and credit available to us under existing and potential future facilities are

sufficient to meet our cash requirements for the next 10 years.

Operating Activities

Our operations are seasonal in nature. The second quarter, which includes

our Anniversary Sale, accounts for approximately 28% of net sales, while

the fourth quarter, which includes the holiday season, accounts for about

30% of net sales. Cash requirements are highest in the third quarter as

we build our inventory for the holiday season.

The increase in net cash provided by operating activities between 2003 and

2002 was primarily due to an increase in net earnings before noncash items,

decreases in inventories and increases in accounts payable partially

offset by an increase in our retained interest in accounts receivable.

Strong sales and effective inventory management left us with low inventory

levels after the holidays. January receipts of new merchandise replenished

our inventory levels resulting in an increase in accounts payable. Retained

interest in accounts receivable increased as Nordstrom VISA credit sales

increased during the year.

The decrease in net cash provided by operating activities between 2002

and 2001 was primarily due to increases in inventories and accounts

receivable partially offset by an increase in net earnings before noncash

items and an increase in our accrual for income taxes. Inventory grew as

we added stores during the year. Accounts receivable increased as

Nordstrom VISA credit sales improved. The increased income tax accrual

resulted from the timing of payments.

In 2004, cash flows provided by operating activities are expected to be in

the range of approximately $380.0 - $420.0 million. Payables are expected

to remain consistent with 2003 and inventory is expected to increase

modestly from new store openings. These factors will be partially offset

by a slower growth in accounts receivable compared to 2003.

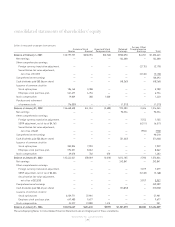

Investing Activities

For the last three years, investing activities have primarily consisted of capital

expenditures and the minority interest purchase of Nordstrom.com.

Capital Expenditures

Our capital expenditures over the last three years totaled approximately

$712 million, net of developer reimbursements, principally to add stores,

improve existing facilities and purchase or develop new information

systems. More than 3.0 million square feet of retail store space has

been added during this period, representing an increase of 19% since

January 31, 2001.

We plan to spend approximately $725 - $775 million, net of developer

reimbursements, on capital projects during the next three years.

Approximately 63% of this investment will be to build new stores and

remodel existing stores and 17% will go toward information technology,

while the remaining 20% is for maintenance and other miscellaneous

spending. Compared to the previous three years, we plan to open fewer

stores, slow spending on information systems and increase our spending

on the improvement of existing facilities. To maximize the profitability of

our new stores, we are opening fewer new stores but are placing them

in established large regional shopping centers. In the information systems

area, we are in the process of implementing our “Point of Sale” system,

which we expect to complete during 2004.

At January 31, 2004, approximately $249 million has been contractually

committed primarily for the construction of new stores or remodeling of

existing stores. Although we have made commitments for stores opening

in 2004 and beyond, it is possible that some stores may not be opened as

scheduled because of delays in the development process, or because of

the termination of store site negotiations.

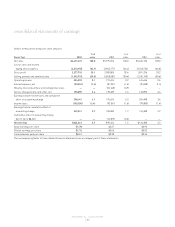

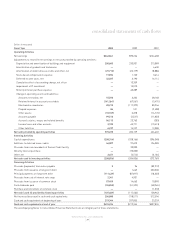

Total Square Footage (in thousands)

management’s discussion and analysis

NORDSTROM, INC. and SUBSIDIARIES

[19 ]

99 00 01 02 03

14,487

16,056

17,048

18,428

19,138